Nike’s Leadership Shake-Up Might Change The Case For Investing In NIKE (NKE)

- Nike has recently overhauled its senior leadership, creating a new EVP, Chief Operating Officer role for long-time executive Venkatesh Alagirisamy and eliminating the Chief Technology Officer and Chief Commercial Officer positions, while also elevating regional heads to report directly to CEO Elliott Hill.

- This reshaping of responsibilities, especially uniting technology, supply chain, and commercial insights under fewer leaders, signals a push for faster decision-making, tighter marketplace feedback loops, and closer alignment between operations and consumer demand.

- We’ll now explore how consolidating technology and operations under the new COO could influence Nike’s existing investment narrative and expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NIKE Investment Narrative Recap

To own Nike today, you generally need to believe the brand can reignite demand in key markets while repairing margins hurt by markdowns and excess inventory. The new COO structure and direct reporting from regional leaders may support faster operational and digital execution, but the biggest near term swing factor remains whether Nike can stabilize revenue in North America, EMEA, and Greater China. The leadership overhaul is important, though it does not immediately change that core risk.

Among recent announcements, the 3 percent increase in Nike’s quarterly dividend to US$0.41 per share stands out in this context. It sits alongside the leadership reset as another signal of how management is balancing investment in a more tech enabled, integrated marketplace with returning cash to shareholders, at a time when cleaning up inventory and reducing promotional days remain central to the investment story.

Yet while the leadership shake up may help, investors should be aware that ongoing revenue pressure in key regions could still...

Read the full narrative on NIKE (it's free!)

NIKE's narrative projects $50.7 billion revenue and $4.4 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $1.2 billion earnings increase from $3.2 billion today.

Uncover how NIKE's forecasts yield a $83.30 fair value, a 27% upside to its current price.

Exploring Other Perspectives

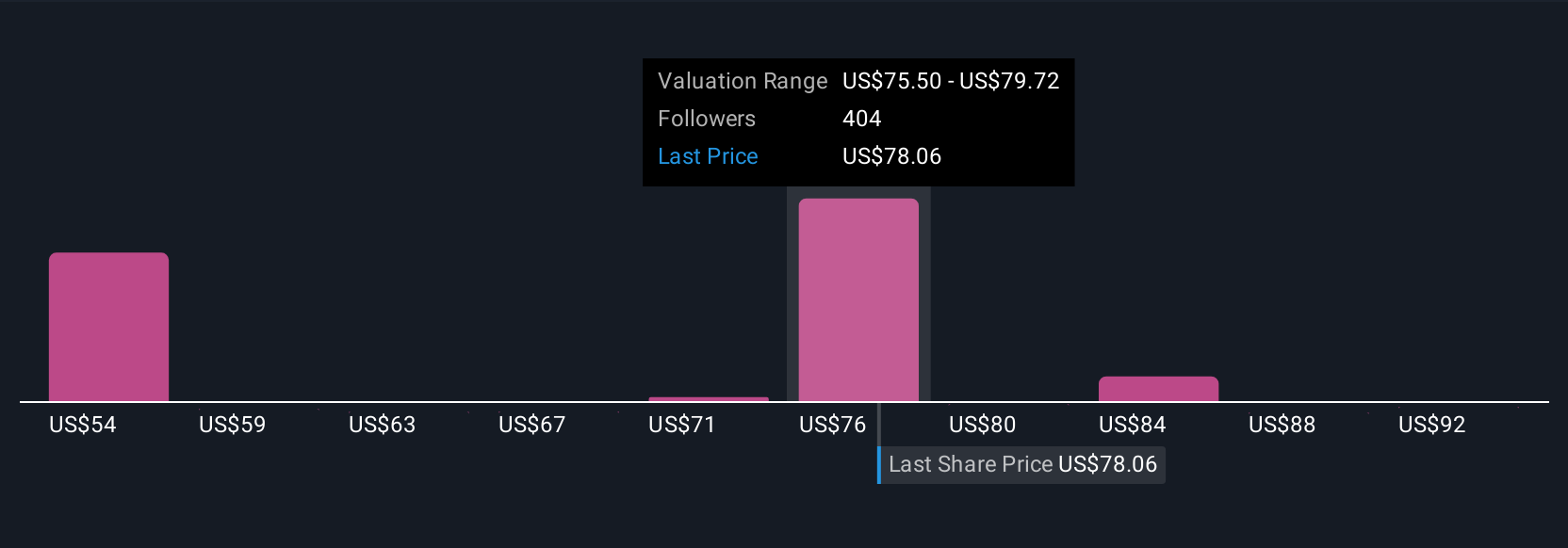

Thirty nine Simply Wall St Community fair value estimates span roughly US$58 to US$97 per share, underlining how far opinions differ. Set that against Nike’s current effort to cut excess inventory and reduce markdowns and you can see why it is worth weighing several viewpoints before deciding what the business might deliver.

Explore 39 other fair value estimates on NIKE - why the stock might be worth as much as 47% more than the current price!

Build Your Own NIKE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIKE research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NIKE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIKE's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal