Will Booz Allen’s US$99 Million Navy NextG Contract Win Change Booz Allen Hamilton Holding's (BAH) Narrative

- In November 2025, Booz Allen Hamilton announced it had secured a US$99 million contract from the U.S. Navy's Military Sealift Command to engineer, deploy, and sustain advanced wireless networks using Low Earth Orbit satellites, 5G, and other technologies across government-operated ships in the Pacific, Europe, and the U.S.

- The contract extends Booz Allen’s earlier 5G rapid prototyping work with Naval Information Warfare Center Atlantic, underscoring how its NextG, edge, and cybersecurity capabilities are being scaled from pilot projects into core mission connectivity for civil service mariners.

- Next, we’ll examine how this US$99 million MSC wireless-contract win could influence Booz Allen’s government-tech investment narrative and risk profile.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Booz Allen Hamilton Holding Investment Narrative Recap

To own Booz Allen Hamilton, you generally need to believe in sustained U.S. government demand for advanced defense, AI, and cybersecurity solutions, even with slow procurement cycles and contract timing uncertainty. The new US$99 million Military Sealift Command wireless contract reinforces Booz Allen’s role in complex NextG and edge projects, but it is modest relative to existing revenue and does not materially change the immediate catalysts or the key risks around funding delays and client concentration.

Among recent developments, Booz Allen’s ongoing share repurchases, backed by a total authorization of US$4,085 million as of October 2025, stand out alongside this contract win. For investors, the combination of continued buybacks and new tech-heavy federal awards can be seen in the context of current analyst expectations for slower revenue and earnings trends, and the risk that more fixed price, outcome based contracts increase execution pressure over time.

Yet behind these new federal tech wins, investors should be aware of how concentrated government budgets and slower awards could...

Read the full narrative on Booz Allen Hamilton Holding (it's free!)

Booz Allen Hamilton Holding's narrative projects $13.5 billion revenue and $775.2 million earnings by 2028. This implies 4.1% yearly revenue growth and an earnings decrease of about $224.8 million from $1.0 billion today.

Uncover how Booz Allen Hamilton Holding's forecasts yield a $101.50 fair value, a 24% upside to its current price.

Exploring Other Perspectives

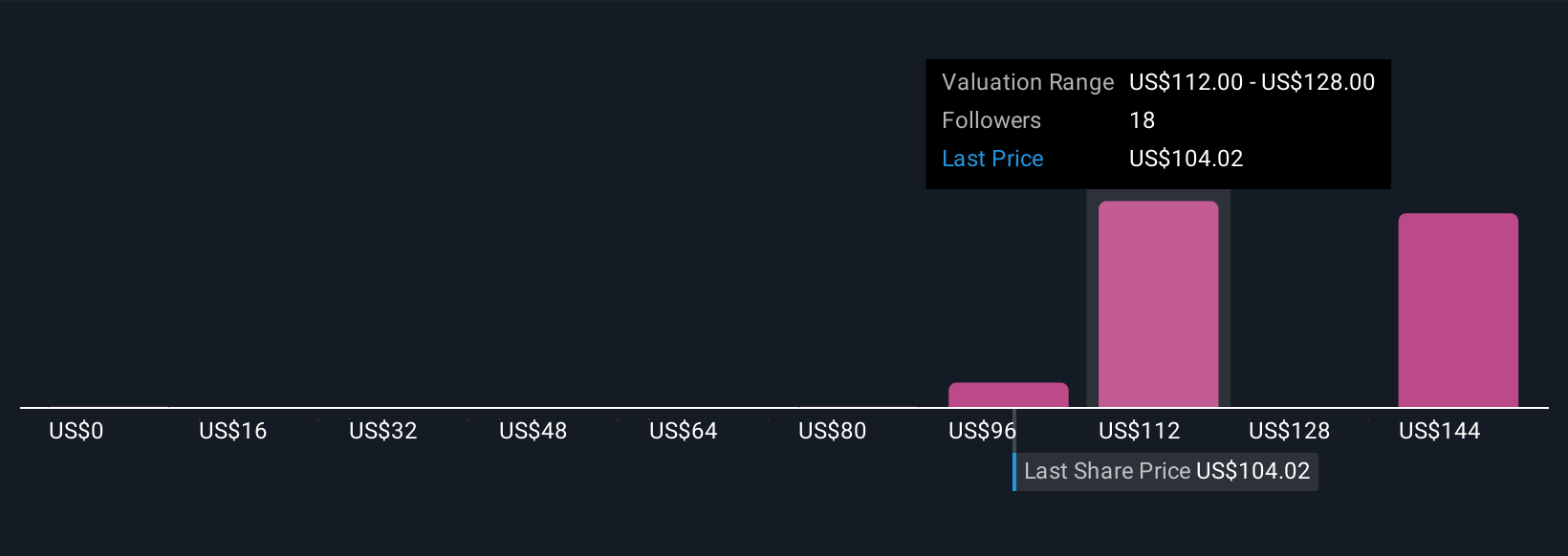

Eight members of the Simply Wall St Community currently see Booz Allen’s fair value between US$89 and about US$166 per share, highlighting very different expectations. When you weigh those views against the risk that heavier use of fixed price, outcome based contracts could pressure margins if complex delivery stumbles, it becomes clear why exploring several perspectives on Booz Allen’s future performance matters.

Explore 8 other fair value estimates on Booz Allen Hamilton Holding - why the stock might be worth over 2x more than the current price!

Build Your Own Booz Allen Hamilton Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Booz Allen Hamilton Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Booz Allen Hamilton Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Booz Allen Hamilton Holding's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal