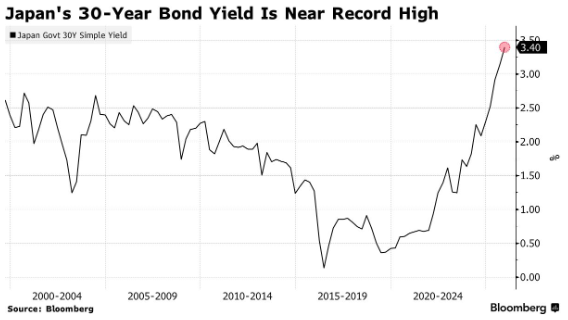

Japan's 30-year treasury bond auction demand is booming, hitting a 4-year high! With a yield of over 3.4%, it was bought by Nomura in a big way

The Zhitong Finance App learned that Japan's 30-year treasury bond auction had the strongest demand since 2019. This indicates that due to rising yields, investors have finally begun to re-enter the market, bringing some respite to the tense and uneasy market due to anticipated interest rate hikes.

The bid multiplier for the 30-year treasury bonds issued by the Ministry of Finance jumped to 4.04, higher than the previous auction level, and easily surpassed the average of the past year. After the auction, the 30-year yield dropped 3 basis points to 3.39%.

The treasury bond auction on Thursday followed a steady 10-year treasury bond auction on Tuesday. At that time, yields reached attractive levels, and buyers rushed in. Taken together, these results have provided some comfort to the market. In the previous few weeks, expectations for the Bank of Japan's interest rate hike heated up and fiscal concerns revived, triggering a round of sharp sell-off, driving yields for various periods to decades-long highs.

Ryutaro Kimura, senior fixed income strategist at AXA Investment Management, said: “The auction results were surprisingly strong, probably because many investors thought it was acceptable for many investors to increase their exposure to ultra-long-term bonds when the yield exceeds 3.4%. The upward pressure on ultra-long-term bond yields may ease temporarily.”

The bid multiplier for this auction increased from 3.125 at the time of the November auction. Another sign of steady investor demand is that the “tail” of this auction (that is, the difference between the average accepted price and the lowest accepted price) was 0.09, compared to 0.27 last month.

Analyst Mark Cranfield said: Japanese treasury investors seem to have found their favorite 30-year bond yield level. The bid multiplier for Thursday's auction was as high as 4.04. This is the highest level of demand since 2019, and the lowest transaction price was far higher than pre-auction expectations, which is also a positive sign.

Furthermore, Nomura became the biggest buyer, which is usually a sign of long-term investor engagement.

Yields on other Japanese term bonds are still rising, particularly short-term bonds that are more sensitive to changes in monetary policy. Bank of Japan Governor Ueda Kazuo's slightly hawkish remarks earlier this week raised investors' expectations for a December rate hike. He said the Bank of Japan will weigh the pros and cons of raising interest rates and take appropriate action, adding that financial conditions will remain relaxed even if interest rates are raised.

The yield on Japan's benchmark 10-year treasury bond rose 3.5 basis points to 1.925%, and the yield on 5-year treasury bonds rose slightly to 1.40%. The swap market currently suggests that the possibility that the Bank of Japan will raise interest rates at the next policy meeting expected to be held on December 19 is about 80%, while the possibility of raising interest rates in January is over 90%. By contrast, just a week ago, the market expected a rate hike in December with a probability of only 56%.

Ken Matsumoto, macro strategist at Crédit Agricole Securities Asia Ltd., said that the current high yield level makes it easier for life insurance companies to buy Japanese bonds. He said that considering that after the interest rate hike is expected in December, the next rate hike will have to wait a long time, this “should be beneficial to bonds”.

Investors are still awaiting details of the government's budget for the next fiscal year, particularly any plans to further reduce the issuance of ultra-long-term bonds. At a meeting last week, major Japanese traders have asked the Ministry of Finance to cut sales of such bonds.

In Japan, the government has announced plans to increase the issuance of short-term bonds to help fund Prime Minister Takaichi Sanae's economic plans, increase the issuance plan for two-year and five-year treasury bonds by 300 billion yen, and increase the supply of treasury notes by 6.3 trillion yen.

Despite this, Kimura of AXA Investment Management said that if the overall issuance volume increases and the reduction in the supply of ultra-long-term Japanese treasury bonds called for by investors fails to be realized, the yield curve may become steeper again.

Investors will now turn their attention to next week's 5-year and 20-year treasury bond auctions, as well as the Federal Reserve's policy decisions and their impact on the Bank of Japan's policy path.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal