How to Use the Naked Put Options Strategy to Earn Income & Buy Stocks at a Discount

For investors who want to generate income from options – and create opportunities to buy stocks at discounted prices – the naked put options strategy is an essential tool.

In a recent video, Rick Orford put Barchart’s Options Screener to the test — showing how naked puts performed on Tesla (TSLA) across a real 30-day period. And the results were eye-opening.

This article explains how naked put options work, the risks, why probabilities matter, and how to use Barchart’s screeners to find trades with confidence.

What is a Naked Put?

A put option gives the buyer the right (but not the obligation) to sell a stock at a specific price — the strike price — before a specific date (the option’s expiration).

When you sell a put to open, you:

- Receive premium upfront

- Take on the obligation to buy the stock at the strike price

- Profit if the stock stays above the strike

This is called a naked put when you do not already own the shares. It’s a strategy used for:

- Income generation

- Buying the underlying stock at a discount when it pulls back

- Entering positions only if the price comes to you

- Taking advantage of elevated volatility

Put another way: You’re getting paid to wait for your desired entry price on the shares.

What is the Goal of a Naked Put?

A naked put seller wants one of two outcomes:

1. Stock stays above your strike → you keep 100% of the premium

This is the “income strategy” version. No shares change hands. You simply collect cash.

2. Stock falls below your strike → you are assigned shares at a discount

This is the “buying shares at a discount” outcome. You get the stock you wanted in your portfolio, but at a lower effective price thanks to the premium collected on the sold put.

Real Example: Tesla Naked Puts

In Rick’s video, he pulled up Tesla options as of Sept. 3, when TSLA was trading at $334.09.

Barchart’s Naked Put Screener showed that 20-delta puts started around the $300 strike, and these trades carried an ~80% probability of profit.

By Oct. 1, TSLA had skyrocketed to $454.39.

The result? Every trade visible on that Sept. 3 screen would have expired worthless — meaning 100% profit on every trade. No assignment.

But the most impressive example came from the $370 strike put:

- It was 10% in the money a month earlier

- Only 53% probability of profit

- Premium was $39.40 per share

- That’s $3,940 per contract

Even this “riskier” strike would likely have expired worthless, allowing traders to keep the entire premium based on where Tesla ended the month.

Why Naked Puts Work

1. You get paid upfront

Premium is yours the moment you hit “sell to open.”

2. Time decay works in your favor

Every day that passes benefits the seller, not the buyer.

3. You pick your own entry price

If you want to buy Tesla at $300 instead of $334… Sell the $300 put and get paid while you wait.

4. You control risk by choosing:

- Strike

- Expiration

- Probability

…based on Barchart’s data and your own risk tolerance.

The Risks: What You Must Understand

Naked puts are powerful, but they’re far from risk-free. Note that this strategy generally requires a higher level of options clearance from your broker that requires a margin account due to the risk involved.

Risk 1: Assignment

If the stock falls below your strike, you may be assigned 100 shares. However, assignment is only a problem if:

- You don’t want the shares

- You sized the trade incorrectly

- You didn’t plan for capital requirements

Otherwise, assignment in this scenario = buying a stock you want at a discount.

Risk 2: Downside exposure

If the stock falls sharply prior to expiration, you’re still obligated to buy shares at the higher strike. Your premium reduces the loss in this scenario, but does not eliminate it.

Risk 3: High-volatility stocks require caution

This strategy works best on stocks where implied volatility (IV) is elevated, but declining. Writing naked puts on stocks with known upcoming catalysts, such as quarterly earnings, can be dangerous, since these events can spark major directional price swings.

How to Use Barchart to Find High-Probability Naked Puts

Barchart simplifies naked put trading with tools like:

1. Naked Put Screener

Filter by:

- Delta

- Probability of profit

- Days to expiration

- Percentage return

- Implied volatility

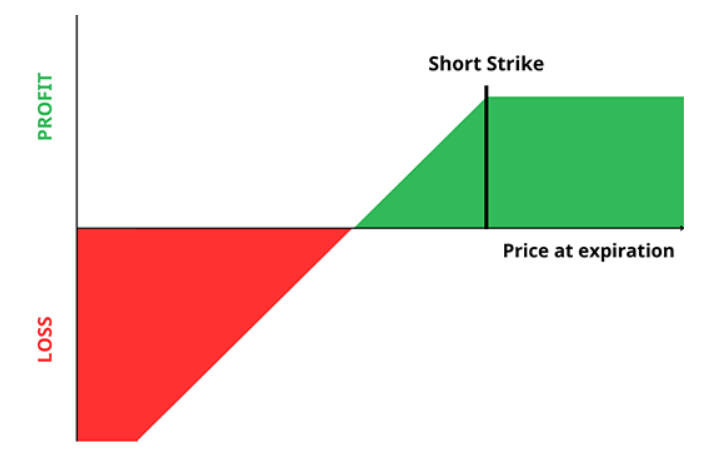

2. Profit/Loss Charts

Visualize assignment price, breakeven, and max profit.

3. IV Rank and Percentile

Great for timing trades to ideal IV conditions.

4. Options Put/Call Ratio Page

Track demand for puts vs. calls — often a leading indicator for premium pricing.

This combination takes the guesswork out of choosing strikes and expirations.

Naked Puts Are a Smart Way to Earn Income With Defined Intent

Whether your goal is to generate monthly cash flow, buy stocks at your preferred price, or simply get paid for your patience, naked put options — when paired with Barchart’s professional-grade tools — can be your winning strategy.

Watch this quick Naked Puts clip to get started:

- Stream Rick Orford’s full video on Barchart screeners

- Try the Naked Put Screener on Barchart

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal