Is ASML Still Attractive After Its 2025 Rally and Conflicting Valuation Signals?

- Wondering if ASML Holding is still worth buying after its huge run, or if you would just be paying up for past success, you are not alone.

- The stock has climbed 5.9% over the last week, 4.0% over the past month, and 39.6% year to date, adding to a 42.3% gain over the last year and 163.0% over five years.

- Those gains have come as ASML keeps strengthening its position as the only maker of cutting edge EUV lithography machines, a critical bottleneck technology for advanced chips. At the same time, ongoing geopolitical tensions around chip export controls and heavy capex plans from leading chipmakers are shaping how investors think about the company’s long term demand and risk profile.

- Despite the strong share price, ASML scores just 2/6 on our valuation checks, suggesting the market might be pricing in a lot of optimism, but not necessarily overpaying on every metric. In the next sections we will walk through multiple valuation approaches to see what is really baked into today’s price, and then finish with a more nuanced way to think about ASML’s value that goes beyond simple multiples and models.

ASML Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and then discounting those back into today’s euros using a required rate of return.

For ASML, the latest twelve month free cash flow is about €8.6 billion. Analysts and internal estimates see this rising steadily, with projections such as roughly €8.8 billion in 2026 and more than €17.3 billion by 2029, and then continuing to grow through 2035 based on extrapolations by Simply Wall St. These cash flows are modeled using a two stage Free Cash Flow to Equity approach, which assumes faster growth in the near term that tapers to a more mature pace later on.

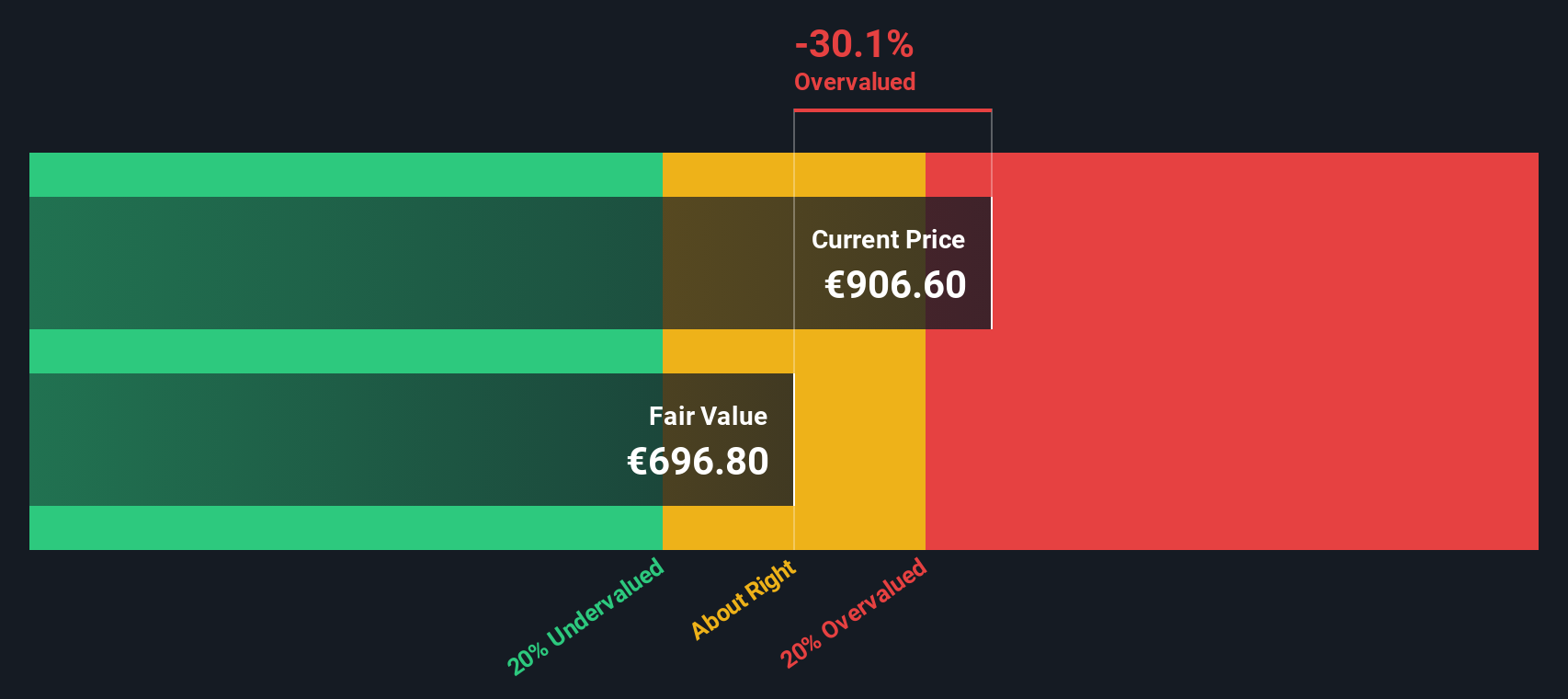

When all those future cash flows are discounted back to today, the intrinsic value comes out at about €702.67 per share. Compared with the current market price, this implies the stock is roughly 37.1% above the level the DCF would justify. This points to meaningful overvaluation on this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 37.1%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

For profitable, established companies like ASML, the price to earnings ratio is often the cleanest shorthand for valuation, because it links what investors pay directly to the profits the business is generating today. A higher PE can be justified when a company has stronger growth prospects or lower perceived risk, while slower growth or higher uncertainty usually calls for a lower, more conservative multiple.

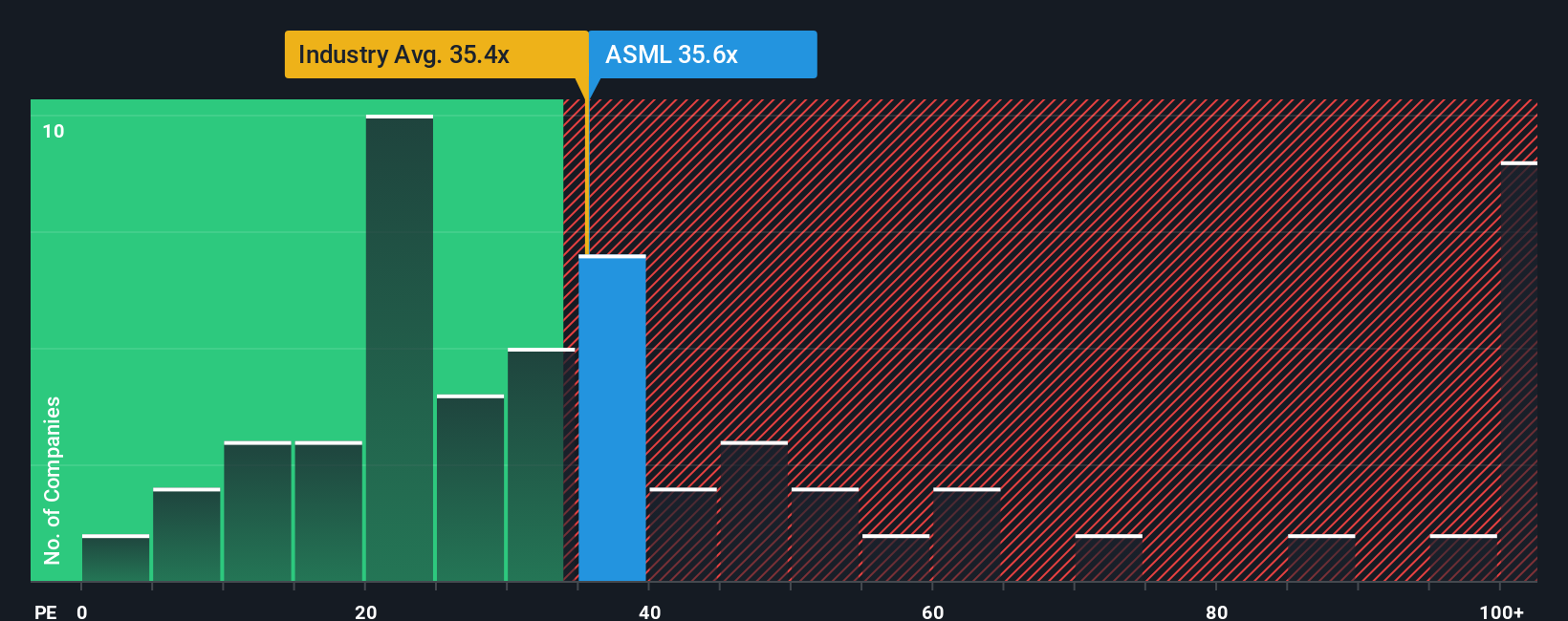

ASML currently trades on about 39.43x earnings. That is above the broader Semiconductor industry average of roughly 34.46x, but actually a bit below the peer group average of around 41.94x, suggesting investors see ASML as a high quality, but not extreme, premium name. To move beyond simple comparisons, Simply Wall St estimates a proprietary “Fair Ratio” of 43.07x, which reflects what investors might reasonably pay given ASML’s earnings growth outlook, margins, scale, industry dynamics and risk profile. This Fair Ratio is more informative than a basic peer or sector check, because it adjusts for the company’s specific strengths and vulnerabilities rather than assuming all chipmakers deserve the same multiple. With ASML’s current 39.43x sitting below the 43.07x Fair Ratio, the shares appear modestly undervalued on this framework.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company with the numbers behind it.

A Narrative is your story about ASML Holding, but grounded in a structured financial forecast, where you spell out how you think revenue, earnings and margins will evolve, what risks matter most, and what that implies for a fair value.

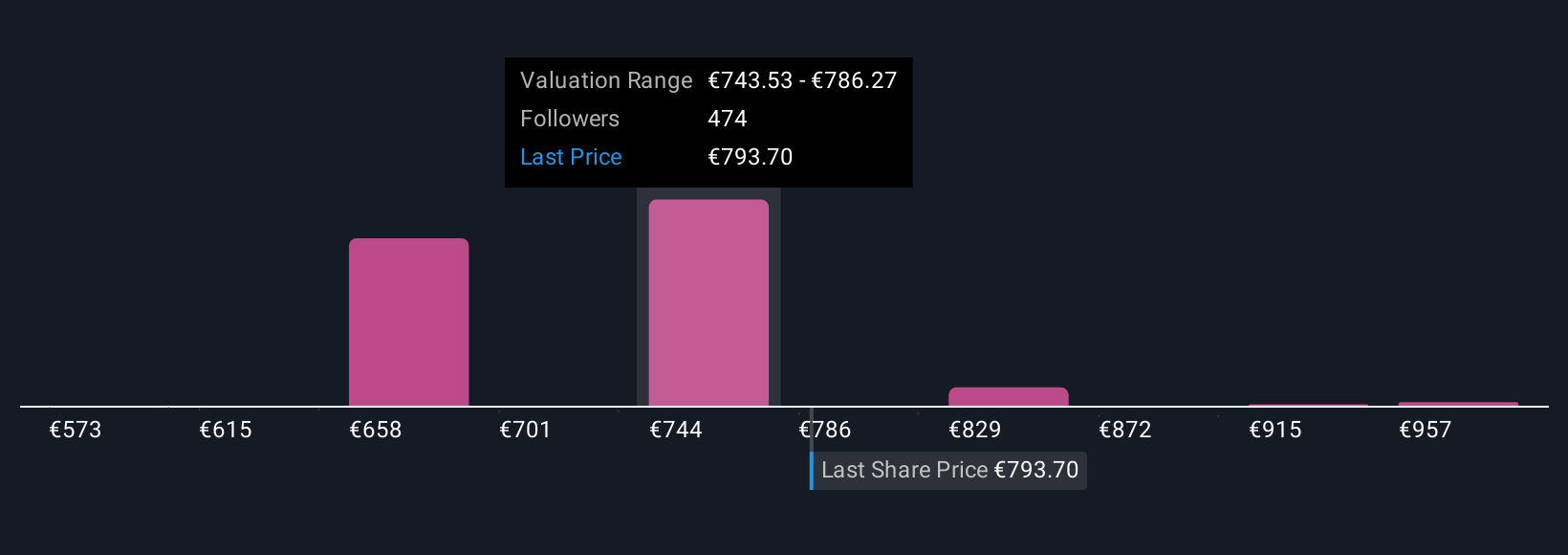

On Simply Wall St, Narratives live in the Community page and are used by millions of investors, because they make it easy to link a company’s story to a set of explicit assumptions and then to a clear Fair Value that you can compare with today’s share price to help inform whether you view it as a buy, a hold, or a sell.

These Narratives update automatically as new earnings, news, or guidance arrive, and you can see how other investors frame ASML, from more cautious fair values around €500 that lean on slower growth and higher risk, through to optimistic views close to €1,000 that assume stronger demand, robust margins and a higher future multiple.

For ASML Holding however we will make it really easy for you with previews of two leading ASML Holding Narratives:

Fair value: €1,000.00 per share

Implied undervaluation vs last close: -26.6%

Forecast revenue growth: 17.26%

- Views the recent pullback after cautious 2026 guidance as a buying opportunity, given strong Q2 2025 results and record bookings.

- Emphasizes ASML’s monopoly in EUV tools, high margin installed base services, and robust backlog as foundations for durable cash flows.

- Argues that secular drivers like AI, advanced nodes, and semiconductor reshoring support a long runway for growth and justify a higher fair value near €1,000.

Fair value: €864.91 per share

Implied overvaluation vs last close: 11.4%

Forecast revenue growth: 9.65%

- Recognizes ASML as an essential, quasi monopoly supplier of EUV systems, but highlights rising geopolitical and competitive risks, particularly around China.

- Notes that export controls and China’s push for self sufficiency could gradually erode ASML’s dominance, even if US and Europe offset near term demand shortfalls.

- Sees upside from secular growth and heavy R and D investment, but concludes that today’s price already discounts a lot of success, leaving limited margin of safety around the €865 fair value estimate.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal