DoorDash (DASH): Revisiting Valuation After Strong Multi‑Year Returns and Recent Share Price Pullback

Recent performance sets the stage

DoorDash (DASH) has quietly outpaced much of the market this year, climbing about 30% year to date even after giving back some gains over the past month.

See our latest analysis for DoorDash.

The recent pullback, including a 1 month share price return of minus 7.27 percent, looks more like a breather than a breakdown. This comes in the context of DoorDash’s 30.37 percent year to date share price return and 3 year total shareholder return of 311.92 percent.

If DoorDash’s run has you thinking about what else could surprise to the upside, now is a good time to explore high growth tech and AI stocks as potential next wave beneficiaries.

With shares still trading at a roughly 27 percent discount to intrinsic value estimates and below average Wall Street targets, the key question is whether DoorDash remains mispriced or if markets have already baked in its next leg of growth?

Most Popular Narrative: 19.4% Undervalued

With DoorDash closing at $222.48 versus a narrative fair value of $276.17, the story leans toward upside, but on very specific future assumptions.

Accelerating growth of high margin revenue streams (notably, platform advertising and emerging SaaS offerings like the SevenRooms acquisition) is expanding DoorDash's profit pool beyond core delivery, supporting further earnings upside.

Curious how a still early margin profile, rapid earnings ramp, and a rich future profit multiple can all coexist in one valuation playbook? Explore the full narrative to see which growth levers, scale assumptions, and long term profitability targets need to align for this fair value to make sense.

Result: Fair Value of $276.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained heavy tech investment and rising regulatory pressure on gig work could easily derail the margin expansion that underpins today’s undervaluation narrative.

Find out about the key risks to this DoorDash narrative.

Another lens on value

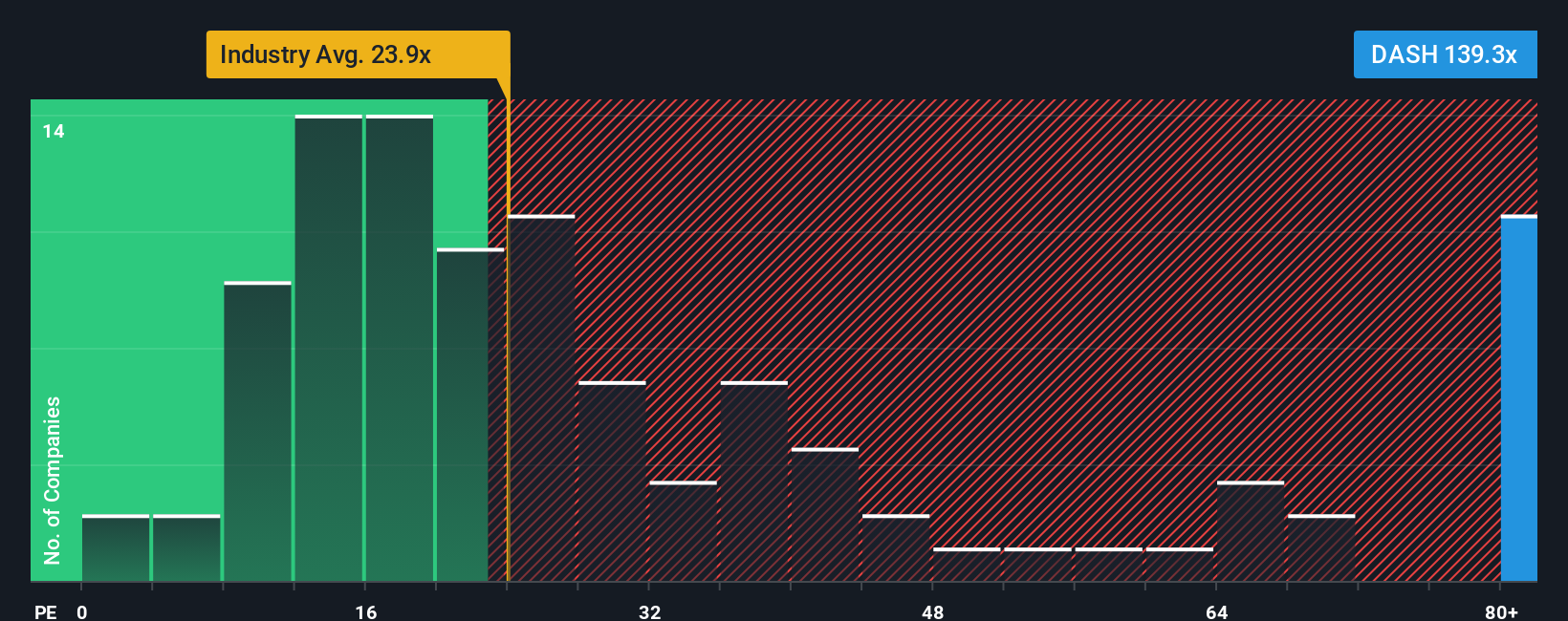

Our fair value work suggests DoorDash is roughly 27.5 percent undervalued, yet the market is paying a steep 111.1 times earnings versus 34.1 times for peers and a 21.2 times industry average, which is well above a 50.1 times fair ratio. Is this premium justified or just momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a tailored view in just minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DoorDash.

Ready for your next investing move?

Before the market’s next big swing, use the Simply Wall St Screener to uncover fresh, data driven opportunities instead of watching others capture the upside first.

- Capture turnaround potential in unloved names by scanning these 915 undervalued stocks based on cash flows that may be priced for pessimism, not reality.

- Position ahead of the next tech wave by zeroing in on these 25 AI penny stocks that blend rapid innovation with scalable business models.

- Boost your income stream by targeting these 14 dividend stocks with yields > 3% that aim to pay you reliably while you stay invested.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal