Why National Energy Services Reunited (NESR) Is Up 5.2% After Landing a Major Saudi Fracturing Deal – And What's Next

- National Energy Services Reunited Corp. recently signed a major unconventional hydraulic fracturing contract at the Saudi–United States Investment Forum, as part of agreements exceeding US$30.00 billion and expected to support its business over a five-year term.

- The deal underscores NESR’s position as the only Saudi energy services “National Champion” listed in the US and deepens its role in cross-border collaboration on energy and AI between Saudi Arabia and the United States.

- We’ll now examine how this large unconventional fracturing contract, with its multi‑year revenue potential, reshapes National Energy Services Reunited’s investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

National Energy Services Reunited Investment Narrative Recap

To own NESR, you have to believe in sustained demand for Middle East and North Africa oilfield services and the company’s ability to win and execute large, capital intensive contracts. The new multi billion unconventional fracturing award in Saudi Arabia strengthens the near term growth catalyst around accelerated unconventional activity, but it also amplifies the key risk of customer concentration and execution strain if contract timelines, payments, or regional conditions shift.

The company’s November 2025 guidance, pointing to a 2026 revenue run rate of about US$2,000,000,000, is especially relevant in light of this contract. The scale and duration of the Jafurah related work appear aligned with that outlook, reinforcing the importance of NESR’s backlog quality and timing, as well as its ability to manage CapEx and working capital as these projects ramp.

Yet this growth comes with concentrated exposure to a handful of national oil companies that investors should be aware of if...

Read the full narrative on National Energy Services Reunited (it's free!)

National Energy Services Reunited’s narrative projects $1.5 billion revenue and $168.6 million earnings by 2028. This requires 4.0% yearly revenue growth and a $95.6 million earnings increase from $73.0 million today.

Uncover how National Energy Services Reunited's forecasts yield a $19.80 fair value, a 34% upside to its current price.

Exploring Other Perspectives

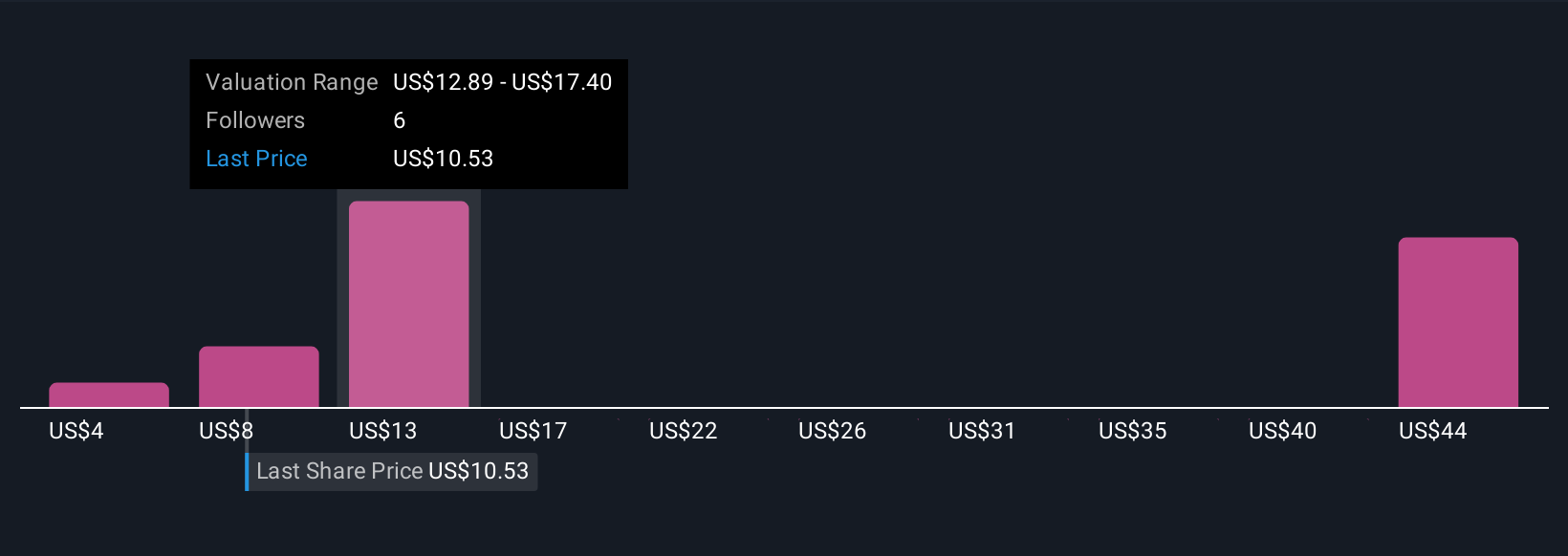

Seven fair value estimates from the Simply Wall St Community span roughly US$3.87 to US$56.42 per share, highlighting sharply different views. You can weigh those opinions against NESR’s growing dependence on large unconventional contracts in Saudi Arabia and what that could mean for future earnings resilience.

Explore 7 other fair value estimates on National Energy Services Reunited - why the stock might be worth over 3x more than the current price!

Build Your Own National Energy Services Reunited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Energy Services Reunited research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free National Energy Services Reunited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Energy Services Reunited's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal