Sun Art Retail Group (SEHK:6808) Valuation After CEO Transition to Retail Veteran Li Weiping

Sun Art Retail Group (SEHK:6808) just announced a CEO handover, with long serving leader Shen Hui stepping down and retail veteran Li Weiping stepping in. The stock immediately reacted to the news.

See our latest analysis for Sun Art Retail Group.

The CEO change comes at a delicate moment, with a 9.8% 7-day share price return but a much weaker one-year total shareholder return of about 12 percent. This signals fading longer-term momentum despite some recent excitement.

If this leadership reset has you rethinking your watchlist, it could be worth scanning fast growing stocks with high insider ownership as a way to spot other compelling stories early.

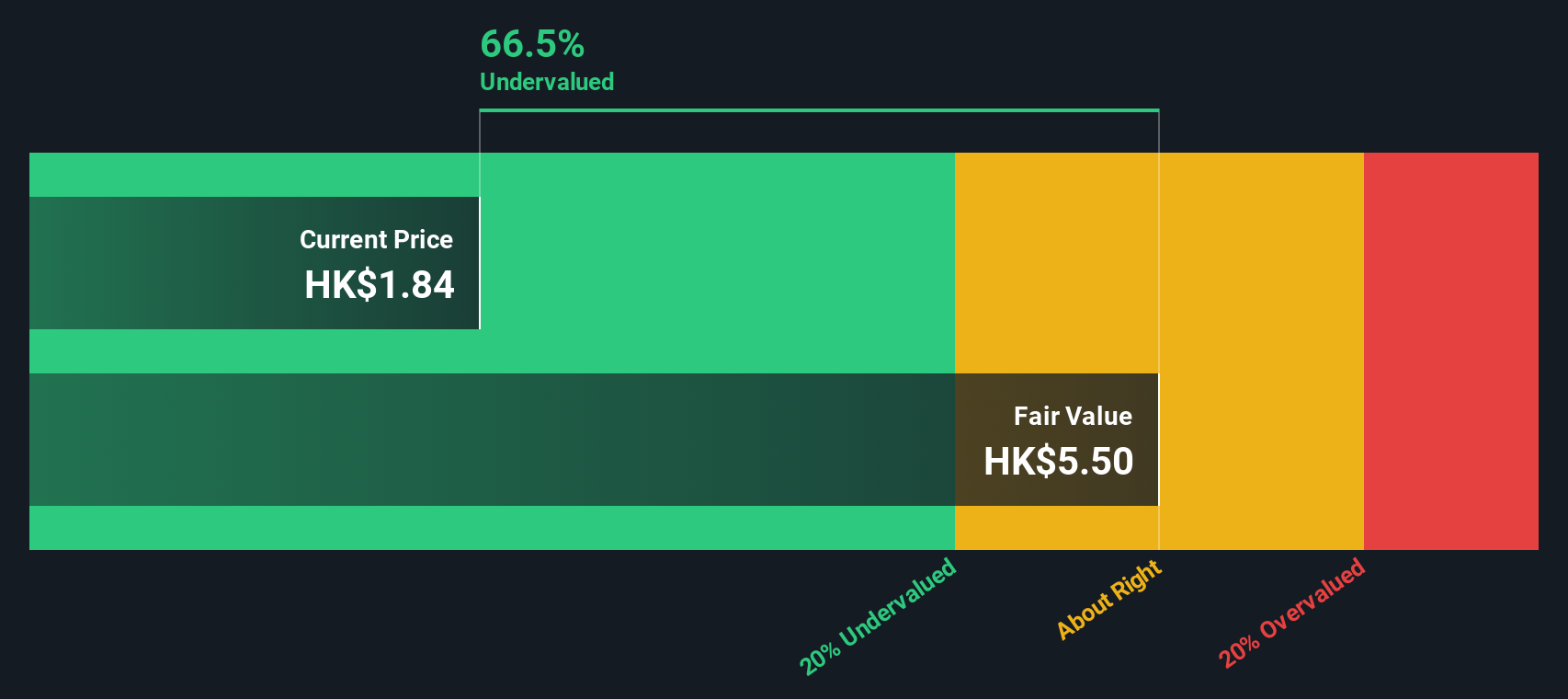

With shares still trading at a steep discount to both analyst targets and some estimates of intrinsic value, yet burdened by years of weak returns, is Sun Art a contrarian buy, or is the market already pricing in a Li led turnaround?

Price-to-Sales of 0.2x: Is it justified?

On a price-to-sales ratio of just 0.2x at the last close of HK$1.79, Sun Art screens as materially cheaper than both its peers and the wider consumer retailing sector.

The price-to-sales multiple compares the company’s market value to its annual revenue, a common yardstick for low margin, scale driven retailers where earnings can swing. For Sun Art, this lean multiple suggests investors are reluctant to pay much for each Hong Kong dollar of sales, despite the business having returned to profitability and analysts forecasting strong earnings growth.

Relative to the Hong Kong Consumer Retailing industry average of 0.6x, the discount is stark and points to the market assigning a much lower quality or sustainability score to Sun Art’s revenue base. When measured against a peer average of 1.7x and an estimated fair price-to-sales ratio of 0.5x, the current 0.2x level looks even more compressed, hinting at meaningful upside should sentiment and execution improve enough for the multiple to move closer to that fair ratio.

Explore the SWS fair ratio for Sun Art Retail Group

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, years of sluggish total returns and modest 1.9 percent revenue growth leave little margin for error if Li’s turnaround strategy stumbles.

Find out about the key risks to this Sun Art Retail Group narrative.

Another View: Our DCF Says the Discount Is Even Deeper

While the low price-to-sales ratio points to value, our DCF model goes further, suggesting Sun Art is trading around 64.6 percent below its fair value of roughly HK$5.06 per share. Is this a classic value trap, or has the market swung too far on pessimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sun Art Retail Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sun Art Retail Group Narrative

If you see the story evolving differently or want to dig into the numbers yourself, you can quickly build a personalized view in minutes with Do it your way.

A great starting point for your Sun Art Retail Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities by using the Simply Wall St screener, so the next compelling idea does not pass you by.

- Capitalize on early stage potential by scanning these 3571 penny stocks with strong financials that already show resilient balance sheets and improving fundamentals.

- Position your portfolio for structural growth by targeting these 25 AI penny stocks that are reshaping everything from productivity tools to complex data infrastructure.

- Strengthen your long term income stream by focusing on these 14 dividend stocks with yields > 3% that balance yield with coverage and room for dividend growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal