How Data Center-Focused Heat Exchangers and Analyst Support Could Reshape Dover's (DOV) Narrative

- Dover recently drew investor attention as CEO Richard Tobin presented at the UBS Global Industrials and Transportation Conference, while its SWEP unit launched new brazed plate heat exchangers targeting data center cooling and district energy markets.

- Together with favorable analyst commentary citing strong demand trends and an ongoing dividend track record, these product launches highlight how Dover is tying its portfolio more closely to data center and sustainability themes.

- Now we’ll examine how this combination of data center-focused innovation and supportive analyst commentary may influence Dover’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Dover Investment Narrative Recap

To own Dover, you generally need to believe that its mix of industrial businesses can keep compounding earnings while gradually tilting toward higher growth, higher margin niches like data centers and sustainability-focused solutions. The SWEP heat exchanger launch and constructive analyst commentary reinforce that data center exposure is becoming a more visible near term catalyst, while the biggest risk still lies in macro uncertainty and demand volatility across more cyclical, slower growing parts of the portfolio, which this news does not materially reduce.

Among the latest updates, SWEP’s new brazed plate heat exchangers for data center cooling and district energy tie directly into one of Dover’s core catalysts: benefiting from rising capital investment in efficient, lower impact thermal management. These launches support the narrative that a larger share of Dover’s portfolio could be aligned with secular growth areas, which may help offset some of the earnings volatility tied to legacy industrial and retail end markets over time.

But while data center growth is encouraging, investors should also be aware that exposure to delayed or volatile industrial projects can still...

Read the full narrative on Dover (it's free!)

Dover's narrative projects $9.1 billion revenue and $1.1 billion earnings by 2028. This requires 5.2% yearly revenue growth with earnings remaining flat from $1.1 billion today.

Uncover how Dover's forecasts yield a $215.06 fair value, a 13% upside to its current price.

Exploring Other Perspectives

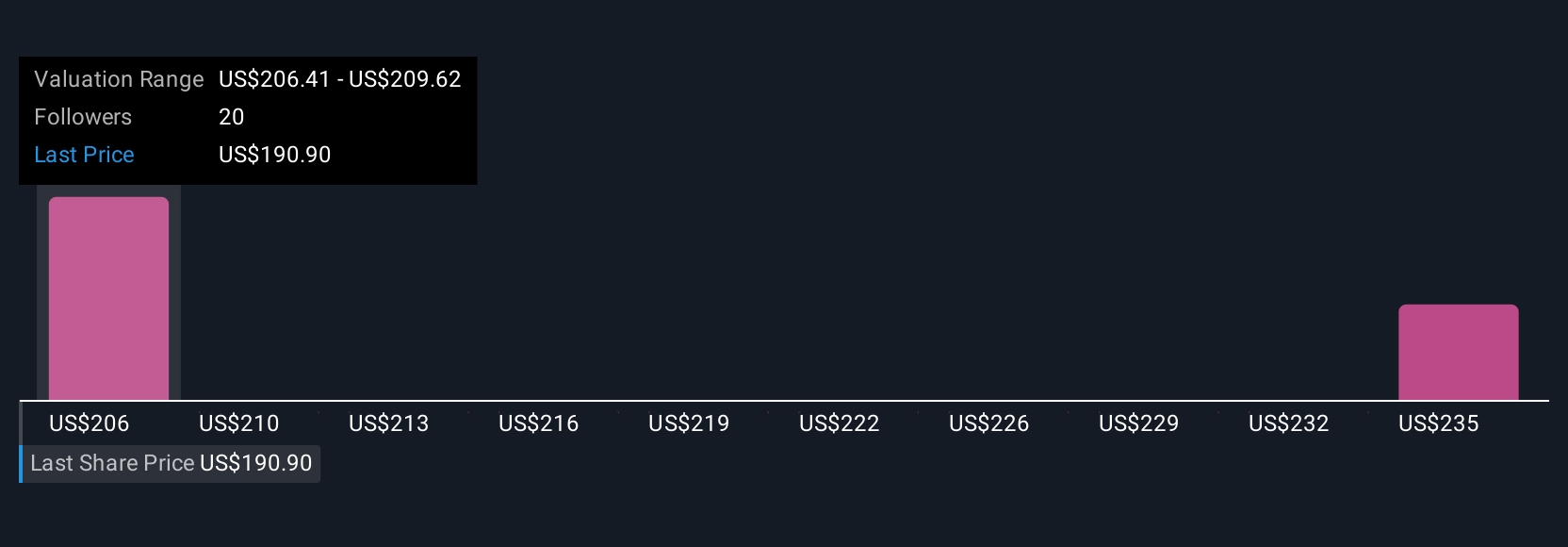

Two fair value estimates from the Simply Wall St Community cluster between US$215.06 and US$231.19, highlighting how differently individual investors can view Dover. Against this, the growing role of data center cooling as a potential earnings catalyst invites you to weigh how much these newer growth pockets can really offset the company’s exposure to slower, cyclical industrial segments.

Explore 2 other fair value estimates on Dover - why the stock might be worth just $215.06!

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal