How Investors Are Reacting To DocuSign (DOCU) Ahead Of Earnings And Digital Workflow Expansion

- In the lead-up to its latest earnings report, DocuSign drew attention as analysts projected quarterly earnings of US$0.92 per share, alongside year-over-year revenue and subscription growth and a larger customer base, supported by ongoing international expansion of its e-signature and cloud-based agreement solutions.

- An interesting angle is how expectations for improving earnings coincide with DocuSign’s positioning as core digital infrastructure for modern contract workflows, aligning closely with current cloud and workflow automation trends.

- Next, we’ll examine how analyst expectations for stronger earnings and expanding digital agreement workflows could influence DocuSign’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

DocuSign Investment Narrative Recap

To own DocuSign, you need to believe digital agreement workflows will keep embedding into everyday business processes and that DocuSign can defend its role as core infrastructure despite intensifying competition. The latest earnings expectations support the near term catalyst of steady digital adoption but do not materially change the biggest risk right now, which is that guidance already points to slower revenue growth compared with the company’s past double digit pace.

Against this backdrop, DocuSign’s ongoing rollout of its AI native Intelligent Agreement Management platform looks closely linked to the earnings story, because it is central to upselling existing e signature customers and lifting revenue per customer over time. The current analyst focus on improving earnings and expanding digital workflows essentially hinges on whether this broader IAM platform can gain traction fast enough to offset growth maturing in the core e signature segment.

Yet investors should also weigh how increased competition and potential pricing pressure in e signatures could influence DocuSign’s ability to...

Read the full narrative on DocuSign (it's free!)

DocuSign’s narrative projects $3.8 billion revenue and $359.8 million earnings by 2028. This requires 7.3% yearly revenue growth and about a $78.8 million earnings increase from $281.0 million today.

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 35% upside to its current price.

Exploring Other Perspectives

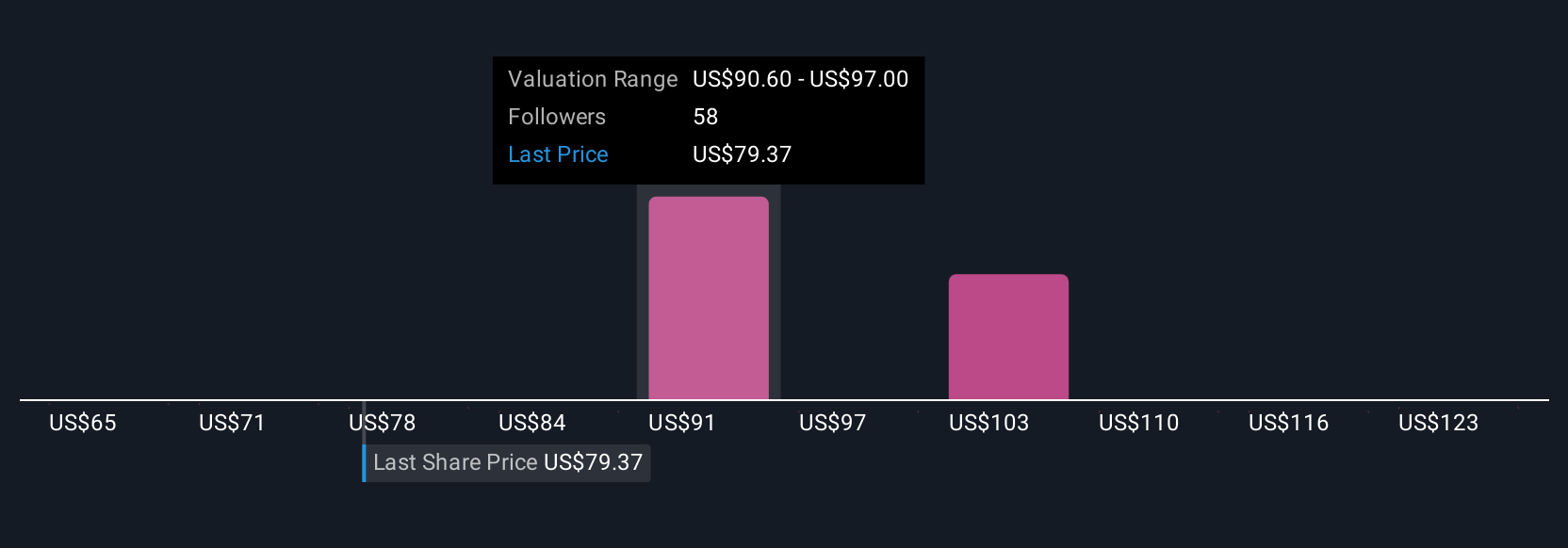

Six Simply Wall St Community fair value estimates for DocuSign range from US$77 to about US$118, highlighting very different assumptions about future upside. Against that spread, the risk that growth slows as the core e signature market matures could be a key factor when you compare these viewpoints and decide which assumptions you find most realistic.

Explore 6 other fair value estimates on DocuSign - why the stock might be worth as much as 72% more than the current price!

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal