Could Apple’s Possible 18A Deal Quietly Redefine Intel’s (INTC) AI-First Foundry Ambitions?

- In recent days, reports have emerged that Apple may use Intel’s upcoming 18A process to manufacture future M-series chips for MacBook and iPad devices from around 2027, marking a potential return of Intel as a key supplier.

- If confirmed, this shift would be a significant endorsement of Intel’s foundry capabilities, especially as it seeks marquee customers to validate its manufacturing turnaround and broaden its role as a third-party chip producer.

- We’ll now examine how the prospect of Intel fabricating Apple’s M-series chips could reshape its AI-and-foundry-focused investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Intel Investment Narrative Recap

To own Intel today, you have to believe its turnaround in AI and advanced manufacturing will translate into sustainably higher earnings, despite low current returns on equity and heavy investment needs. The Apple 18A foundry rumor supports the core thesis of rebuilding Intel’s manufacturing credibility, but it does not remove the near term execution risk around delivering leading edge nodes profitably.

The clearest recent link to this story is Intel’s progress on its 18A and 14A nodes, including producing over 30,000 wafers on 18A in a single quarter, which underpins any future Apple work. This technical ramp is also central to Intel’s broader AI and foundry ambitions, where consistent, reliable execution is the key short term catalyst and also the area where investors remain most cautious.

Yet investors should also weigh how much room for error Intel really has on its process roadmap and AI execution before the turnaround thesis starts to unravel...

Read the full narrative on Intel (it's free!)

Intel’s narrative projects $58.1 billion revenue and $5.2 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $25.7 billion earnings increase from $-20.5 billion today.

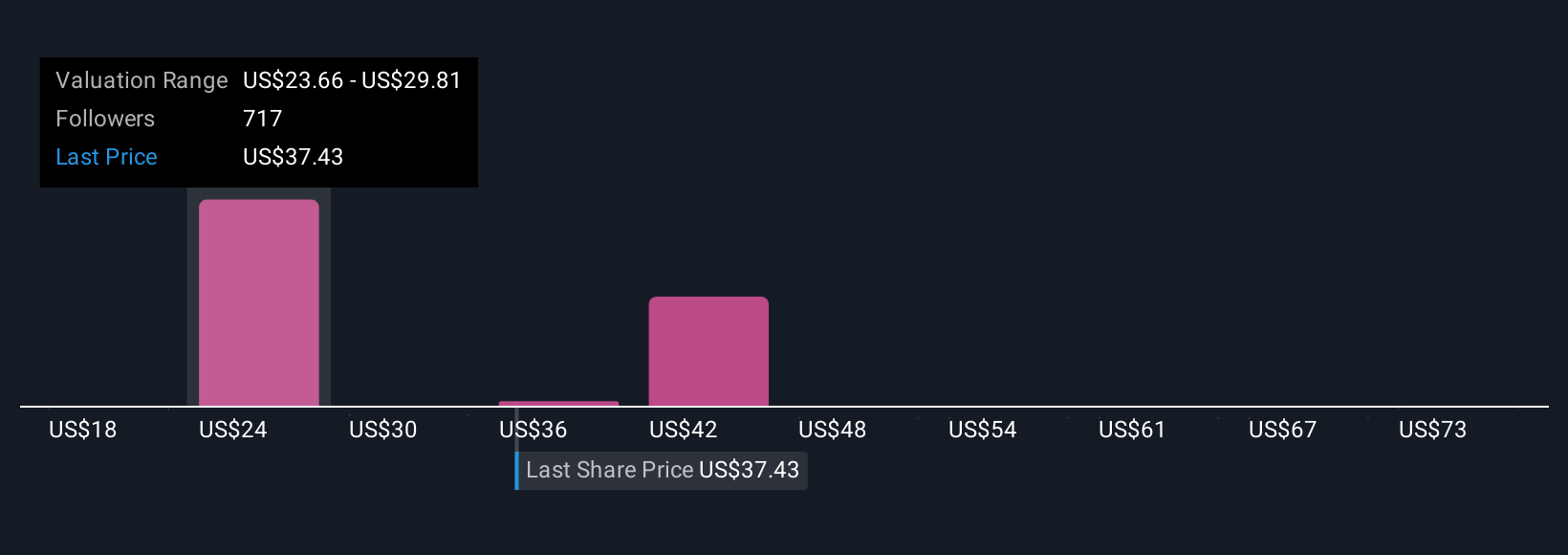

Uncover how Intel's forecasts yield a $37.27 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already assuming Intel could lift revenue to about US$62.1 billion and earnings to roughly US$8.7 billion by 2028, but if node delays or AI execution issues persist while deals like the potential Apple win evolve, you and those analysts may be looking at very different futures for the same stock.

Explore 27 other fair value estimates on Intel - why the stock might be worth less than half the current price!

Build Your Own Intel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intel's overall financial health at a glance.

No Opportunity In Intel?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal