Is FactSet Now Attractive After AI Expansion and a 42% Share Price Slide?

- If you have been wondering whether FactSet Research Systems is starting to look like a bargain after a rough stretch, you are not alone. This is exactly the kind of setup valuation focused investors like to dig into.

- The stock is up about 4.3% over the last month but still down roughly 42.0% over the past year, a combination that often signals the market is rethinking its expectations while risk perceptions are still elevated.

- Recent headlines have focused on FactSet expanding its data and analytics partnerships and doubling down on AI driven tools for institutional investors. These moves underscore how central its platform has become in day to day workflows. At the same time, the broader shift toward data heavy, subscription based models across finance has put a spotlight on whether established providers like FactSet can keep defending their pricing power.

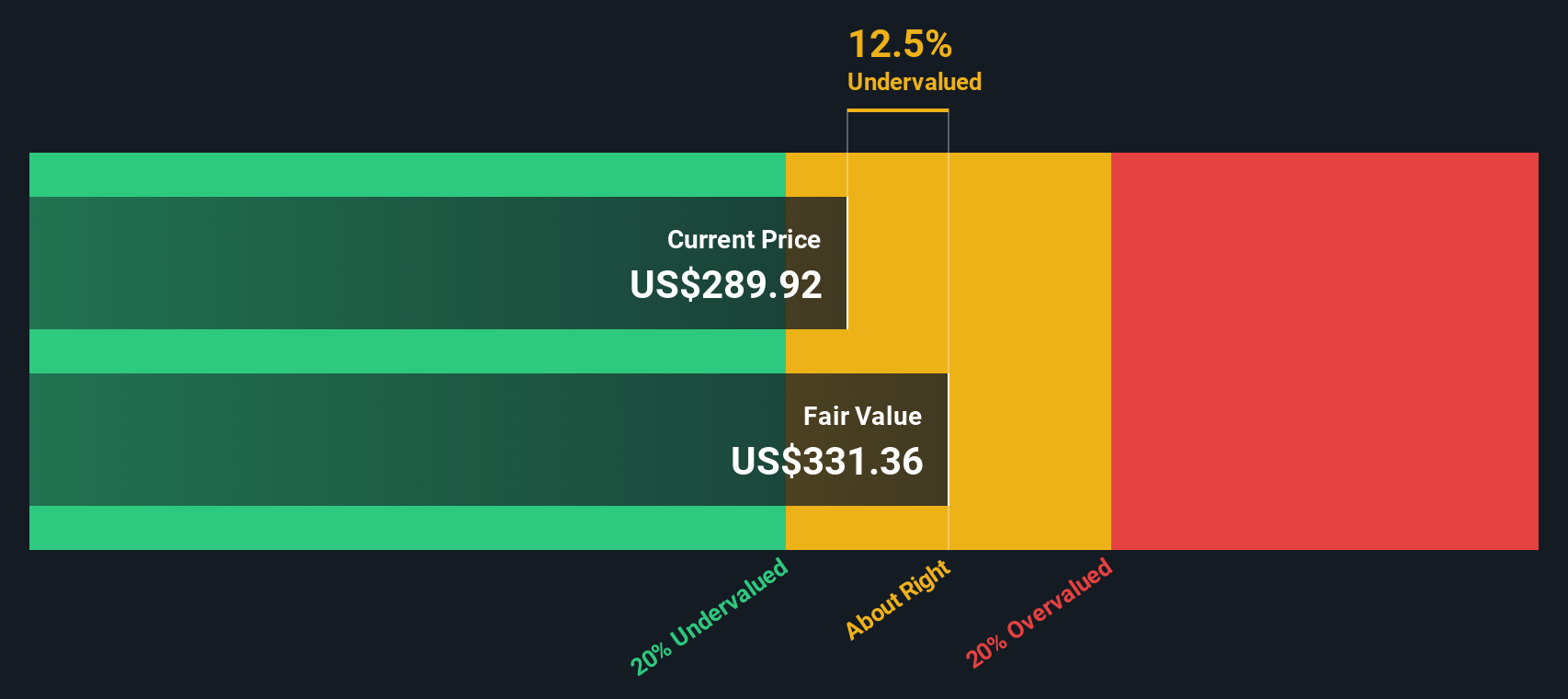

- On our scorecard FactSet earns a valuation score of 4/6, meaning it screens as undervalued on four of six checks. Next we will unpack what different valuation approaches are saying about that number, before closing with a more intuitive way to think about what the stock might really be worth.

Approach 1: FactSet Research Systems Excess Returns Analysis

The Excess Returns model looks at how much value FactSet Research Systems creates above the minimum return shareholders require, then capitalizes those surplus profits into an intrinsic value per share.

For FactSet, the starting point is a Book Value of $58.08 per share and a Stable EPS of $19.72 per share, based on the median return on equity from the past 5 years. With an Average Return on Equity of 28.17% and a Cost of Equity of $5.92 per share, the model estimates an Excess Return of $13.80 per share. This indicates that a substantial portion of earnings is economic profit rather than just compensation for risk.

The analysis also assumes a Stable Book Value of $70.00 per share, derived from weighted future book value estimates from 5 analysts. Using these inputs in the Excess Returns framework produces an intrinsic value of about $335 per share. This implies the stock is approximately 17.0% undervalued relative to its current trading price.

Result: UNDERVALUED

Our Excess Returns analysis suggests FactSet Research Systems is undervalued by 17.0%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: FactSet Research Systems Price vs Earnings

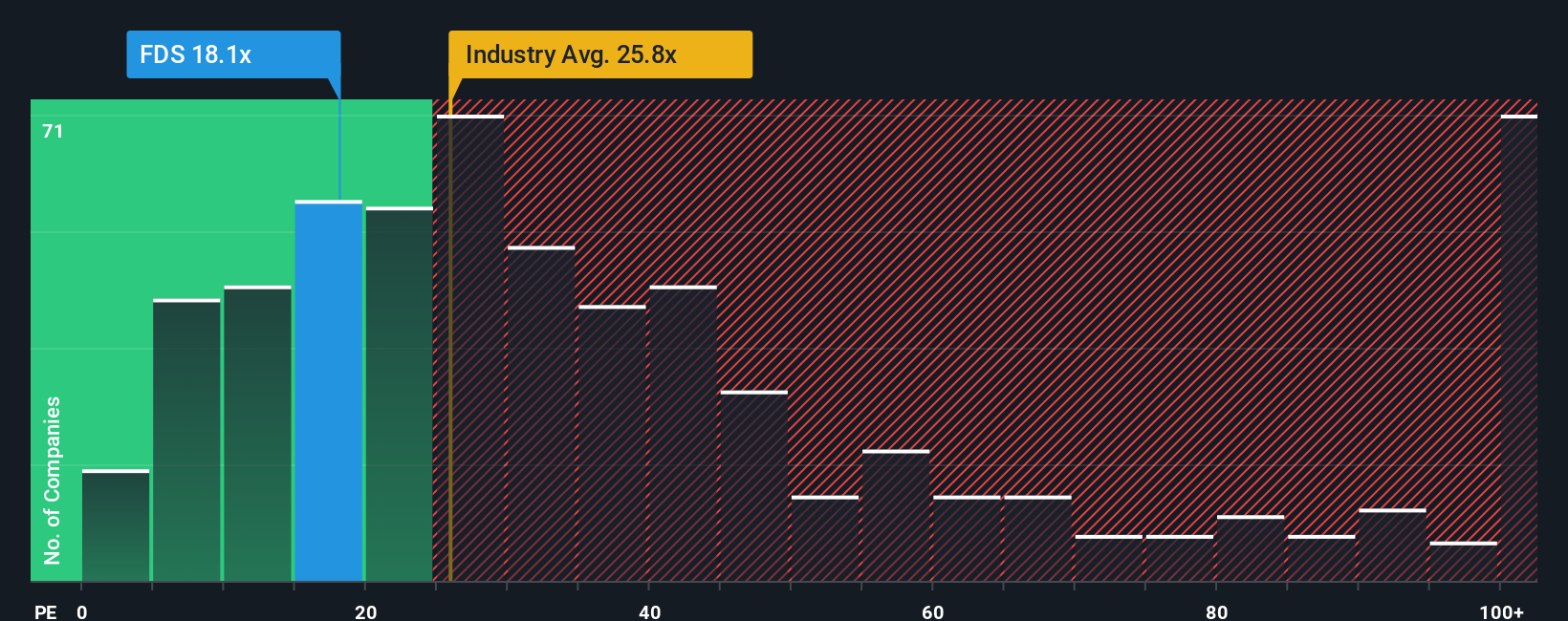

For a mature, consistently profitable business like FactSet, the price to earnings, or PE, ratio is a natural way to think about valuation because it links what investors pay today to the earnings the company is already generating.

In general, faster and more reliable earnings growth, supported by strong competitive advantages and a solid balance sheet, justifies a higher PE, while slower growth or higher risk usually calls for a discount. Against that backdrop, FactSet currently trades at about 17.4x earnings, below both the Capital Markets industry average of roughly 23.8x and the peer group average near 28.6x, suggesting the market is applying a cautious multiple despite the company’s quality profile.

Simply Wall St also calculates a proprietary Fair Ratio for each stock, which is the PE you would expect once you adjust for factors like earnings growth, profitability, industry dynamics, market cap and company specific risks. For FactSet, that Fair Ratio is around 14.0x, notably lower than its current 17.4x. Because this measure is tailored to the company rather than broad group averages, it offers a more nuanced view of what investors could be willing to pay, and on this basis the shares look somewhat expensive.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

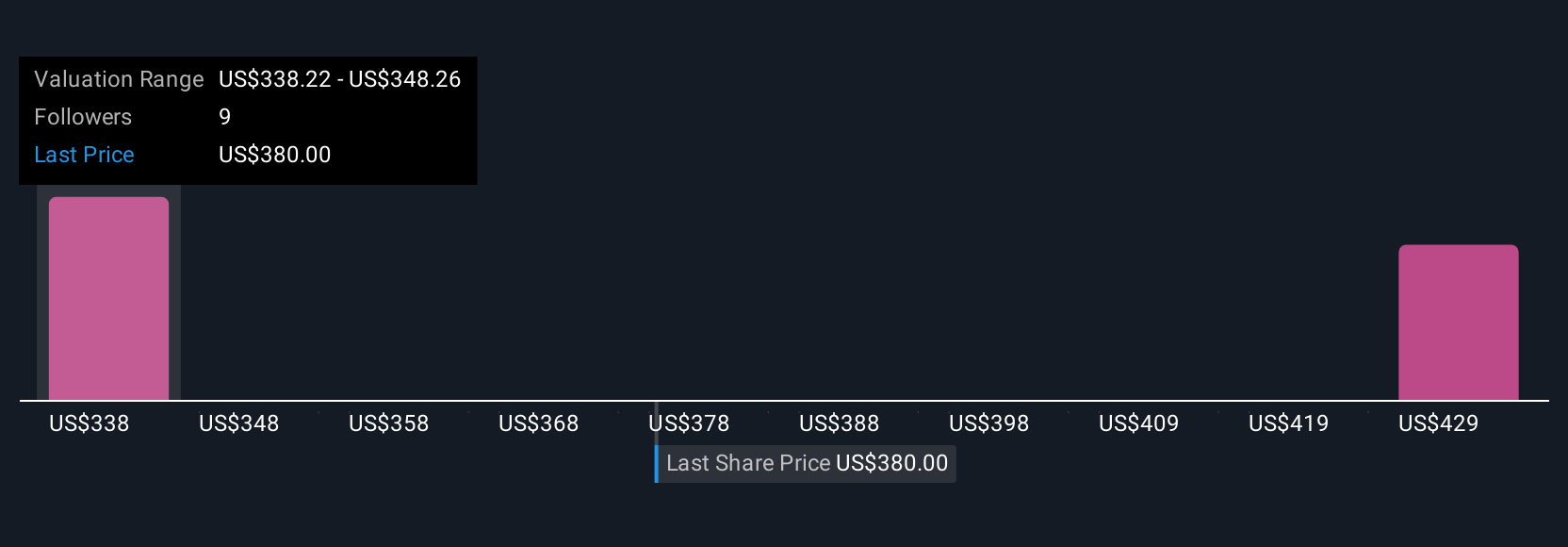

Upgrade Your Decision Making: Choose your FactSet Research Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you write the story behind your numbers by linking your view of FactSet Research Systems, your forecast for its revenue, earnings and margins, and your estimate of fair value. Narratives then continuously update that fair value as new news or earnings arrive so you can compare it to the current share price and decide whether it looks more like the bullish $500 scenario, where AI integration and margin expansion are associated with long term upside, or the more cautious $355 view, where competitive and cost pressures are associated with capped returns.

Do you think there's more to the story for FactSet Research Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal