Exploring America's Car-Mart's Earnings Expectations

America's Car-Mart (NASDAQ:CRMT) is set to give its latest quarterly earnings report on Thursday, 2025-12-04. Here's what investors need to know before the announcement.

Analysts estimate that America's Car-Mart will report an earnings per share (EPS) of $-0.10.

America's Car-Mart bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

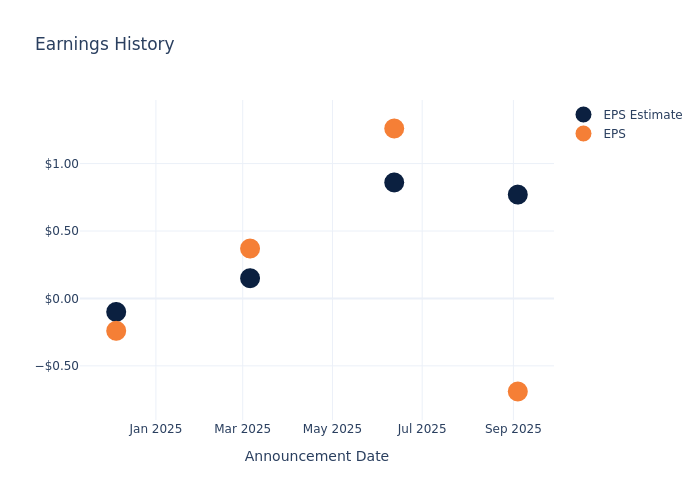

Historical Earnings Performance

The company's EPS missed by $1.46 in the last quarter, leading to a 1.08% drop in the share price on the following day.

Here's a look at America's Car-Mart's past performance and the resulting price change:

| Quarter | Q1 2026 | Q4 2025 | Q3 2025 | Q2 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.77 | 0.86 | 0.15 | -0.10 |

| EPS Actual | -0.69 | 1.26 | 0.37 | -0.24 |

| Price Change % | -1.00 | -2.00 | 0.00 | 1.00 |

America's Car-Mart Share Price Analysis

Shares of America's Car-Mart were trading at $21.92 as of December 02. Over the last 52-week period, shares are down 56.62%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analysts' Perspectives on America's Car-Mart

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding America's Car-Mart.

With 1 analyst ratings, America's Car-Mart has a consensus rating of Outperform. The average one-year price target is $45.0, indicating a potential 105.29% upside.

Analyzing Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of OneWater Marine and Monro, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for OneWater Marine, with an average 1-year price target of $17.0, suggesting a potential 22.45% downside.

- Analysts currently favor an Neutral trajectory for Monro, with an average 1-year price target of $17.0, suggesting a potential 22.45% downside.

Insights: Peer Analysis

Within the peer analysis summary, vital metrics for OneWater Marine and Monro are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| America's Car-Mart | Outperform | -1.85% | $166.23M | -1.01% |

| OneWater Marine | Buy | -16.77% | $128.66M | -33.31% |

| Monro | Neutral | -4.14% | $103.11M | 0.88% |

Key Takeaway:

America's Car-Mart ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is in the middle for Return on Equity.

About America's Car-Mart

America's Car-Mart Inc is an automotive retailer in the U.S. focused exclusively on the Integrated Auto Sales and Finance segment of the used car market. The company's operations are principally conducted through its two operating subsidiaries, America's Car Mart Inc and Colonial Auto Finance. It predominantly sells older model used vehicles and provides financing for substantially all of its customers. It earns revenue from the sale of used vehicles and, in the majority of cases, a related service contract and an accident protection plan product, as well as interest income and late fees from the related financing.

America's Car-Mart: Delving into Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Decline in Revenue: Over the 3 months period, America's Car-Mart faced challenges, resulting in a decline of approximately -1.85% in revenue growth as of 31 July, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: America's Car-Mart's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -1.68%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -1.01%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): America's Car-Mart's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.36%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.5.

To track all earnings releases for America's Car-Mart visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal