Advance Auto Parts (AAP): Reassessing Valuation After Recent Share Price Rebound

Advance Auto Parts (AAP) has quietly outperformed the broader market over the past month, gaining about 13% as investors reassess a business that is still working through a tough multi year reset.

See our latest analysis for Advance Auto Parts.

The latest move takes Advance Auto Parts' share price to $53.53, adding to an 11.2% year to date share price return, but still set against a painful three year total shareholder return of about negative 61%. This suggests that recent optimism reflects a tentative reassessment of execution risk rather than a full turnaround.

If this rebound has you thinking about where else momentum and value might be lining up in autos, it could be worth exploring auto manufacturers as a next step.

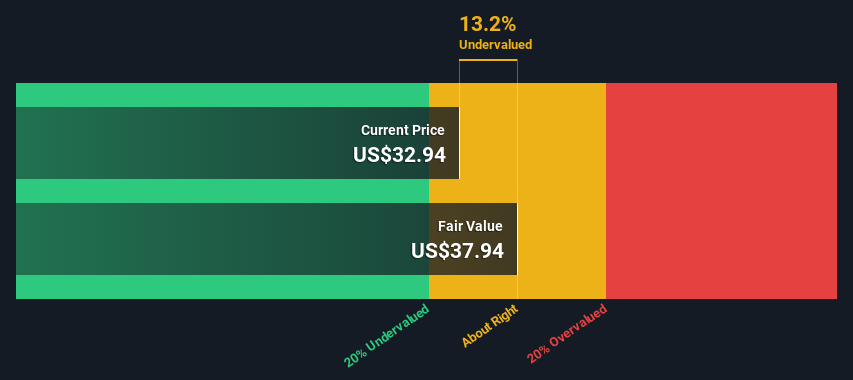

With shares now trading close to analyst targets despite negative earnings and only modest revenue growth, the key question is whether Advance Auto Parts remains mispriced or if the market is already baking in a successful reset.

Most Popular Narrative: 1% Undervalued

With Advance Auto Parts last closing at $53.53 against a narrative fair value of $54.30, the current setup frames a modest upside driven by execution.

The consolidation of distribution centers (DCs) from 38 to 12 by 2026 aims to enhance supply chain efficiency. This reorganization, along with new market hub stores, is projected to reduce supply chain costs and improve gross margins, impacting earnings positively.

Curious how a low growth revenue outlook can still support a higher valuation? The narrative leans heavily on margin rebuilding and a future earnings multiple that sidesteps typical retail pessimism. Want to see which profit assumptions and discount rate make that math work?

Result: Fair Value of $54.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if store closures drag longer than expected or if weaker consumer spending keeps sales and margin recovery stuck in first gear.

Find out about the key risks to this Advance Auto Parts narrative.

Another Lens on Value

Our DCF model paints a starker picture, putting fair value for Advance Auto Parts at just $6.94, meaning the current $53.53 price screens as sharply overvalued. If cash flows do not rebuild as hoped, investors may want to consider whether the recent narrative is leaning too hard on future margin repair.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advance Auto Parts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advance Auto Parts Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can craft a fresh narrative in minutes: Do it your way.

A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one turnaround story. Sharpen your edge by scanning fresh opportunities that match your style before the market fully catches on.

- Capture momentum in tiny companies with real fundamentals by targeting these 3571 penny stocks with strong financials that might be gearing up for their next big leg higher.

- Position ahead of the next tech shift by focusing on these 25 AI penny stocks at the intersection of innovation, scalable business models, and powerful data advantages.

- Lock in potential bargains by zeroing in on these 920 undervalued stocks based on cash flows where current prices look out of step with their underlying cash flows and long term prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal