Is Tamarack Valley Energy’s (TSX:TVE) Cautious 2026 Budget Quietly Redefining Its Growth Playbook?

- Tamarack Valley Energy recently released its 2026 corporate budget, outlining a CA$390–CA$410 million capital program focused on Clearwater and Charlie Lake development, waterflood expansion, and maintaining low breakeven costs while continuing dividends and share buybacks.

- An interesting wrinkle is that Tamarack is deliberately targeting only about 3% year-over-year production growth in 2026, reflecting a cautious response to a weaker WTI price outlook even as it increases spending on its highest-quality assets.

- With this new budget emphasizing disciplined growth and waterflood investment, we’ll now examine how it reshapes Tamarack Valley Energy’s investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tamarack Valley Energy Investment Narrative Recap

To own Tamarack Valley Energy, you have to believe its focus on Clearwater and Charlie Lake, plus waterflood expansion, can support sustainable free cash flow despite commodity volatility, regional discounts and a leveraged balance sheet. The 2026 budget’s modest 3% growth target and continued capital returns do not materially change the near term catalyst, which remains execution on waterflood performance, or the key risk around oil prices and Western Canadian pricing differentials.

The recent dividend increase to CA$0.013333 per share per month is particularly relevant alongside the new budget, since it underlines management’s commitment to ongoing cash returns while funding a CA$390 to CA$410 million capital program. For investors tracking catalysts, the combination of steady dividends, active buybacks and heavier spending on waterflood projects puts even more emphasis on whether future operating cash flow can comfortably support both balance sheet repair and shareholder distributions.

Yet while the capital plan looks disciplined, investors should be aware that Tamarack’s exposure to Canadian differentials and evolving domestic regulation could...

Read the full narrative on Tamarack Valley Energy (it's free!)

Tamarack Valley Energy's narrative projects CA$1.7 billion revenue and CA$80.5 million earnings by 2028. This requires 4.8% yearly revenue growth and a CA$178.7 million earnings decrease from CA$259.2 million today.

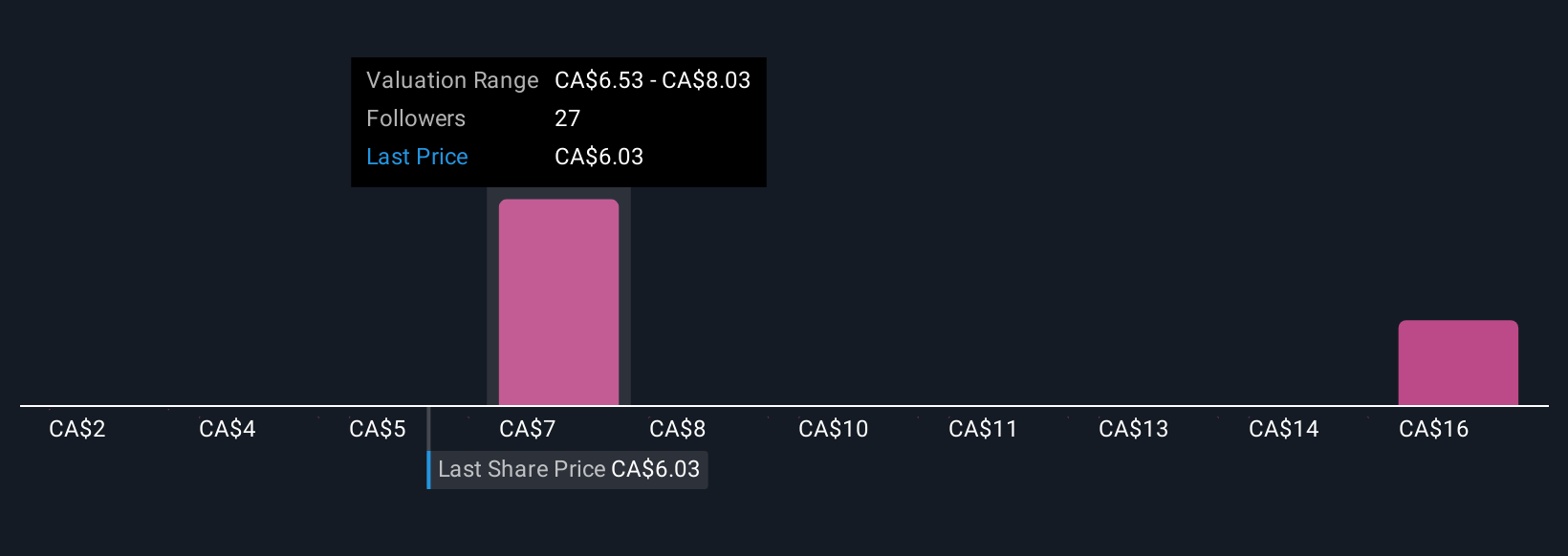

Uncover how Tamarack Valley Energy's forecasts yield a CA$8.10 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community valuations for Tamarack Valley Energy span roughly CA$7.47 to CA$17.68, underlining how far apart individual expectations can be. Against that backdrop, the new budget’s focus on waterflood driven stability raises clear questions about how resilient cash flows might be if oil prices or Canadian differentials move against the company, so it is worth weighing several viewpoints before forming your own.

Explore 3 other fair value estimates on Tamarack Valley Energy - why the stock might be worth 7% less than the current price!

Build Your Own Tamarack Valley Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tamarack Valley Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tamarack Valley Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tamarack Valley Energy's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal