Rumble (RUM): Reassessing Valuation After a Weak Quarter and Surprising Post‑Earnings Share Price Rebound

Rumble (RUM) just delivered a weaker quarter, with revenue slipping and results missing expectations, yet the stock has climbed about 15% since the report, suggesting that investors see something more in the story.

See our latest analysis for Rumble.

The latest move takes Rumble’s 1 month share price return to 14.2%, although its year to date share price return is still deeply negative, so this rebound looks more like early momentum than a full trend change.

If this earnings pop has you rethinking the opportunity set in digital platforms, it might be worth scanning high growth tech and AI stocks to see what else the market could be repricing.

With revenues slipping but the share price bouncing, investors now face a tougher call: is Rumble an overlooked growth platform trading at a discount, or has the market already priced in a long runway of future expansion?

Most Popular Narrative Narrative: 54.2% Undervalued

With Rumble last closing at $7.10 against a narrative fair value of $15.50, the story being told assumes a far more valuable platform ahead.

Accelerated investment in AI and cloud infrastructure, including a potential acquisition of Northern Data, positions Rumble to capitalize on the secular trend toward scalable, decentralized compute and alternative cloud solutions, potentially unlocking high-value enterprise and government client segments and enhancing long-term gross margins and earnings.

Curious why such heavy spending and a bold margin rebound still justify a sharply higher value? The narrative leans on rapid scaling, richer monetization, and a future earnings multiple more often reserved for elite growth names. Want to see the precise growth and profitability path that supports that kind of upside? Read on to unpack the full playbook behind this valuation call.

Result: Fair Value of $15.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on flawless execution, as heavy AI and cloud spending, plus regulatory and advertiser pushback, could quickly undermine the bullish case.

Find out about the key risks to this Rumble narrative.

Another View: Market Ratios Flash a Very Different Signal

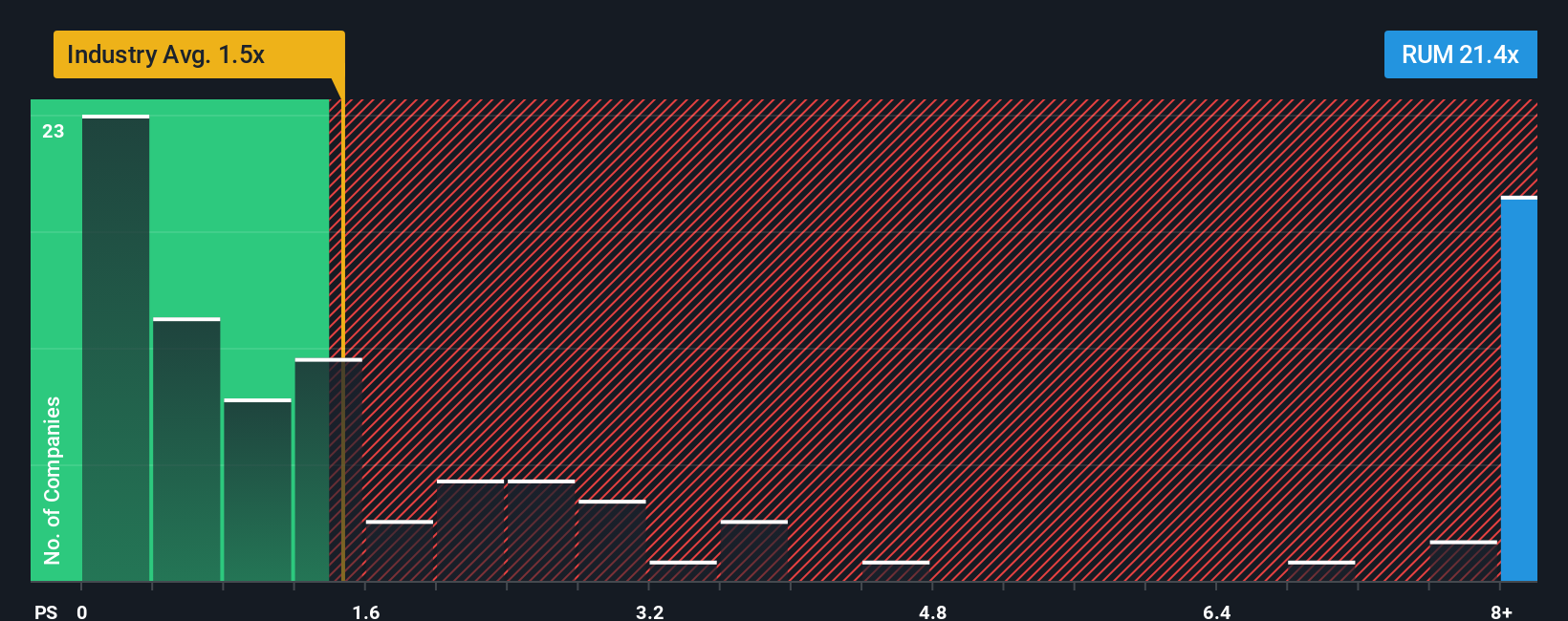

While the narrative fair value points to upside, Rumble’s price to sales ratio of 23.2 times is far richer than the US Interactive Media and Services industry at 1.0 times and a fair ratio of 3.6 times. This implies meaningful downside risk if sentiment normalizes. Could the story be running ahead of the numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rumble Narrative

If this angle does not match your view or you prefer to dig into the numbers yourself, you can build a custom story in just a few minutes: Do it your way.

A great starting point for your Rumble research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock when you can scan powerful, pre built shortlists that surface fresh opportunities before they hit the wider market’s radar.

- Target potential mispricings by reviewing companies flagged in these 925 undervalued stocks based on cash flows where cash flows and valuations may not yet match up.

- Capitalize on cutting edge automation trends by assessing innovators highlighted in these 24 AI penny stocks that could reshape entire industries.

- Reinforce your income strategy by focusing on reliable payers selected in these 14 dividend stocks with yields > 3% with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal