Should PennyMac’s Q3 Earnings Beat And 18% ROE Require Action From PennyMac Financial (PFSI) Investors?

- PennyMac Financial Services recently reported an exceptional third quarter, with revenues rising 11.3% year on year to US$637.1 million and earnings surpassing analyst estimates.

- The company’s 18% return on equity and strong performance across mortgage origination, servicing, and investment management suggest its operating model is holding up well despite broader sector pressures.

- We’ll now examine how this earnings beat and strong return on equity may influence PennyMac’s existing investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

PennyMac Financial Services Investment Narrative Recap

To hold PennyMac Financial Services, you need to believe its diversified model in origination, servicing, and investment management can keep generating solid returns despite a tough mortgage backdrop. The latest quarter’s 11.3% revenue growth to US$637.1 million and 18% return on equity support that view and slightly ease near term concerns around earnings pressure, but they do not remove the key risk that persistently high interest rates could still weigh on future loan production.

One recent development that ties directly into this earnings strength is the company’s consistent US$0.30 per share quarterly dividend through 2025. Maintaining that payout alongside an earnings beat and an 18% return on equity underlines management’s confidence in cash generation and the servicing driven recurring revenue base, which many investors see as a key catalyst if mortgage volumes improve over time.

But while the quarter looked strong, investors should be very aware of how quickly PennyMac’s heavy exposure to mortgage servicing rights can...

Read the full narrative on PennyMac Financial Services (it's free!)

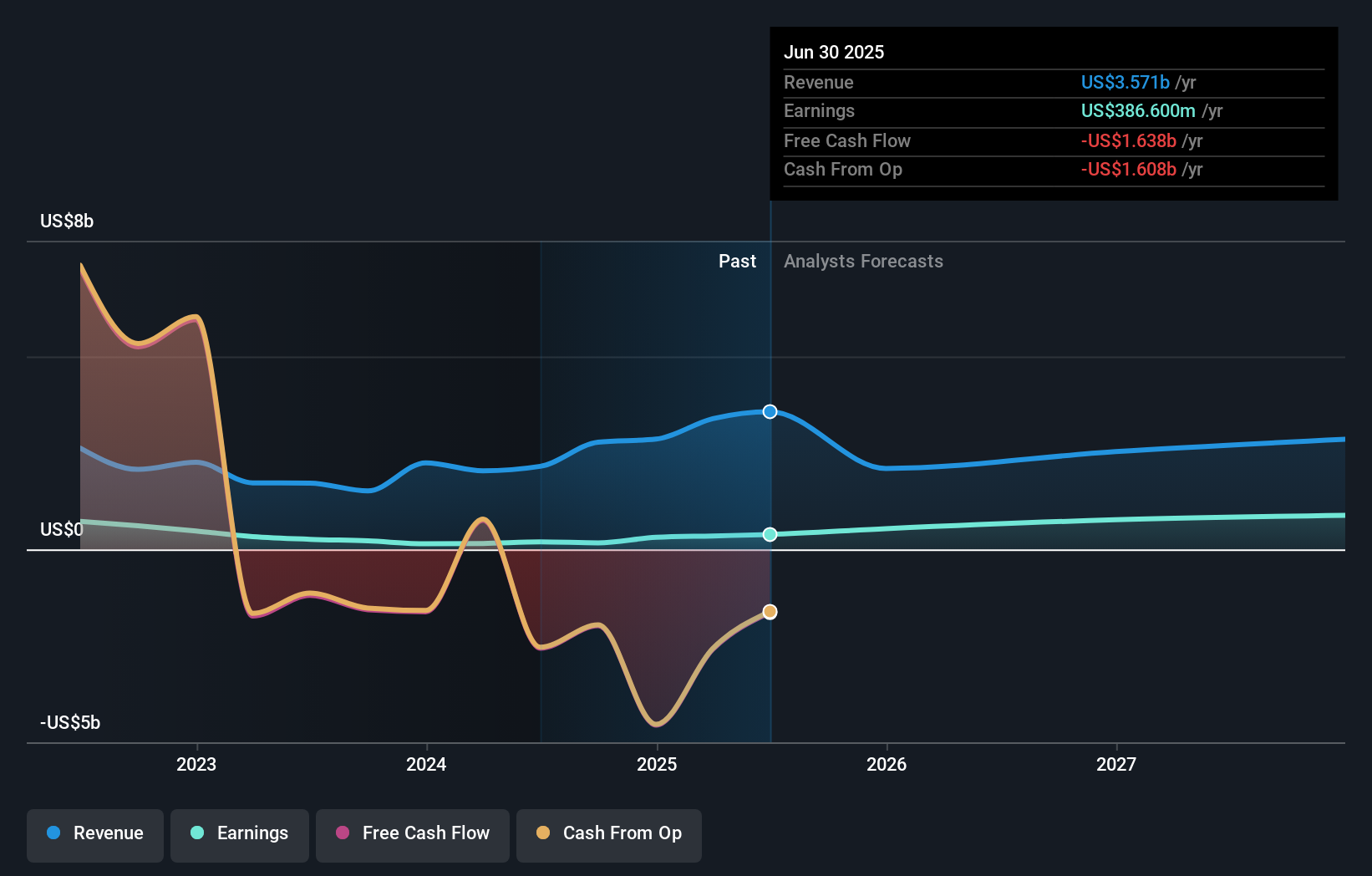

PennyMac Financial Services' narrative projects $2.5 billion revenue and $1.1 billion earnings by 2028. This assumes an 11.0% yearly revenue decline and an earnings increase of about $713 million from $386.6 million today.

Uncover how PennyMac Financial Services' forecasts yield a $138.57 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between about US$125.68 and US$138.57, showing how differently individual investors are sizing up PennyMac. Set against the recent earnings beat and 18% return on equity, this spread underlines why you may want to weigh both the upside from its large servicing portfolio and the ongoing interest rate and origination volume risks before reaching your own view.

Explore 2 other fair value estimates on PennyMac Financial Services - why the stock might be worth as much as $138.57!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal