Confluent (CFLT) Is Up 8.3% After Q3 Beat, AI Launches, Acquisition Buzz - What's Changed

- In Q3 2025, Confluent reported revenue growth of 19% year over year, beating expectations, expanded billings to US$318.1 million, and launched new AI-oriented Intelligence features, Streaming Agents enhancements, and a private cloud offering for regulated industries.

- At the same time, Jackson Peak Capital highlighted Confluent as its largest, high-conviction, event-driven position with potential acquisition appeal, underscoring how the company’s evolving data streaming platform is increasingly central to enterprise AI workloads.

- We’ll now examine how Confluent’s stronger-than-expected Q3 results and new AI Intelligence capabilities may reshape its existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Confluent Investment Narrative Recap

To own Confluent, you need to believe its data streaming platform will stay central to real-time and AI workloads, offsetting current losses and competitive pressure from cloud providers and open source. The Q3 beat and healthy billings support that thesis in the near term, but do not materially reduce the biggest risk right now, which is slower cloud consumption growth as some customers optimize spend and large AI-native users shift toward self-managed options.

The new Confluent Intelligence capabilities look particularly relevant here, because they tie the platform more tightly to AI agents and real-time context, which is exactly where many of the medium term growth catalysts are focused. If Intelligence and Streaming Agents help customers build production AI use cases faster and more reliably, they could deepen usage of Confluent Cloud and partially counter the risk that high-value customers migrate workloads elsewhere.

Yet, while AI-linked demand is encouraging, investors should also be aware of the growing risk that cloud consumption trends remain muted and...

Read the full narrative on Confluent (it's free!)

Confluent's narrative projects $1.7 billion revenue and $220.6 million earnings by 2028. This requires 16.5% yearly revenue growth and a $532.3 million earnings increase from -$311.7 million today.

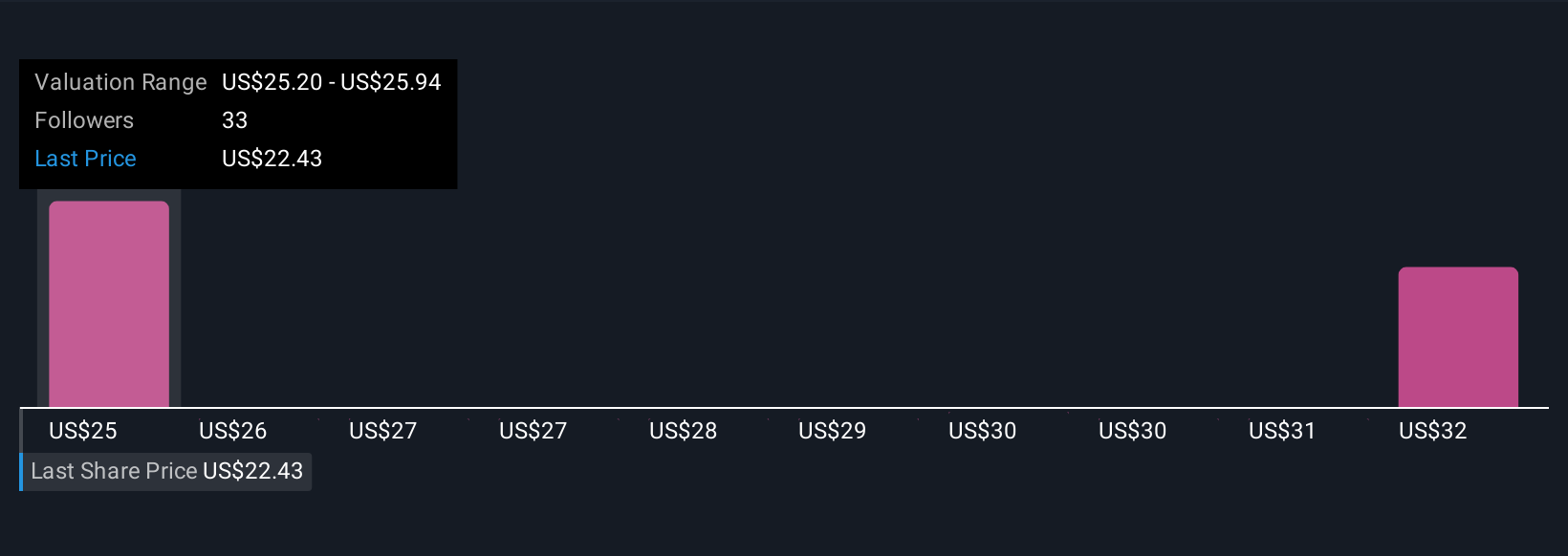

Uncover how Confluent's forecasts yield a $27.87 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Confluent cluster between US$27.87 and US$33.85, showing how far individual views on upside can spread. Against this, the central risk many highlight is that slower Confluent Cloud consumption and customer optimization could still weigh on revenue momentum and sentiment, so it is worth comparing several viewpoints before forming your own.

Explore 3 other fair value estimates on Confluent - why the stock might be worth just $27.87!

Build Your Own Confluent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Confluent research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Confluent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Confluent's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal