Discovering Undiscovered Gems in Asia December 2025

As Asia's markets navigate a complex landscape of economic indicators and shifting global sentiments, investors are increasingly turning their attention to small-cap stocks, which have shown resilience amid broader market fluctuations. In this dynamic environment, identifying promising stocks involves focusing on companies with strong fundamentals and growth potential that can capitalize on regional trends and technological advancements.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lelon Electronics | 16.20% | 4.62% | 7.59% | ★★★★★★ |

| Konishi | 0.13% | 1.57% | 10.10% | ★★★★★★ |

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| 104 | NA | 9.90% | 10.14% | ★★★★★★ |

| Anapass | 8.99% | 20.82% | 58.41% | ★★★★★★ |

| New Asia Construction & Development | 42.25% | 8.68% | 50.79% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| Apacer Technology | 9.82% | 1.89% | 0.97% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Anji Foodstuff (SHSE:603696)

Simply Wall St Value Rating: ★★★★★★

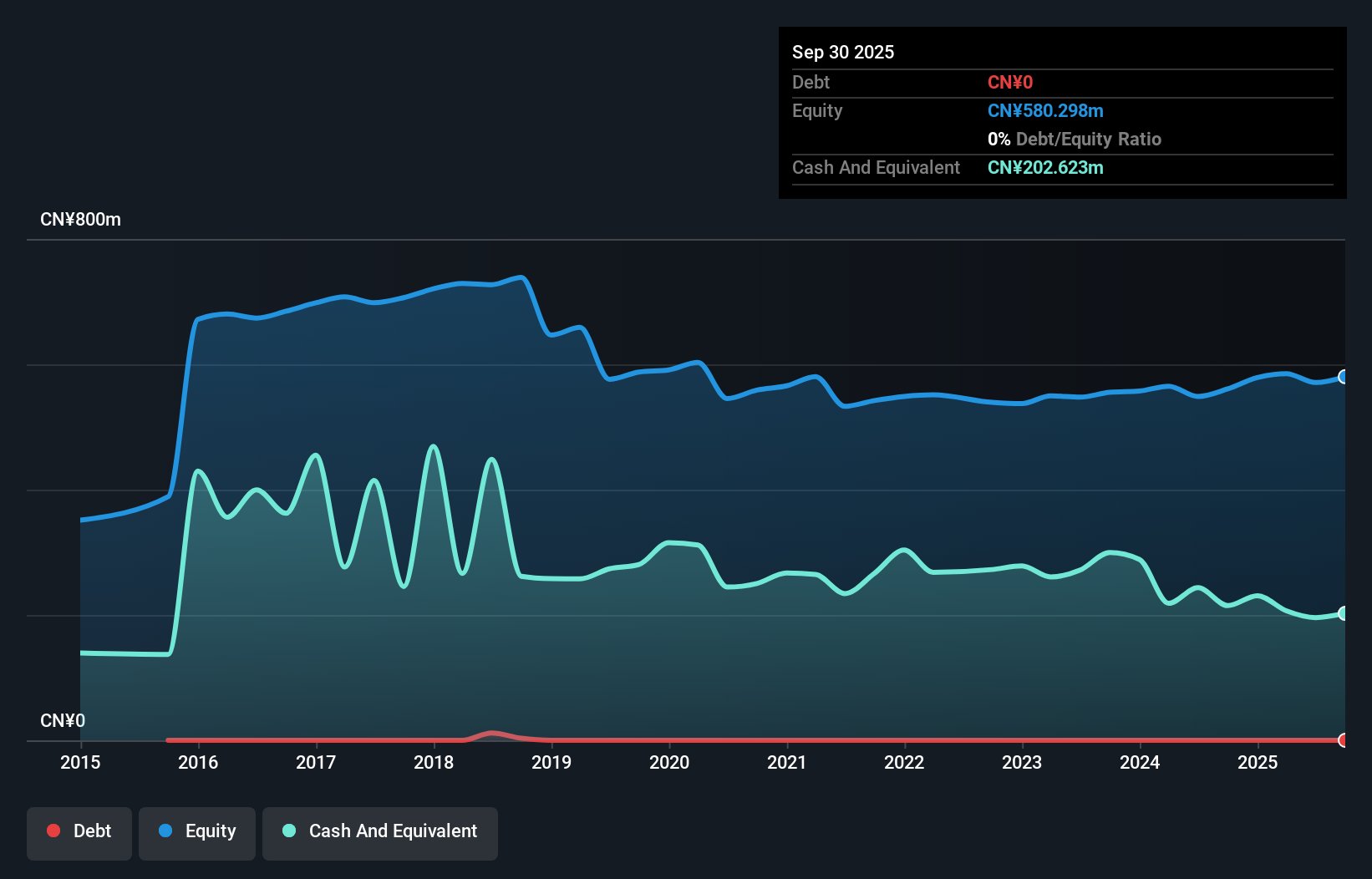

Overview: Anji Foodstuff Co., Ltd focuses on the research and development, production, and sale of condiments both in China and internationally, with a market capitalization of CN¥3.78 billion.

Operations: Anji Foodstuff generates revenue primarily from its food processing segment, amounting to CN¥620.12 million. The company's financial performance is influenced by its ability to manage production costs and optimize profit margins within this segment.

Anji Foodstuff, a nimble player in the food sector, has been making waves with its impressive earnings growth of 68.7% over the past year, outpacing the industry’s 4.8%. The company operates without debt, which simplifies financial management and eliminates concerns about interest coverage. Although free cash flow remains negative, indicating potential liquidity challenges ahead, Anji's net income rose to CNY 23.22 million for the nine months ending September 2025 from CNY 21.31 million a year earlier. Despite recent volatility in share price and a historical decline in earnings by 10.2% annually over five years, Anji's high-quality earnings suggest resilience in its core operations amidst market fluctuations.

- Take a closer look at Anji Foodstuff's potential here in our health report.

Examine Anji Foodstuff's past performance report to understand how it has performed in the past.

Fujian Mindong Electric Power Limited (SZSE:000993)

Simply Wall St Value Rating: ★★★★★★

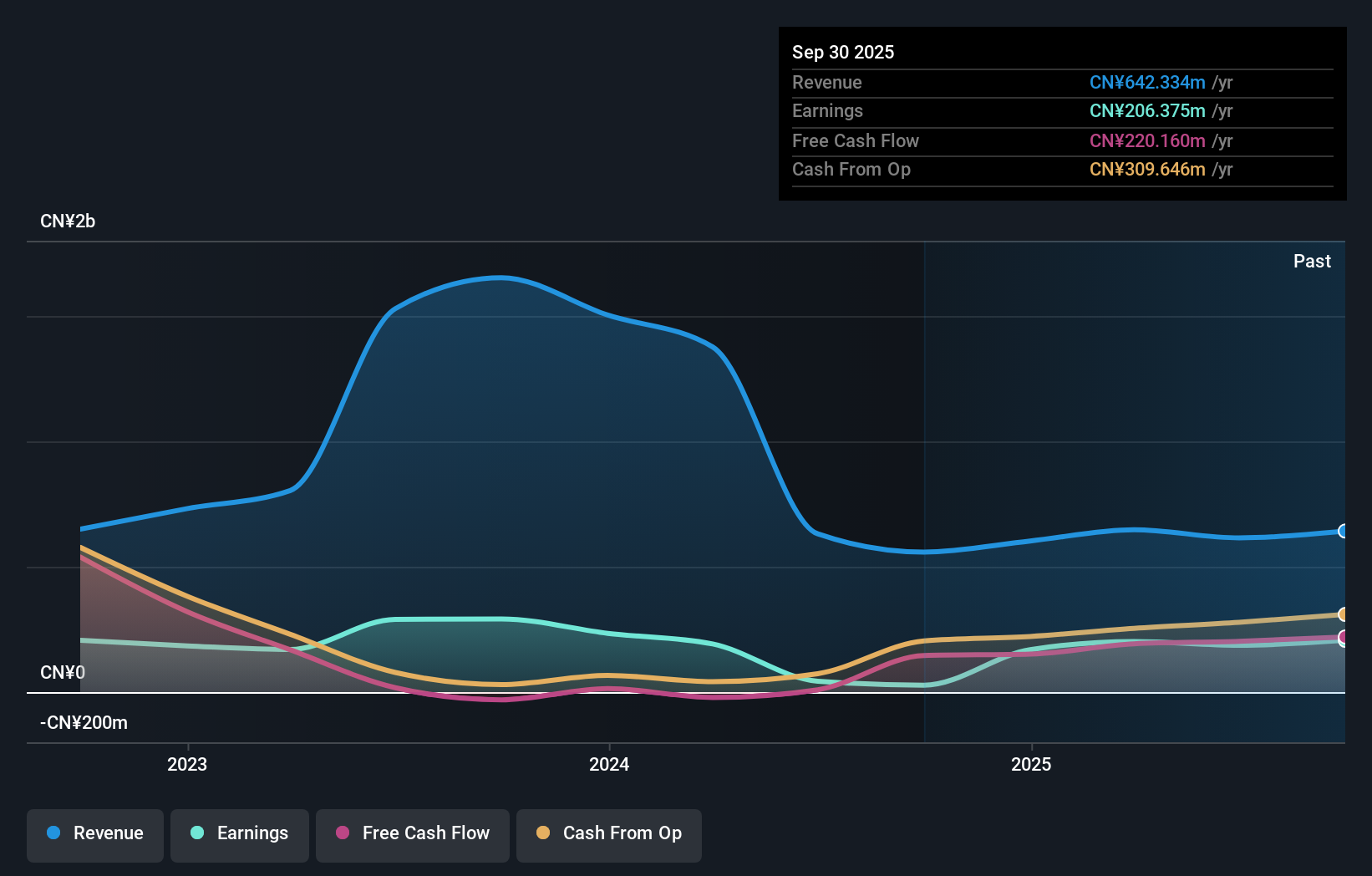

Overview: Fujian Mindong Electric Power Limited Company, along with its subsidiaries, focuses on the production and development of hydropower, wind, and photovoltaic power in China with a market capitalization of approximately CN¥6.38 billion.

Operations: Fujian Mindong Electric Power Limited derives its revenue primarily from hydropower, wind, and photovoltaic power production in China. The company has a market capitalization of approximately CN¥6.38 billion.

Fujian Mindong Electric Power, a smaller player in the renewable energy sector, has shown significant financial improvement. Over the past year, its earnings skyrocketed by 648%, outpacing industry averages. The company's net debt to equity ratio stands at a satisfactory 2%, signaling prudent financial management. Despite recent volatility in its share price, Fujian Mindong's sales reached CN¥489.85 million for the first nine months of 2025, up from CN¥450.17 million last year. A notable one-off gain of CN¥65.4 million impacted recent results, and it trades at 47% below fair value estimates, suggesting potential undervaluation.

QNAP Systems (TPEX:7805)

Simply Wall St Value Rating: ★★★★★☆

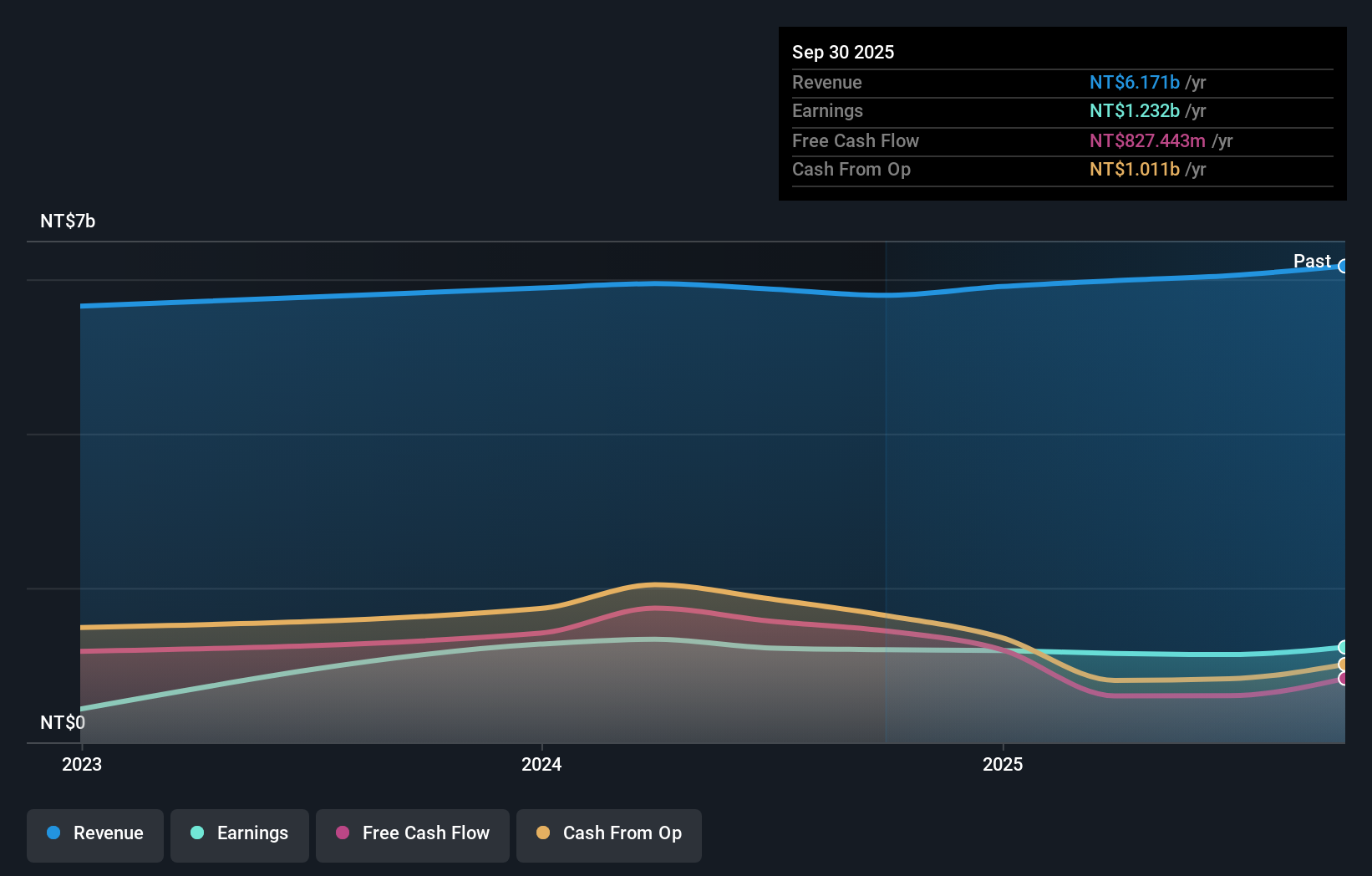

Overview: QNAP Systems, Inc. is a Taiwanese company that manufactures and sells data storage and processing equipment, wired communication machinery, and optical instruments, with a market cap of NT$24.60 billion.

Operations: QNAP Systems generates revenue primarily from its computer peripherals segment, totaling NT$6.17 billion. The company's financial performance is influenced by its cost structure and market dynamics within the technology sector.

QNAP Systems, a tech company with high-quality earnings, recently reported a notable rise in net income to TWD 383.35 million for Q3, up from TWD 288.35 million the previous year. Their earnings per share also increased significantly to TWD 12.65 from TWD 9.93 in the same period last year, reflecting robust financial health and growth prospects. With a price-to-earnings ratio of 20x below the TW market average of 20.1x, QNAP appears well-valued amidst its peers. The launch of their TL-R6020Sep-RP storage solution underscores their commitment to innovation and scalability in data management solutions for enterprises seeking efficient space utilization and reliable data archiving capabilities.

- Delve into the full analysis health report here for a deeper understanding of QNAP Systems.

Review our historical performance report to gain insights into QNAP Systems''s past performance.

Make It Happen

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2506 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal