Snowflake (SNOW): Valuation Check After Expanded Anthropic AI Partnership and Latest Q3 Earnings Update

Snowflake (SNOW) just delivered a two-for-one update: a $200 million expansion of its Anthropic partnership to embed Claude powered AI agents across its data cloud, and fresh Q3 results with new guidance.

See our latest analysis for Snowflake.

Those moves have kept Snowflake’s share price on the front foot, with a roughly 19% 3 month share price return and a 42% 1 year total shareholder return suggesting momentum is still building rather than cooling off.

If Snowflake’s AI push has your attention, it could be a good moment to explore other high potential software names through high growth tech and AI stocks.

With the stock near its revised analyst targets after a powerful AI driven rerating, investors now face a tougher question: is Snowflake still trading below its long term potential, or has the market already priced in that growth?

Most Popular Narrative: 2.8% Undervalued

With Snowflake closing at $265 compared to a narrative fair value near $273, the story frames today’s price as slightly below long run potential.

The analysts have a consensus price target of $260.624 for Snowflake based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $440.0, and the most bearish reporting a price target of just $170.0.

Want to see what justifies this punchy valuation? The narrative leans on rapid revenue compounding, a sharp margin swing, and a future earnings multiple usually reserved for elite software winners.

Result: Fair Value of $272.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat outlook could be challenged if demand for cloud migration cools, or if hyperscaler rivals put pressure on Snowflake’s pricing power and large enterprise wins.

Find out about the key risks to this Snowflake narrative.

Another View: Rich Multiples Signal a Very Different Story

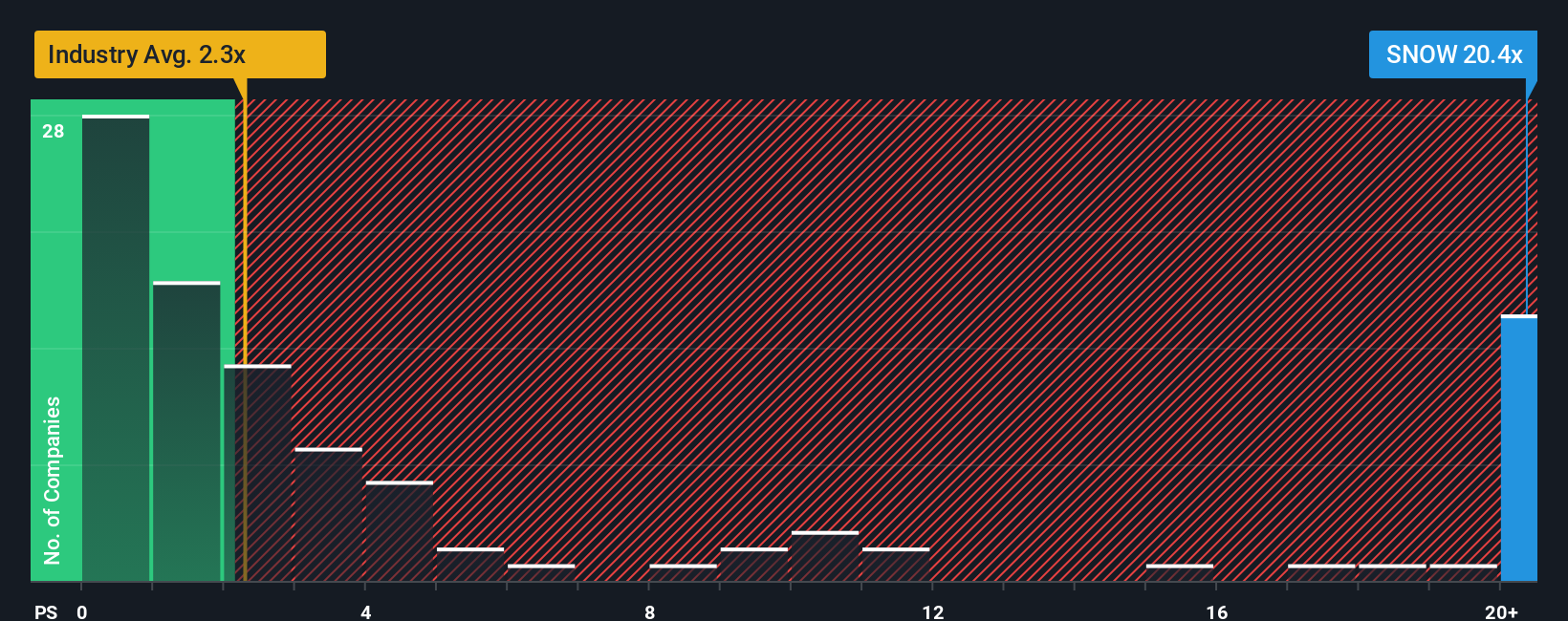

While the narrative fair value paints Snowflake as modestly undervalued, its price to sales ratio tells a sharper story. At 21.8 times sales, Snowflake trades far above the US IT industry at 2.5 times, peers at 20.9 times, and even its own fair ratio of 12.9 times. That gap suggests investors are paying up heavily for the AI growth story, leaving less room for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Snowflake Narrative

If you see the numbers differently or want to challenge the consensus, you can spin up a tailored Snowflake view in minutes: Do it your way.

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Snowflake is just one opportunity, and the market will not wait forever. Put your research to work by scanning for fresh ideas before the crowd moves first.

- Capture potential mispricings by running through these 920 undervalued stocks based on cash flows that may still trade below their long term cash flow power.

- Ride structural growth in automation and data by targeting these 25 AI penny stocks positioned at the heart of the AI transition.

- Identify income opportunities by filtering for these 14 dividend stocks with yields > 3% that aim to provide regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal