Will William Blair’s Outperform Initiation Shift Viridian Therapeutics’ (VRDN) Narrative Among Institutional Investors?

- On December 3, 2025, William Blair initiated coverage on Viridian Therapeutics with an “Outperform” rating, adding to a series of favorable analyst views on the company.

- This new endorsement from a respected research house strengthens the perception of growing institutional confidence in Viridian’s longer-term prospects.

- Next, we’ll explore how William Blair’s positive initiation helps shape Viridian Therapeutics’ investment narrative and what it could mean for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Viridian Therapeutics' Investment Narrative?

To own Viridian Therapeutics today, you really have to believe that veligrotug’s thyroid eye disease program will convert its recent regulatory and clinical momentum into a commercial franchise, and that VRDN-003 can extend that opportunity. The BLA filing, Breakthrough Therapy designation and revenue interest financing all put the FDA review and Phase 3 readouts at the center of the story, while the October equity raise and ongoing losses show how reliant the company still is on external capital. William Blair’s new Outperform rating mostly reinforces existing optimism rather than changing those core catalysts, but it can support sentiment after a strong 1-year share price run and widen the shareholder base. The key risk, unchanged by this initiation, is that any disappointment in veligrotug’s approval, label or uptake could quickly reprice expectations.

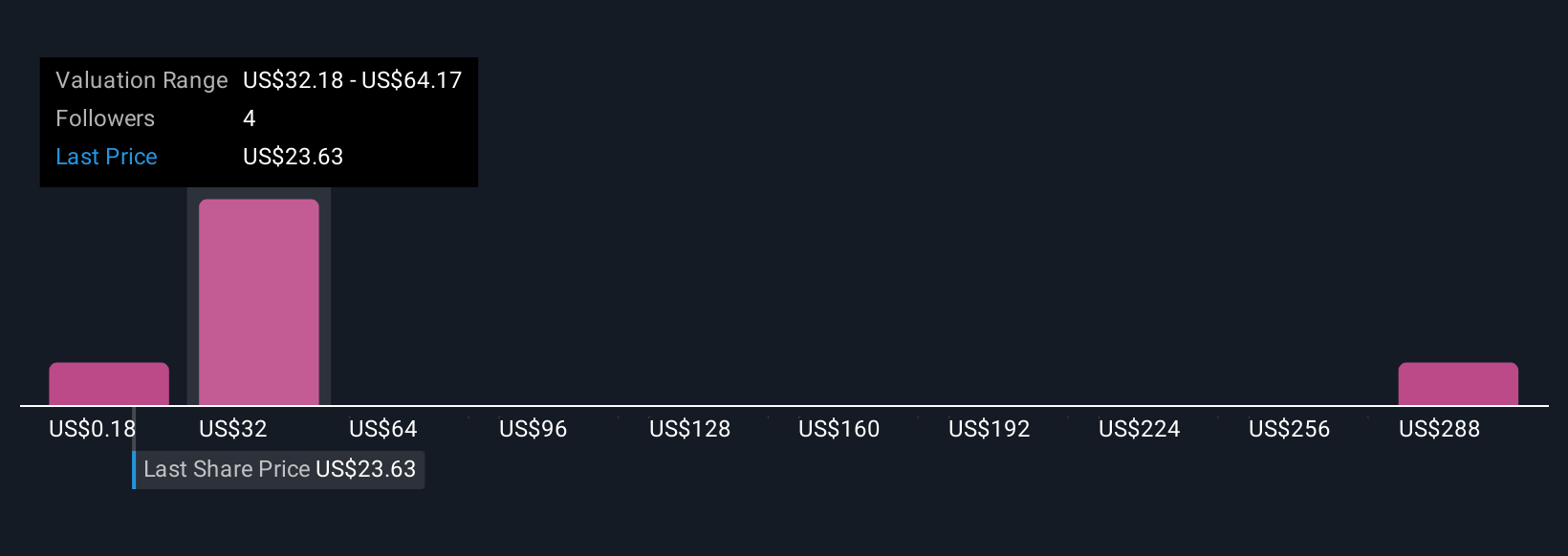

However, there is one clinical and funding risk here that investors really should not ignore. Despite retreating, Viridian Therapeutics' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Viridian Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Viridian Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viridian Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viridian Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viridian Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal