Corpay (CPAY): Revisiting Valuation After a Solid Q3 Beat and Slightly Upgraded Full-Year Outlook

Corpay (CPAY) just paired a solid third quarter beat on revenue and adjusted EPS with the launch of USCIS Navigator, a timely payments tool built around new immigration fee rules.

See our latest analysis for Corpay.

Despite the upbeat Q3 print and the USCIS Navigator launch, Corpay’s recent 1 month share price return of 13.9 percent comes after a tougher year to date stretch, with an 11.8 percent year to date share price decline and a 1 year total shareholder return of negative 19.2 percent, even as the 3 year total shareholder return sits above 60 percent. This suggests long term holders are still ahead while near term momentum is only just starting to rebuild.

If this kind of payments driven story has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as you look for other potential compounders.

With revenue still growing double digits and the stock trading at a steep intrinsic discount, the setup is intriguing. But is Corpay now a mispriced compounder in plain sight, or is the market already baking in that future growth?

Most Popular Narrative Narrative: 14.6% Undervalued

Corpay’s most followed narrative pegs fair value noticeably above the last close of $299.89, framing today’s price as a discounted entry into future earnings power.

Corpay's rapid expansion of its international cross-border platform, including product launches like the multicurrency account (MCA), extension of services to new customer verticals (FIs, asset managers, digital asset providers), and accretive acquisitions (e.g., Alpha, GPS) positions the company to capitalize on growing global commerce and cross-border payment flows, supporting sustained revenue growth and increasing the company's long-term earnings power.

Want to see what kind of revenue runway and margin lift justify that upside view? The narrative leans on aggressive scaling, richer economics, and a bold earnings re rating. Curious how far those projections really go?

Result: Fair Value of $351.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could crack if stablecoin adoption squeezes cross border yields, or if rising compliance and cybersecurity costs erode margins faster than expected.

Find out about the key risks to this Corpay narrative.

Another Angle on Valuation

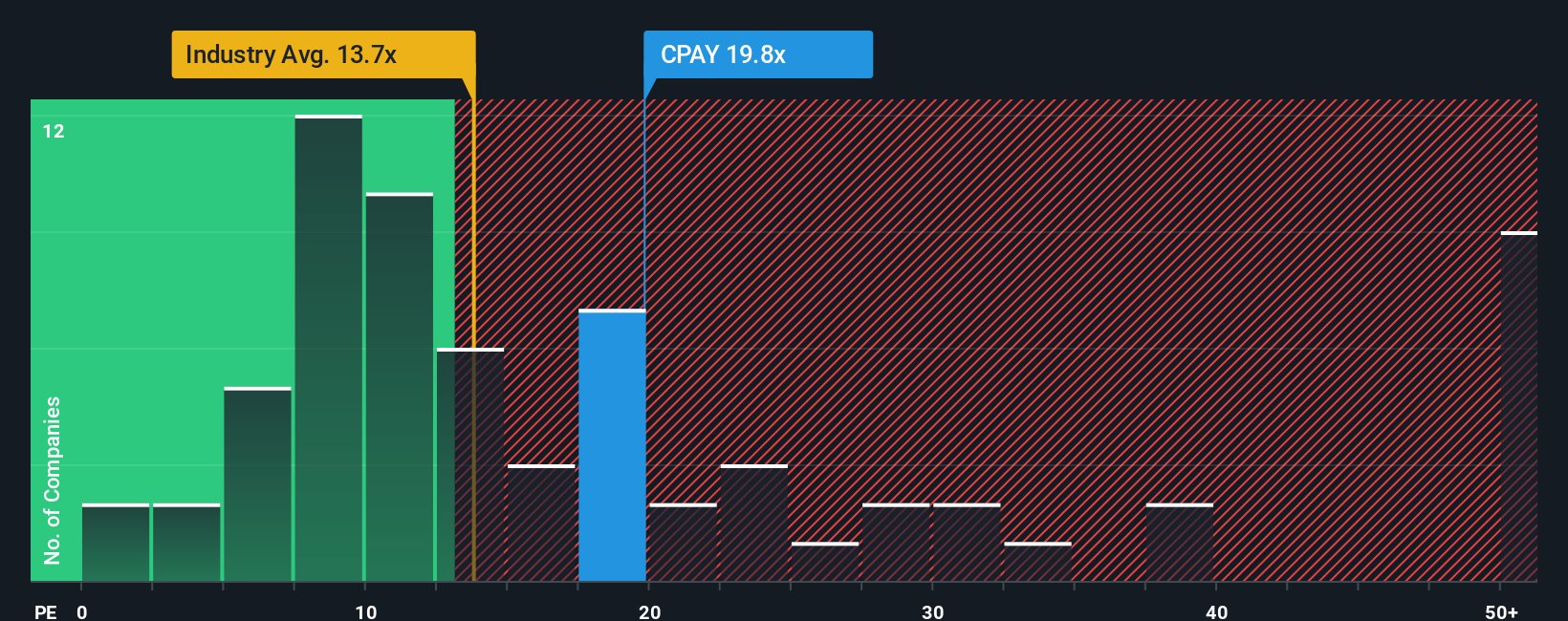

Analysts see Corpay as roughly 14.6 percent undervalued, yet the current price sits on 20 times earnings versus a 13.7 times industry average and a 30.8 times peer average, while our fair ratio sits at 18.8 times. Is this a modest bargain or compensation for real execution risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corpay Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can build a personalized view in just a few minutes, starting with Do it your way.

A great starting point for your Corpay research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Corpay when the market is full of mispriced opportunities that fit your style. Use the Simply Wall Street Screener to uncover them now.

- Capture steady income potential by reviewing these 14 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while markets stay volatile.

- Ride the next wave of innovation by targeting these 25 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence across industries.

- Lock in value opportunities early by scanning these 920 undervalued stocks based on cash flows before the broader market catches on to their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal