What Trinity Capital (TRIN)'s Insurtech Bet on Kinetic Means for Shareholders

- Earlier this week, Trinity Capital Inc. announced it had committed growth capital to Kinetic, a workers' compensation Managing General Underwriter, to speed up development of its end-to-end workplace injury claims and safety technology platform.

- The move spotlights Trinity’s focus on financing growth-stage insurtech businesses that aim to lower claims costs while improving workplace safety outcomes for insurers and employers.

- We’ll now examine how Trinity’s funding of Kinetic’s workplace injury management platform could influence its investment narrative and long-term growth profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Trinity Capital Investment Narrative Recap

To own Trinity Capital, you need to believe in its ability to compound value by scaling a diversified venture lending platform while protecting credit quality and funding costs. The Kinetic growth capital fits this narrative by reinforcing Trinity’s exposure to higher growth, tech-enabled borrowers, but it does not appear to materially change the near term focus on maintaining strong credit performance as the key catalyst and guarding against any deterioration in startup or venture markets as the biggest current risk.

Among recent announcements, the US$200,000,000 secured term loan facility with KeyBank stands out in relation to the Kinetic funding, because it expands Trinity’s lending capacity at a time when venture debt demand and its unfunded commitment pipeline are both elevated. This additional firepower supports the company’s ability to back growth stage names like Kinetic, but it also heightens investor attention on how Trinity balances rapid origination with disciplined underwriting so that portfolio performance keeps pace with balance sheet expansion.

Yet investors should be aware that if the innovation and venture ecosystem slows unexpectedly, Trinity’s rapid origination pace could...

Read the full narrative on Trinity Capital (it's free!)

Trinity Capital's narrative projects $344.1 million revenue and $159.5 million earnings by 2028.

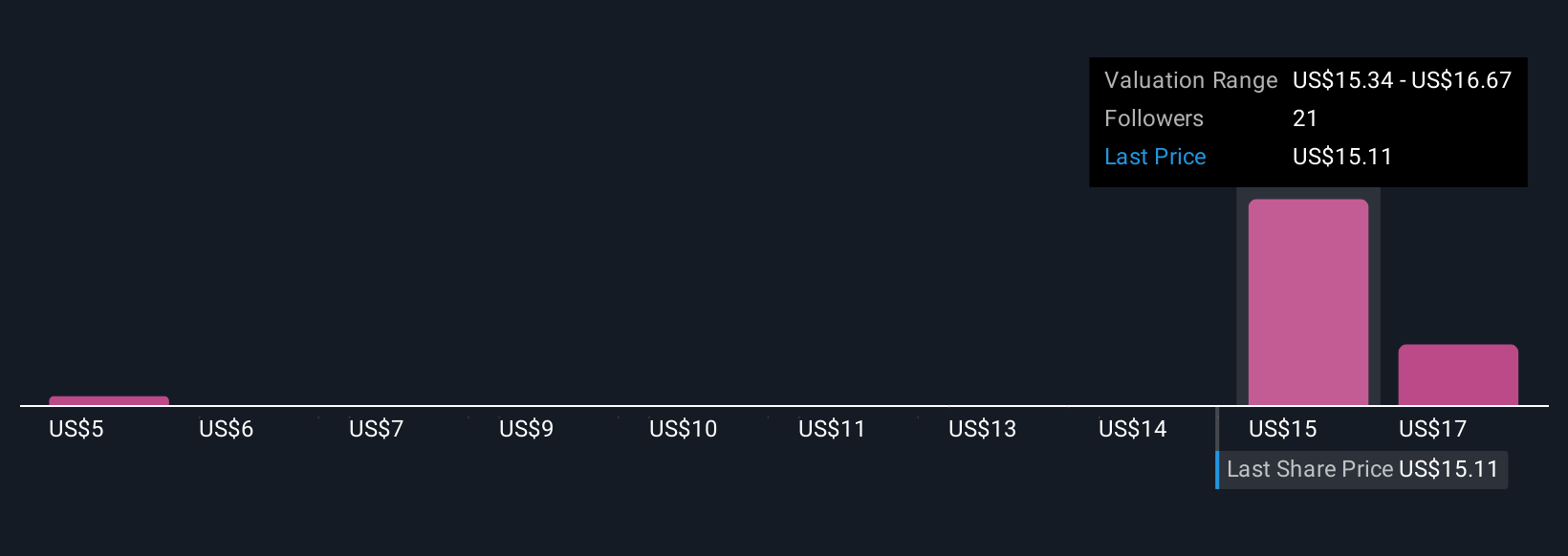

Uncover how Trinity Capital's forecasts yield a $16.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$4.71 to US$24.92 per share, underlining how far apart individual views can be. When you set those against Trinity’s dependence on a robust venture and innovation pipeline to support its growth ambitions, it becomes clear why many investors prefer to weigh several viewpoints before forming a conviction.

Explore 8 other fair value estimates on Trinity Capital - why the stock might be worth less than half the current price!

Build Your Own Trinity Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Capital research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Trinity Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Capital's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal