Five9 (FIVN): Reassessing Valuation After Strong Enterprise AI Growth and Expanded Leadership Bench

Five9 (FIVN) heads into its UBS Global Technology and AI Conference appearance with an unusual mix of pressure and promise, as fresh data on AI driven growth clashes with a steep share price reset.

See our latest analysis for Five9.

Those updates have landed against a tough backdrop, with the share price down sharply in 2025 and a roughly 51% one year total shareholder return. However, recent 1 day and 7 day share price gains hint that downside momentum may be easing as investors reassess Five9’s AI driven growth story.

If you are weighing Five9 against other AI driven platforms, this is an easy moment to explore high growth tech and AI stocks as potential alternatives or complements in your portfolio.

With shares now trading at a steep discount to analyst targets despite double digit AI revenue and bookings growth, investors face a pivotal question: is this a mispriced recovery story, or is the market already discounting that future growth?

Most Popular Narrative Narrative: 39.9% Undervalued

With Five9 last closing at $20.45 versus a narrative fair value near $34, the spread points to a potentially mispriced long term earnings story.

Five9's accelerated adoption of AI driven solutions highlighted by 42% Enterprise AI revenue growth and a surge in AI bookings (representing over 20% of Enterprise new ACV) positions the company to benefit from increasing enterprise investment in AI and automation for customer experience, supporting higher recurring revenues and expanded net margins as AI products command premium pricing.

Curious what kind of growth, margin lift, and future profit multiple are embedded in that view? The most followed narrative lays out an aggressive transformation path, built on compounding earnings power and a valuation framework normally reserved for established software leaders, but leaves key assumptions that drive its fair value estimate just out of sight.

Result: Fair Value of $34.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and leadership transition risk could derail Five9’s AI driven momentum and challenge both margin expansion and the long term recovery thesis.

Find out about the key risks to this Five9 narrative.

Another Way to Look at Value

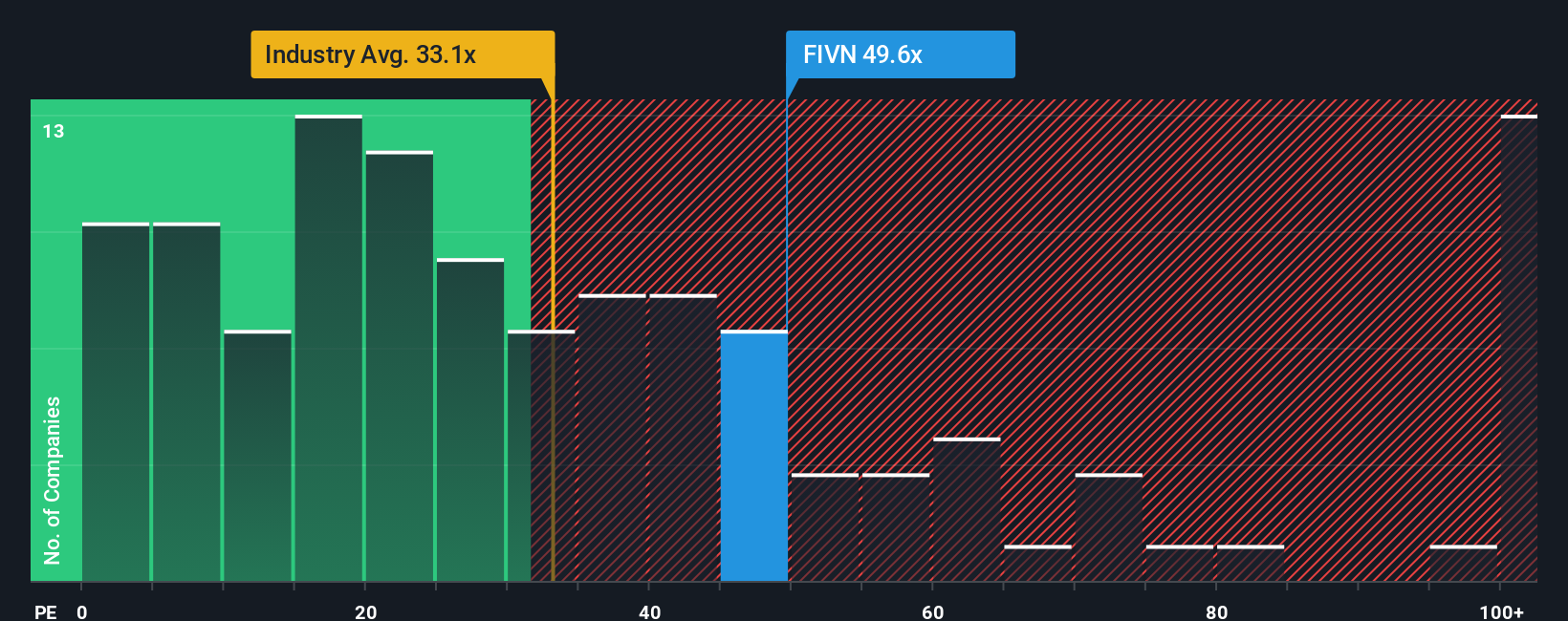

Our valuation checks flag a very different picture from the bullish narrative. On earnings, Five9 trades on a 51.1x P/E, well above the US Software industry at 31.7x, peers at 29.5x, and a fair ratio of 38.1x, suggesting meaningful downside risk if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five9 Narrative

If you see the story differently or want to stress test the numbers yourself, build a personalized Five9 narrative in just a few minutes, starting with Do it your way.

A great starting point for your Five9 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

Before you move on, lock in fresh ideas with our screener powered shortlists so you are not relying on a single AI themed opportunity.

- Target steady income potential by reviewing these 14 dividend stocks with yields > 3% to help strengthen your portfolio’s cash flow.

- Capitalize on innovation trends by evaluating these 25 AI penny stocks positioned at the forefront of AI adoption.

- Explore potential high upside opportunities early by scanning these 3571 penny stocks with strong financials that still trade under the market’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal