European Stocks That May Be Trading Below Their Estimated Value

As European markets continue to experience positive momentum, with the pan-European STOXX Europe 600 Index closing 2.35% higher and major single-country indexes also rising, investors are keenly watching for opportunities that might be trading below their estimated value. In such a climate, identifying stocks that are potentially undervalued can offer significant opportunities for those looking to capitalize on discrepancies between market prices and intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN131.40 | PLN257.25 | 48.9% |

| Truecaller (OM:TRUE B) | SEK23.04 | SEK46.05 | 50% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.88 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK126.73 | 50% |

| KB Components (OM:KBC) | SEK42.60 | SEK83.33 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.77 | 49.4% |

| Exail Technologies (ENXTPA:EXA) | €81.90 | €161.83 | 49.4% |

| Circle (BIT:CIRC) | €8.00 | €15.68 | 49% |

| Atea (OB:ATEA) | NOK151.00 | NOK300.55 | 49.8% |

| Aker BioMarine (OB:AKBM) | NOK88.70 | NOK175.95 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

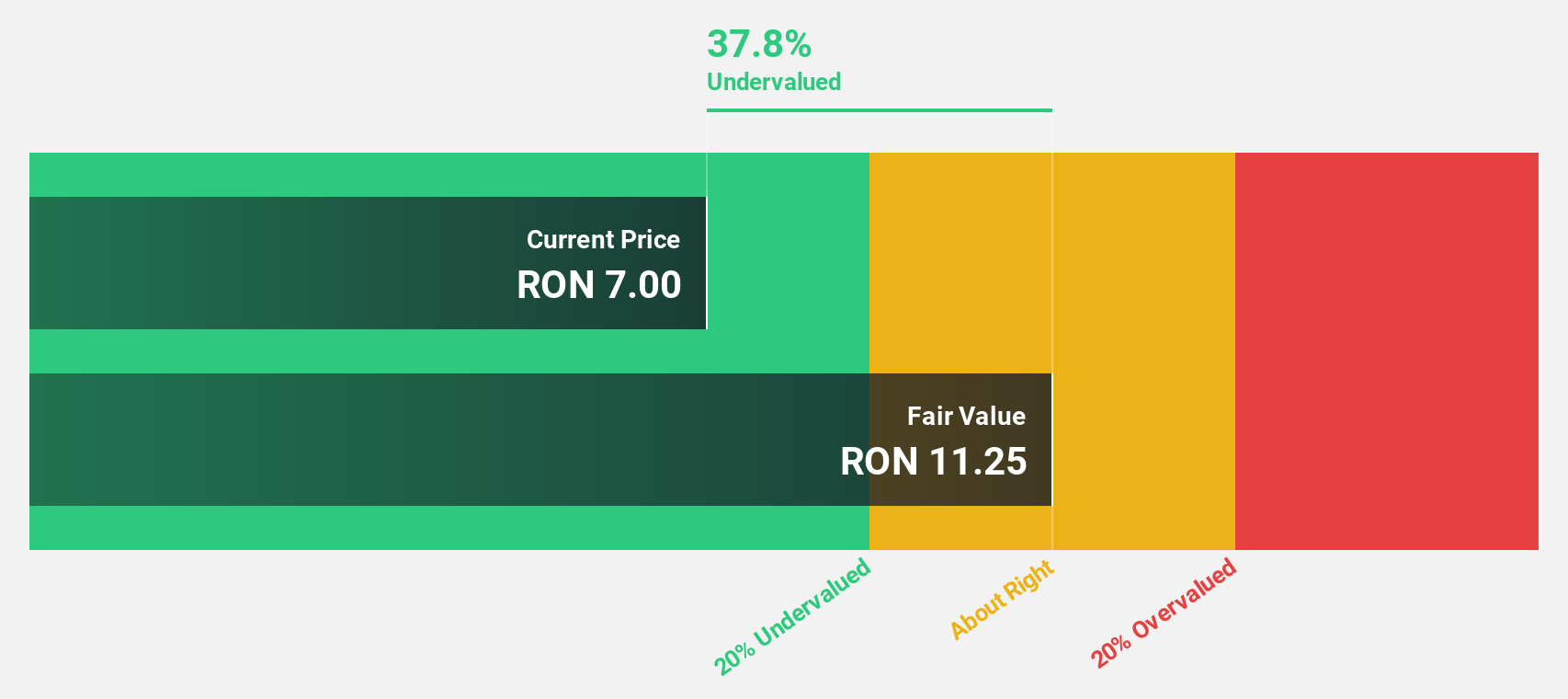

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is a Romanian company involved in the exploration, production, and supply of natural gas, with a market capitalization of RON37.89 billion.

Operations: The company generates revenue through its segments, with Upstream contributing RON7.85 billion, Storage providing RON614.59 million, and Electricity accounting for RON485.92 million.

Estimated Discount To Fair Value: 34.3%

SNGN Romgaz is trading at a notable discount to its estimated fair value of RON14.97, with strong earnings growth projected at 13% annually, outpacing the Romanian market's 9%. Recent third-quarter results show significant net income growth from RON 436.44 million to RON 755.09 million year-on-year. Additionally, strategic initiatives like the renewable energy partnership with Electrica enhance its long-term prospects while maintaining robust cash flow fundamentals that support its undervaluation thesis based on discounted cash flows.

- Our earnings growth report unveils the potential for significant increases in SNGN Romgaz's future results.

- Get an in-depth perspective on SNGN Romgaz's balance sheet by reading our health report here.

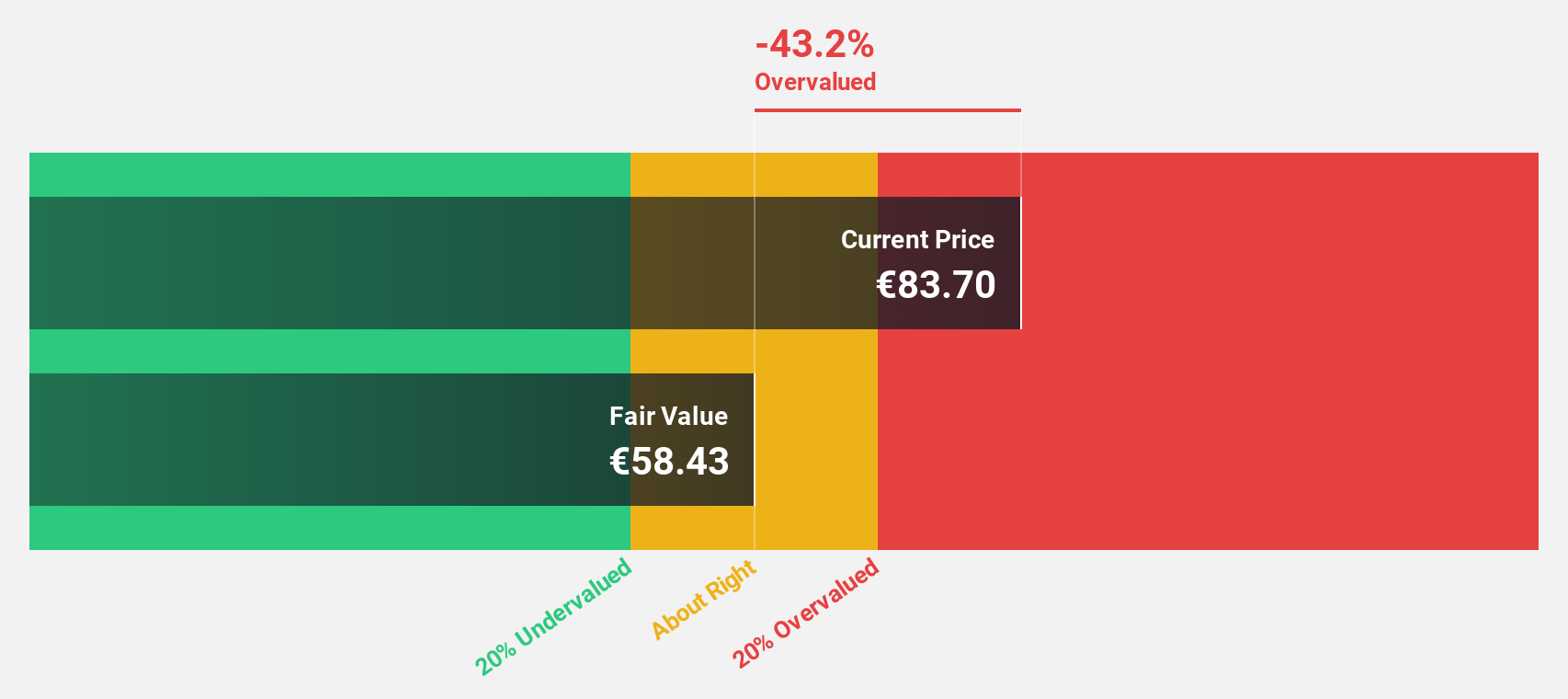

Exail Technologies (ENXTPA:EXA)

Overview: Exail Technologies offers robotics, maritime, navigation, aerospace, and photonics technology solutions both in France and internationally, with a market cap of €1.39 billion.

Operations: Exail Technologies generates revenue through its segments in Advanced Technologies (€108.99 million), Structure Exail Technologies (€1.14 million), and Navigation & Maritime Robotics (€335.41 million).

Estimated Discount To Fair Value: 49.4%

Exail Technologies, trading significantly below its estimated fair value of €161.83, is projected to experience robust earnings growth at 87.1% annually, surpassing the French market's average. Despite high share price volatility and interest coverage concerns, its recent profitability turnaround and inclusion in major indices like Euronext 150 highlight its potential. Recent advancements in autonomous drone technology further bolster Exail's innovative edge and operational capabilities in marine robotics, enhancing long-term growth prospects despite current undervaluation based on cash flows.

- Our growth report here indicates Exail Technologies may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Exail Technologies.

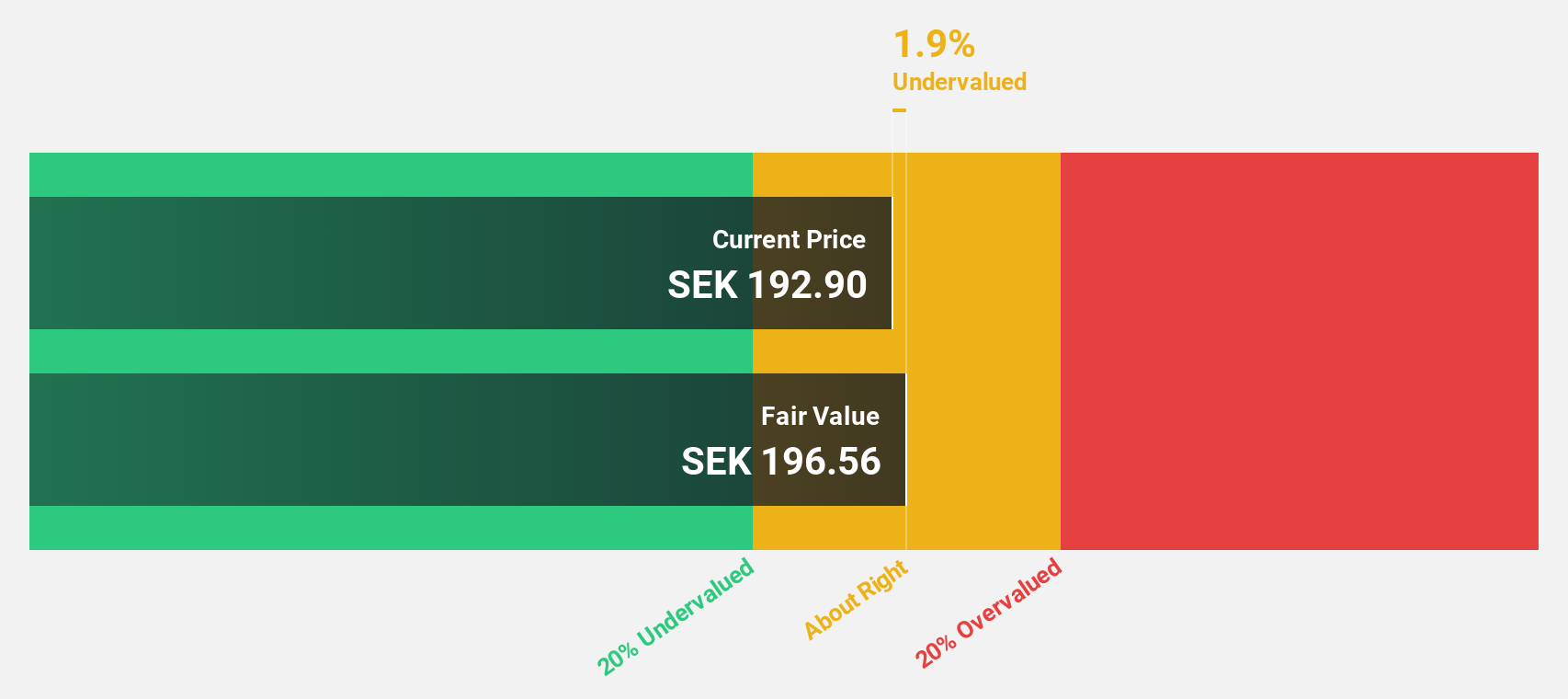

Paradox Interactive (OM:PDX)

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across the United States, Europe, Sweden, and internationally, with a market cap of SEK17.80 billion.

Operations: The company's revenue primarily comes from its Computer Graphics segment, which generated SEK2.03 billion.

Estimated Discount To Fair Value: 35.8%

Paradox Interactive, trading at SEK168.5, is undervalued compared to its fair value estimate of SEK262.29. Despite a recent dip in quarterly sales and net income, the company is expected to achieve significant earnings growth of 24.1% annually over the next three years, outpacing both revenue growth and the Swedish market average. Recent product launches like "Thrones of Blood" for Age of Wonders 4 and "Surviving Mars: Relaunched" could bolster future cash flows amidst this promising outlook for profitability improvement.

- According our earnings growth report, there's an indication that Paradox Interactive might be ready to expand.

- Unlock comprehensive insights into our analysis of Paradox Interactive stock in this financial health report.

Where To Now?

- Embark on your investment journey to our 197 Undervalued European Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal