3 Middle Eastern Dividend Stocks Yielding Up To 5.5%

Amid rising oil prices and anticipation of U.S. rate cuts, most Gulf stock markets have recently experienced gains, reflecting investor optimism in the region's economic resilience. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive option for investors seeking to capitalize on current market conditions while potentially benefiting from regional growth prospects.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.48% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.10% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.57% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.80% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.75% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.53% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.47% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.38% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.40% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.96% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

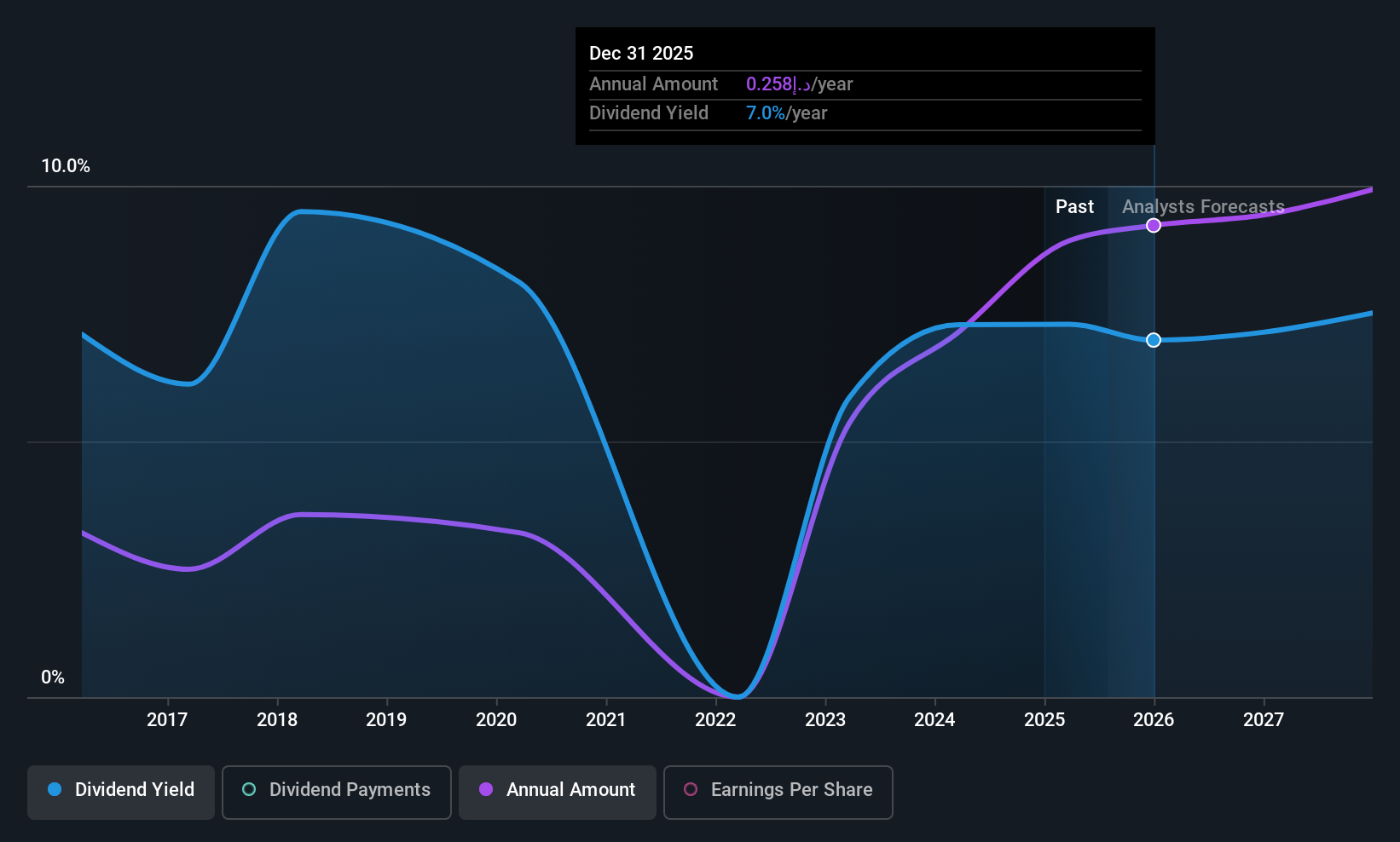

Air Arabia PJSC (DFM:AIRARABIA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Air Arabia PJSC, along with its subsidiaries, offers air travel services and has a market capitalization of AED20.91 billion.

Operations: Air Arabia PJSC generates revenue primarily from its airline segment, amounting to AED6.70 billion.

Dividend Yield: 5.6%

Air Arabia PJSC's dividend yield of 5.58% is below the top quartile in the AE market, and its dividend history has been unreliable over the past decade due to volatility. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 75.4% and 70.2%, respectively. Recent earnings growth, with Q3 net income rising to AED 582.5 million from AED 525.02 million last year, supports its ability to maintain dividends amid fluctuating payments historically.

- Delve into the full analysis dividend report here for a deeper understanding of Air Arabia PJSC.

- Our expertly prepared valuation report Air Arabia PJSC implies its share price may be lower than expected.

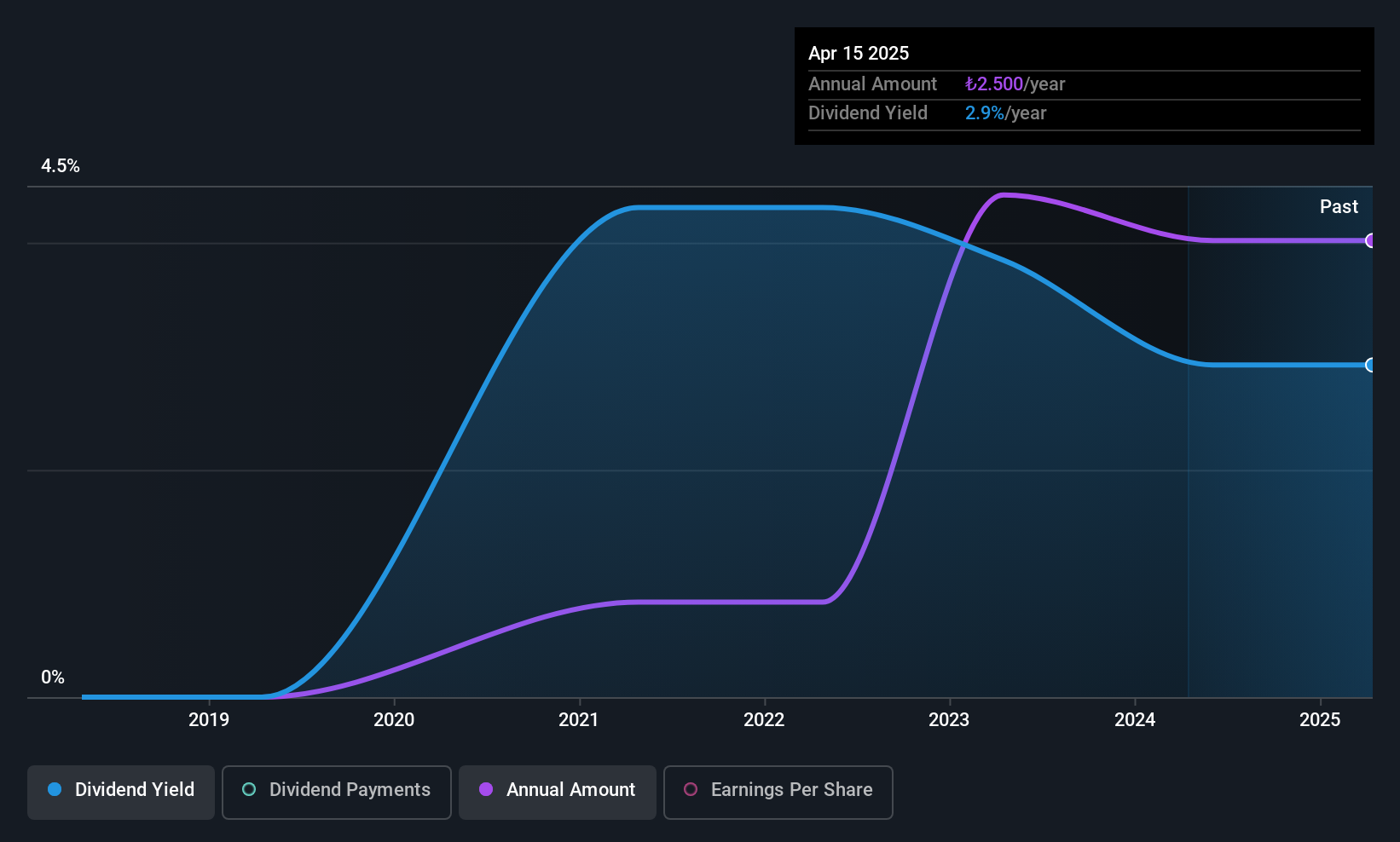

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri (IBSE:VAKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. operates in the textile and ready-to-wear clothing industry, with a market cap of TRY91.52 billion.

Operations: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. generates revenue primarily from its apparel segment, which amounts to TRY14.94 billion.

Dividend Yield: 4.4%

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's dividend yield of 4.37% ranks in the top quartile of the Turkish market, supported by a low payout ratio of 17%, ensuring dividends are well-covered by earnings and cash flows. However, recent financial performance raises concerns as Q3 net income dropped significantly to TRY 0.22 million from TRY 9.36 million last year, and a nine-month net loss was reported, potentially impacting future dividend stability despite historical growth over five years.

- Unlock comprehensive insights into our analysis of Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri stock in this dividend report.

- The analysis detailed in our Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri valuation report hints at an inflated share price compared to its estimated value.

Al Rajhi Banking and Investment (SASE:1120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi Banking and Investment Corporation, along with its subsidiaries, offers banking and investment services both within Saudi Arabia and internationally, with a market cap of SAR383.40 billion.

Operations: Al Rajhi Banking and Investment Corporation generates revenue primarily from its Retail Segment (SAR17.42 billion), Treasury Segment (SAR7.54 billion), Corporate Segment (SAR8.39 billion), and Investment Services, Brokerage, and Other Segments (SAR1.84 billion).

Dividend Yield: 3%

Al Rajhi Banking and Investment's dividend yield of 3.05% is below the top quartile in Saudi Arabia, but its payout ratio of 39.2% indicates dividends are well-covered by earnings. Recent earnings growth, with net income rising to SAR 18.42 billion for the nine months ending September 2025, supports dividend sustainability despite a historically volatile dividend track record. A recent agreement as a payment agent for Al Kuzama Trading Company underscores its commitment to timely dividend distribution practices.

- Get an in-depth perspective on Al Rajhi Banking and Investment's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Al Rajhi Banking and Investment's share price might be too optimistic.

Turning Ideas Into Actions

- Unlock more gems! Our Top Middle Eastern Dividend Stocks screener has unearthed 56 more companies for you to explore.Click here to unveil our expertly curated list of 59 Top Middle Eastern Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal