How New Helios Rack-Scale Tie-Up With HPE At Advanced Micro Devices (AMD) Has Changed Its Investment Story

- In late November and early December 2025, AMD’s ecosystem partners Vultr, HPE and Zyphra announced major AI infrastructure moves, including a Vultr AI supercluster using 24,000 AMD Instinct MI355X GPUs in Ohio, HPE’s adoption of AMD’s new “Helios” rack-scale AI platform, and Zyphra’s frontier-scale MoE training success on an all‑AMD stack.

- Taken together, these deployments highlight growing real-world validation of AMD’s AI accelerators and full-stack platform for large-scale training, inference, and high-performance computing workloads across cloud, enterprise, and research customers.

- We’ll now explore how the Helios rack-scale platform partnership with HPE may reshape AMD’s existing investment narrative around AI growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Advanced Micro Devices Investment Narrative Recap

To own AMD today, you need to believe its full‑stack AI strategy turns big design wins into sustained data center revenue and margin expansion, despite intense GPU competition and premium valuation. The Vultr, HPE, and Zyphra announcements reinforce the core AI thesis but do not materially change the near term catalyst, which remains execution on large cloud and hyperscale ramps, or the key risk that rivals and in house chips cap AMD’s share and pricing power.

Among the latest news, HPE’s early adoption of the Helios rack scale AI platform stands out as most relevant. It ties AMD’s Instinct GPUs, EPYC CPUs, Pensando networking, and ROCm software into a packaged system that could shorten deployment cycles for cloud, enterprise, and sovereign buyers, directly linked to the catalyst around AI data center growth while also highlighting the risk that any slowdown in hyperscaler buildouts would ripple through these integrated deals.

Yet, beneath the AI optimism, investors should be aware of how quickly intensifying competition and custom chips could pressure AMD’s margins and AI market share...

Read the full narrative on Advanced Micro Devices (it's free!)

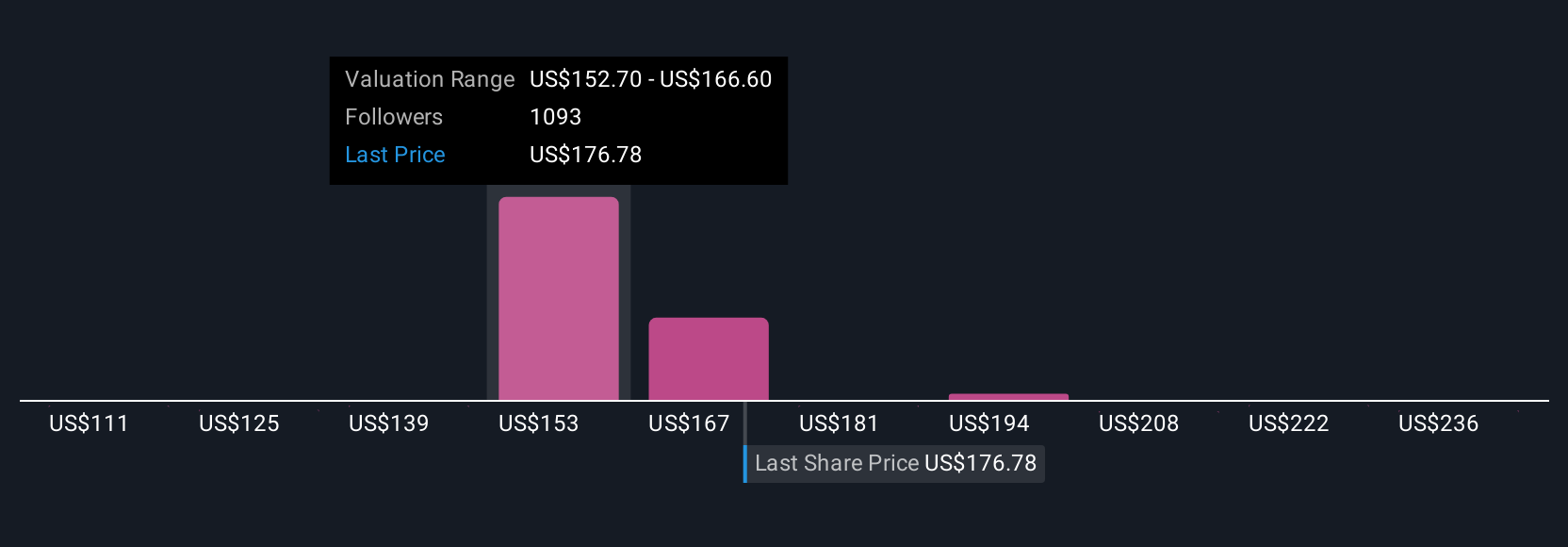

Advanced Micro Devices’ narrative projects $46.2 billion revenue and $9.0 billion earnings by 2028. This requires 18.5% yearly revenue growth and a roughly $6.8 billion earnings increase from $2.2 billion today.

Uncover how Advanced Micro Devices' forecasts yield a $276.76 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Before this news, the most optimistic analysts were already assuming AMD could reach about US$59.8 billion in revenue and US$12.5 billion in earnings by 2028, a far more aggressive path than consensus. These views lean heavily on faster AI rack scale adoption and higher margins, so today’s Helios, Vultr and Zyphra updates could push that narrative even further or test it if competitive or geopolitical risks start to bite.

Explore 121 other fair value estimates on Advanced Micro Devices - why the stock might be worth as much as 74% more than the current price!

Build Your Own Advanced Micro Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Micro Devices research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Advanced Micro Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Micro Devices' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal