City Holding (CHCO) Valuation After Dividend Hike and Commercial Banking Leadership Transition

City Holding (CHCO) just gave income focused investors a fresh reason to pay attention, with a 10% boost to its quarterly dividend and a leadership transition in its commercial banking ranks.

See our latest analysis for City Holding.

At around $122.78, the stock has quietly put up a 4.6% year to date share price return, while a robust 5 year total shareholder return of just over 100% suggests long term momentum is still firmly intact.

If this steady regional bank story has you thinking about where else to put fresh money to work, now is a good time to explore fast growing stocks with high insider ownership.

But with management signaling confidence through a higher dividend and shares trading modestly below analyst targets, is City Holding quietly undervalued, or is the market already baking in the next leg of its growth?

Price-to-Earnings of 14x: Is it justified?

City Holding trades on a 14x price to earnings multiple, a premium to peers that suggests investors are paying up for each dollar of profit.

The price to earnings ratio compares the current share price to the company’s earnings per share. It is a quick gauge of how richly those earnings are valued. For a mature regional bank like City Holding, this metric helps reveal whether the market expects steady, reliable profit growth or is demanding a discount because of slower prospects.

In this case, the 14x price to earnings stands above both the peer average of 12.9x and the wider US banks industry average of 11.5x. This signals that the market is assigning City Holding a noticeably richer valuation than many rivals. When set against an estimated fair price to earnings ratio of 9.8x, that gap looks even wider and highlights how far the current multiple could fall if sentiment reverted toward that fair level.

Explore the SWS fair ratio for City Holding

Result: Price-to-Earnings of 14x (OVERVALUED)

However, slowing net income growth and the risk of regional banking headwinds pressuring margins could quickly challenge today’s premium valuation and dividend confidence.

Find out about the key risks to this City Holding narrative.

Another View on Value

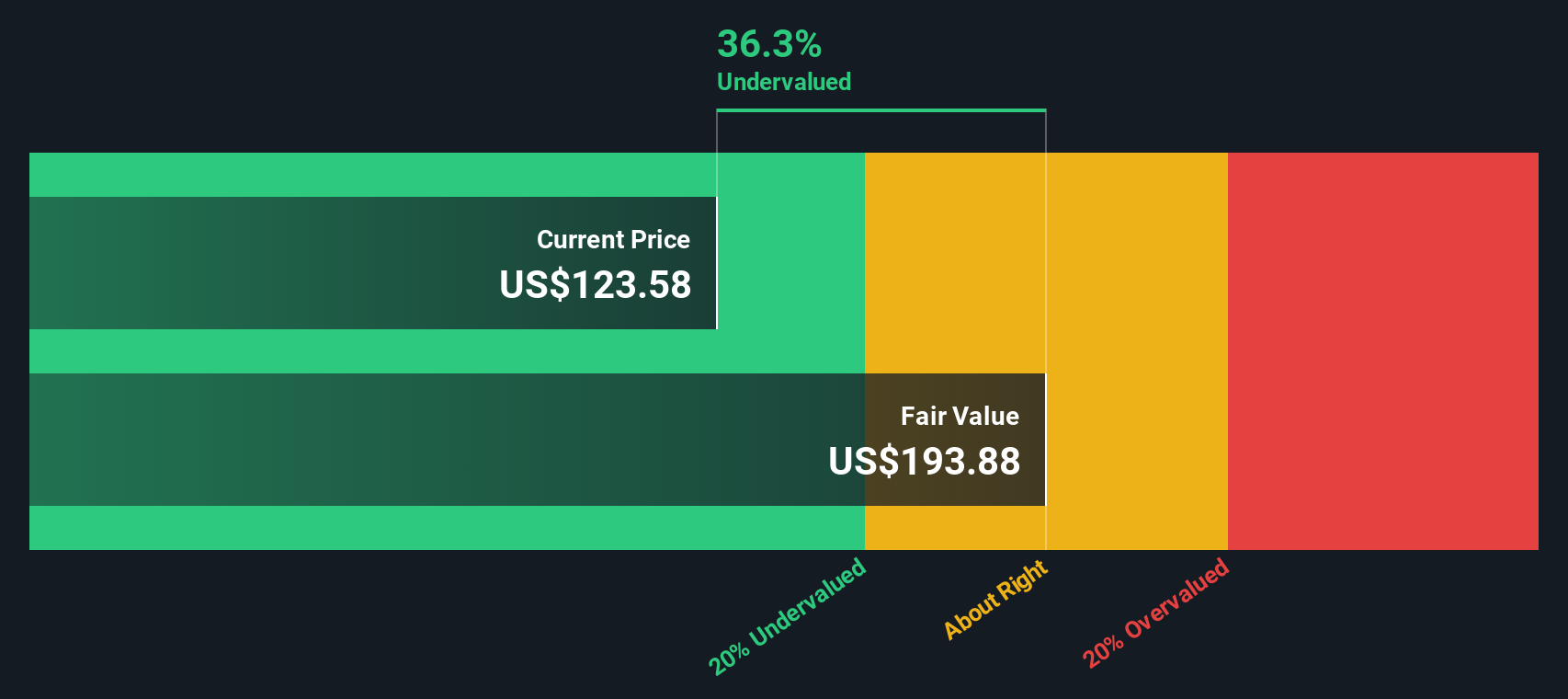

Our DCF model paints a very different picture, suggesting City Holding is trading about 39.8% below its fair value, with an implied worth near $203.96 a share. If earnings only creep higher, is the market being overly cautious, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out City Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own City Holding Narrative

If you are not fully convinced by this view or want to dig into the numbers yourself, you can build a fresh thesis in minutes: Do it your way.

A great starting point for your City Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when you can quickly scan fresh markets, uncover compelling setups, and evaluate how you might position yourself relative to investors who stay on autopilot.

- Explore momentum in smaller names by reviewing these 3573 penny stocks with strong financials that pair higher risk with improving fundamentals and the possibility of outsized upside.

- Focus on the next wave of innovation by targeting these 25 AI penny stocks that are harnessing artificial intelligence to drive new growth stories.

- Evaluate income opportunities by assessing these 14 dividend stocks with yields > 3% that combine attractive yields with balance sheets designed to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal