Undiscovered Gems in Global Stocks for December 2025

As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic indicators, small-cap stocks have been in the spotlight, with the Russell 2000 Index showing robust gains. In this environment of cautious optimism and shifting economic dynamics, identifying promising opportunities requires a keen eye for companies that can thrive amid evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 7.71% | 21.57% | ★★★★★★ |

| CAC Holdings | 5.03% | 1.71% | 16.00% | ★★★★★★ |

| Savior Lifetec | NA | -11.98% | 25.39% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Innotech | 38.43% | 5.37% | -7.82% | ★★★★★★ |

| Saha-Union | 0.70% | 0.67% | 18.29% | ★★★★★★ |

| AblePrint Technology | 7.13% | 15.97% | 15.61% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

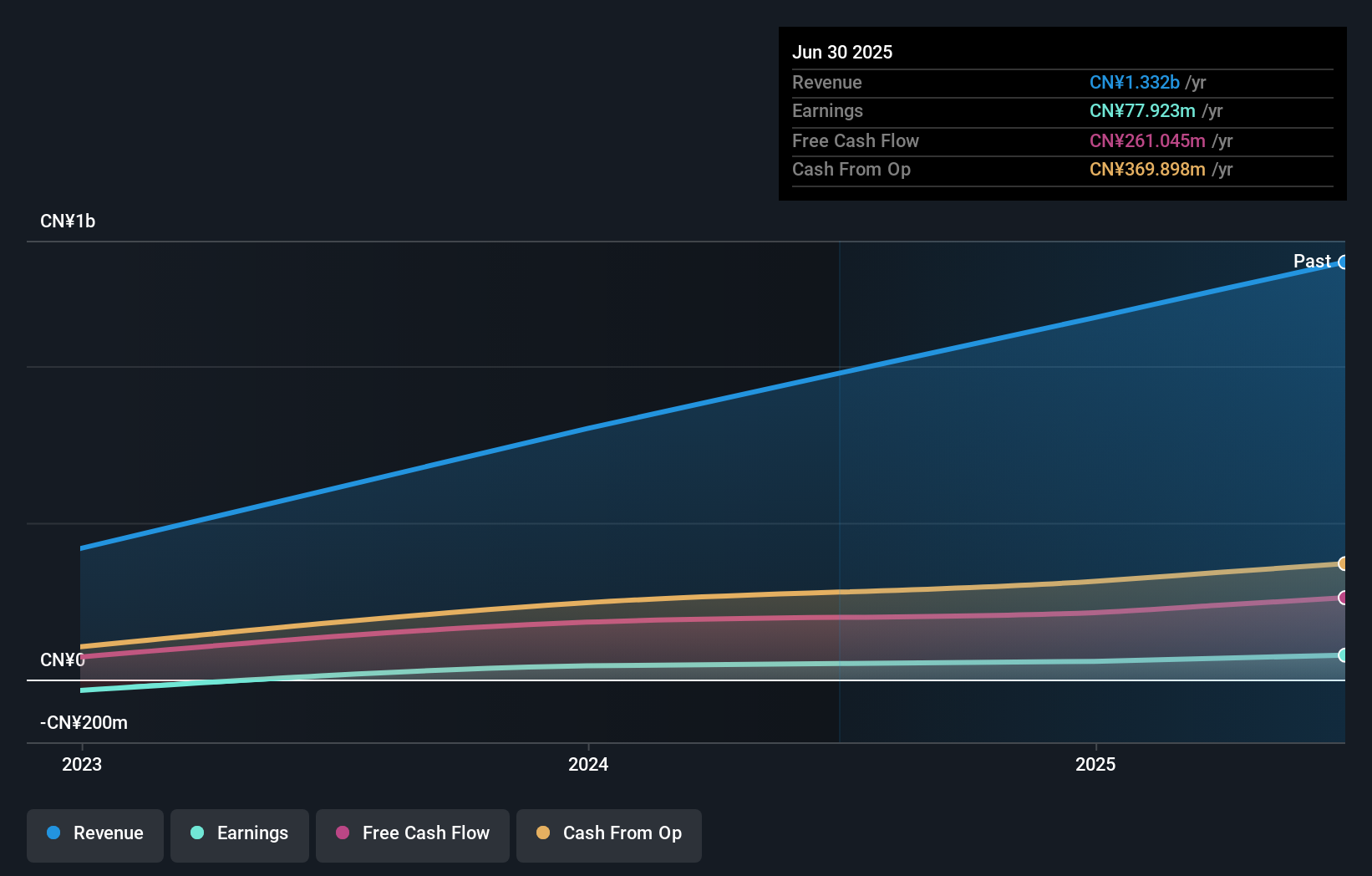

Guangzhou Xiao Noodles Catering Management (SEHK:2408)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangzhou Xiao Noodles Catering Management Co., Ltd. operates self-managed restaurants and oversees franchise operations in China, with a market capitalization of approximately HK$3.66 billion.

Operations: Guangzhou Xiao Noodles generates revenue primarily from its self-operated restaurants, amounting to CN¥1.33 billion. The company's financial performance is influenced by its operational efficiency and cost management strategies.

Guangzhou Xiao Noodles Catering Management is drawing attention with its recent IPO filing of HKD 685 million, offering shares priced between HKD 5.64 and HKD 7.04. The company is debt-free, reflecting a strong financial position, and it has shown impressive earnings growth of 52% over the past year, outpacing the hospitality industry's average growth of nearly 10%. Trading at about 48% below its estimated fair value suggests potential undervaluation. Despite these positives, shares remain highly illiquid, which could pose challenges for investors seeking liquidity in their investments.

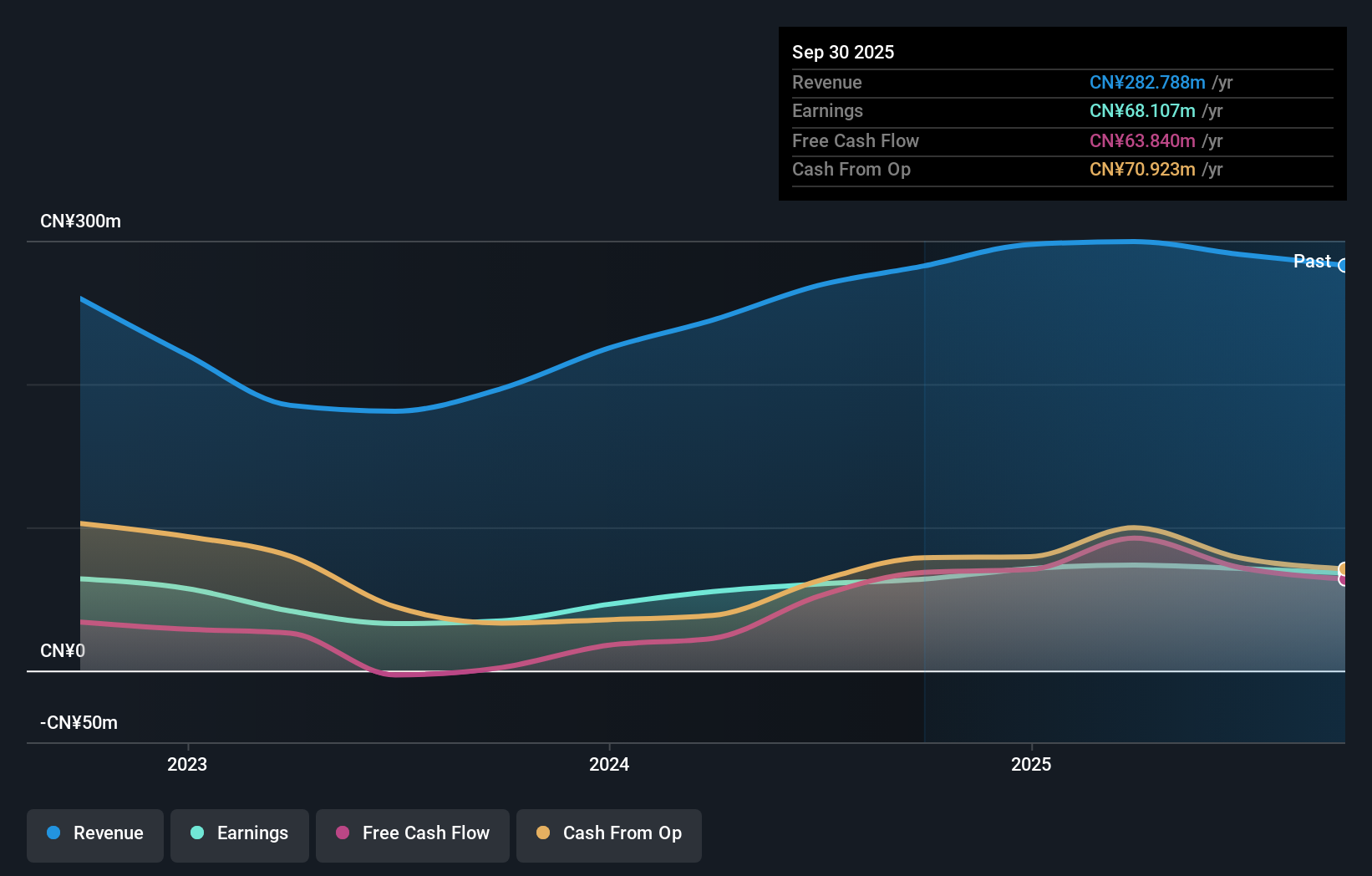

Yangzhou Seashine New MaterialsLtd (SZSE:300885)

Simply Wall St Value Rating: ★★★★★★

Overview: Yangzhou Seashine New Materials Co., Ltd. focuses on the research, design, development, production, and sale of powder metallurgy products in China with a market capitalization of CN¥5.29 billion.

Operations: Yangzhou Seashine generates revenue through the production and sale of powder metallurgy products. The company's financial performance includes a notable gross profit margin, reflecting its efficiency in managing production costs relative to sales.

Yangzhou Seashine New Materials, a modestly sized player in the materials sector, showcases a debt-free balance sheet over the past five years. Despite earnings declining by 4.1% annually over five years, recent yearly growth of 6.6% outpaced the Consumer Durables industry’s -3.4%. The company reported high-quality earnings and positive free cash flow, though revenue for nine months ending September 2025 was CNY 202.53 million compared to CNY 217.17 million last year with net income slightly lower at CNY 42.61 million from CNY 45.73 million previously, reflecting some challenges amidst its volatile share price backdrop.

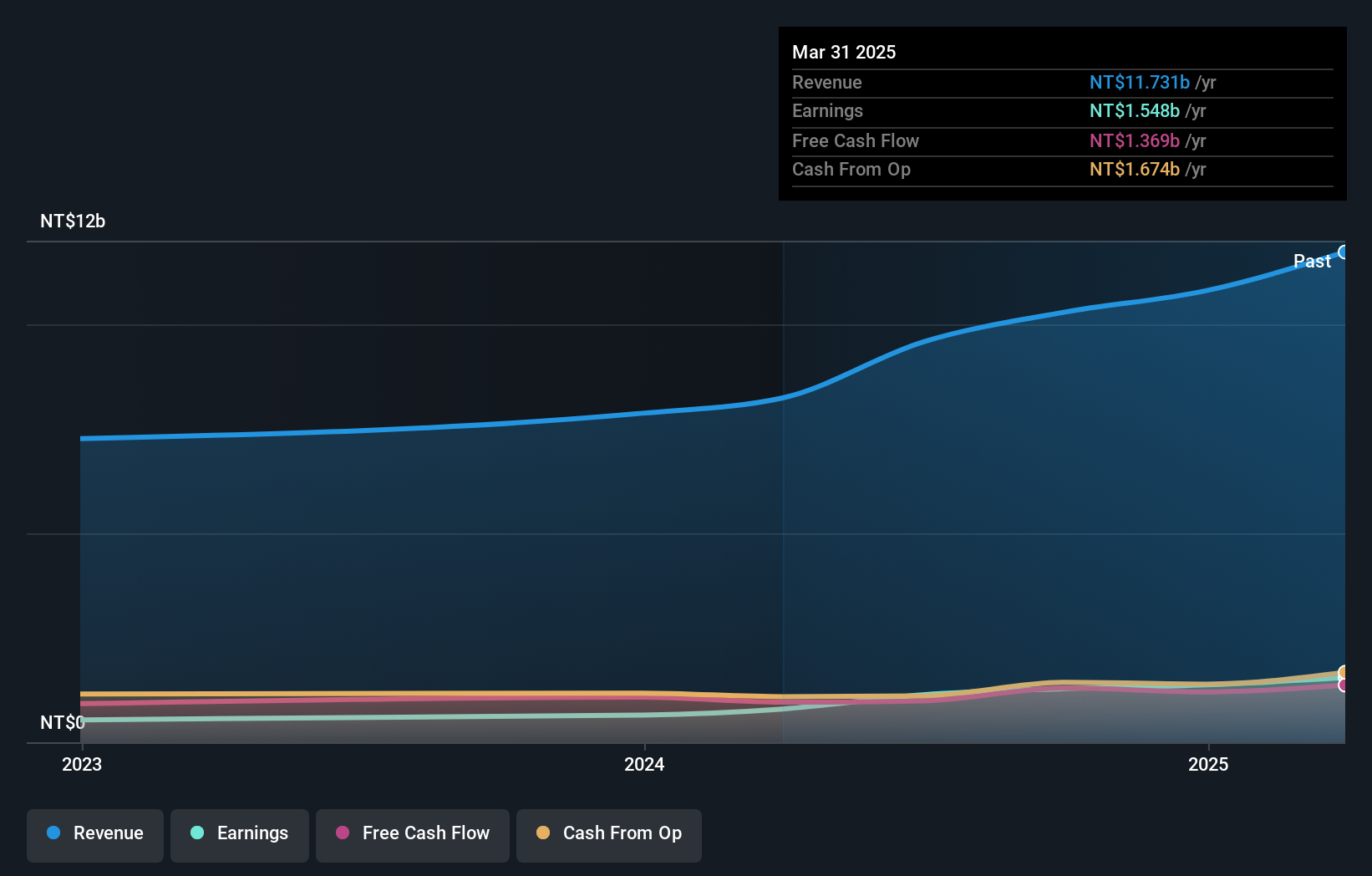

Syntec Technology (TWSE:7750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Syntec Technology Co., Ltd. is involved in the research and development, manufacturing, sales, and maintenance of industrial electronic automation controllers across Taiwan, Asia, and internationally with a market cap of NT$53.60 billion.

Operations: Syntec Technology generates revenue primarily from its Machinery & Industrial Equipment segment, which reported NT$12.94 billion. The company's financial performance is influenced by its focus on industrial electronic automation controllers.

Syntec Technology, a nimble player in its field, has shown robust financial health with earnings growing 34.9% over the past year, outpacing the Machinery industry's -4%. The company reported third-quarter sales of TWD 3.03 billion and net income of TWD 365.06 million, reflecting solid performance compared to last year’s figures of TWD 2.5 billion and TWD 280.5 million respectively. With a follow-on equity offering raising TWD 4.79 billion, Syntec appears well-capitalized and trades at a discount of about 24.6% below its estimated fair value, suggesting potential for future appreciation in value for investors eyeing growth opportunities.

Seize The Opportunity

- Explore the 3022 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal