How AI Spending, Guidance Shift and Capital Returns At Concentrix (CNXC) Has Changed Its Investment Story

- In recent days, Concentrix updated its fiscal 2025 outlook, raising revenue guidance while trimming EPS and free cash flow expectations as it steps up AI spending and absorbs higher interest costs from prior acquisitions.

- At the same time, insider share purchases and a dividend increase to a 3.9% yield suggest management is signaling confidence despite near-term profitability pressure.

- Next, we’ll examine how heavier AI investment and softer EPS guidance may reshape Concentrix’s existing investment narrative and risk-reward profile.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Concentrix Investment Narrative Recap

To own Concentrix, you need to believe its heavier AI spending and Webhelp integration can eventually convert modest revenue growth into stronger earnings, despite a significant share price drawdown and a sizeable debt load. The updated 2025 guidance raises the bar for revenue as a near term catalyst but softens EPS and free cash flow expectations, reinforcing that interest costs and integration execution remain the most important risks. Overall, the outlook change refines the narrative rather than materially transforming it.

The recent dividend increase to US$0.36 per share, lifting the yield to about 3.9%, is especially relevant here because it highlights how Concentrix is balancing AI investment and higher interest expense with ongoing cash returns. For investors focused on the risk reward trade off, this capital allocation choice sits alongside continued buybacks and modest revenue guidance as they assess whether current profitability pressure is a temporary trade off or a more persistent feature of the story.

Yet behind the higher revenue guidance and richer dividend, investors should be aware of the company’s significant debt burden and potential refinancing risk...

Read the full narrative on Concentrix (it's free!)

Concentrix's narrative projects $10.6 billion revenue and $509.6 million earnings by 2028.

Uncover how Concentrix's forecasts yield a $64.83 fair value, a 76% upside to its current price.

Exploring Other Perspectives

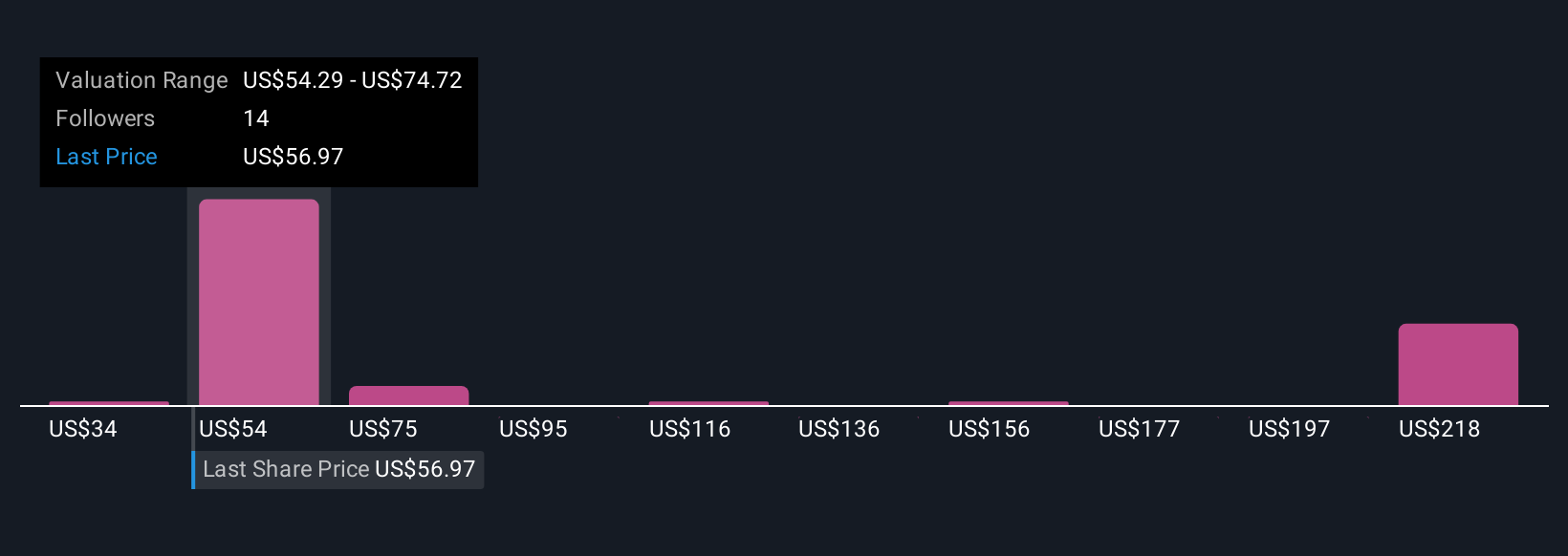

Six members of the Simply Wall St Community currently see Concentrix’s fair value between US$33.87 and US$169.24, illustrating how far opinions can spread. Against that backdrop, rising AI investment and interest costs sit at the center of the debate about whether modest forecast revenue growth can support stronger long term performance, so it makes sense to compare several of these viewpoints before deciding where you stand.

Explore 6 other fair value estimates on Concentrix - why the stock might be worth over 4x more than the current price!

Build Your Own Concentrix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Concentrix research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Concentrix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Concentrix's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal