Will Strong AI Cloud Demand And Revenue Beat Change Ciena's (CIEN) Network Infrastructure Narrative?

- Ciena recently reported quarterly revenue above the upper end of its guidance, reflecting strong demand from hyperscalers and rapidly expanding AI-focused cloud data center operators, alongside a continuing recovery in telecom network investment.

- This combination of cloud and AI-driven orders suggests Ciena’s role in building next-generation network infrastructure is becoming more central for large customers.

- Next, we’ll examine how this stronger-than-guided, AI-focused cloud demand reshapes Ciena’s existing investment narrative and risk-reward balance.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ciena Investment Narrative Recap

To own Ciena, you need to believe that AI and cloud data centers will keep driving demand for high-capacity optical networks, and that Ciena can remain a key supplier to hyperscalers despite customer concentration and technology shifts. The latest revenue beat above guidance reinforces the near term AI and cloud demand catalyst, but it does not remove the risk that a few large customers could still swing results sharply if orders slow or move elsewhere.

Among recent announcements, the ongoing share repurchase program, with US$245.29 million spent to retire 3,268,252 shares since late 2024, stands out alongside the strong cloud driven quarter. While buybacks do not change the underlying reliance on hyperscalers, they can amplify both the benefits of revenue strength and the impact of any future slowdown tied to AI focused capex cycles.

However, investors should also be aware that Ciena’s heavy dependence on a small group of hyperscaler and cloud customers means...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028.

Uncover how Ciena's forecasts yield a $152.62 fair value, a 25% downside to its current price.

Exploring Other Perspectives

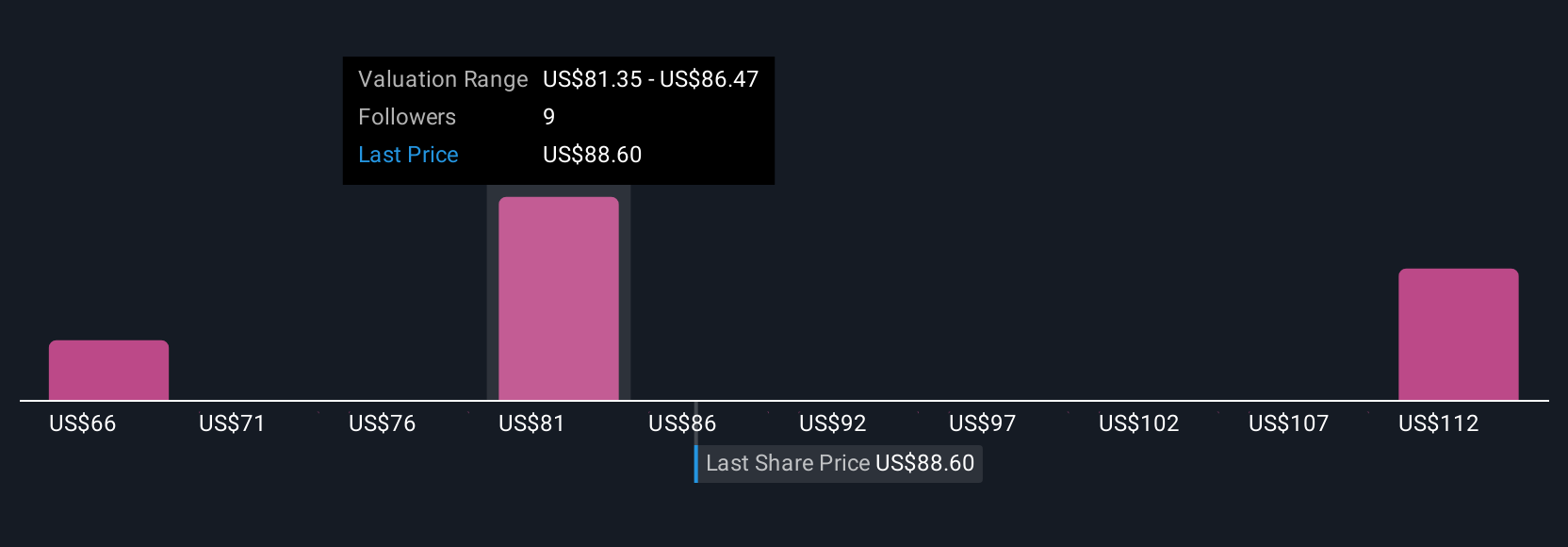

Five fair value estimates from the Simply Wall St Community span roughly US$67.93 to US$152.63, showing just how far apart individual views can be. Against this wide range, the recent revenue beat tied to hyperscaler AI demand highlights how strongly differing expectations about that single growth engine can shape your view of Ciena’s potential performance, so it is worth comparing several perspectives before deciding what you believe.

Explore 5 other fair value estimates on Ciena - why the stock might be worth less than half the current price!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal