REA Group (ASX:REA) Valuation After OpenAI Partnership, realAssist Launch and Ray White Data Deal

REA Group (ASX:REA) has been busy, rolling out OpenAI powered tools and its new realAssist companion while locking in a data heavy integration with Ray White, moves that reshape how its marketplace captures value.

See our latest analysis for REA Group.

Despite the launch of OpenAI powered tools and the Ray White data deal, REA Group’s share price return has been under pressure. A 30 day share price return of minus 11.73 percent has fed into a year to date share price loss of 19.13 percent. However, the three year total shareholder return of 60.35 percent still points to solid long term value creation and suggests current weakness may reflect a reset in expectations rather than a broken growth story.

If you are weighing REA’s AI push against other market leaders, this could be a good moment to explore high growth tech and AI stocks as potential next candidates for your watchlist.

With REA trading below analyst targets despite resilient growth, investors now face a key question: is this reset in sentiment opening a window to buy future earnings power cheaply, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 21.9% Undervalued

Compared to REA Group’s last close of A$190.13, the most followed narrative points to a higher fair value anchored in sustained earnings expansion.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 46.2x on those 2028 earnings, down from 46.4x today. This future PE is lower than the current PE for the AU Interactive Media and Services industry at 46.4x.

Curious why steady revenue growth, expanding profit margins and a premium valuation multiple all still add up to a discount? Want to see the detailed earnings path and assumptions behind that call? The full narrative unpacks the growth runway, profitability trajectory and valuation bridge the market is currently questioning.

Result: Fair Value of A$243.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory scrutiny and a more aggressive push from rivals like Domain or CoStar could compress pricing power and derail the earnings upgrade story.

Find out about the key risks to this REA Group narrative.

Another Lens on Valuation

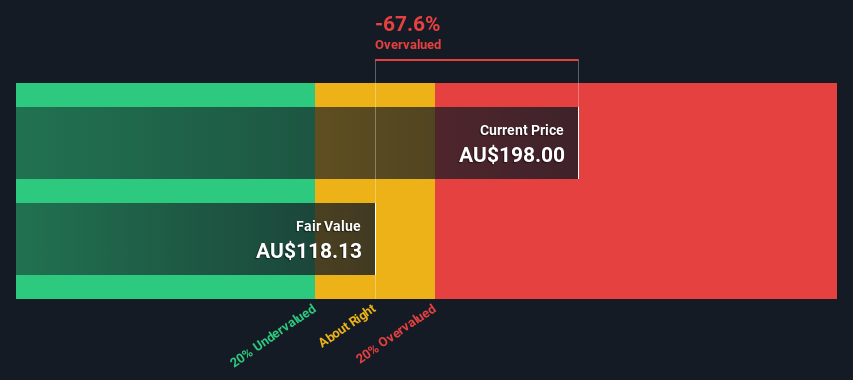

Analysts see REA as 21.9 percent undervalued based on future earnings, yet our DCF model paints a cooler picture, with the shares trading above an estimated fair value of A$155.48. Is the market overpaying for growth, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own REA Group Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a fresh view in minutes using Do it your way.

A great starting point for your REA Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning hand picked ideas from our screeners so you are not chasing the market later.

- Use these 927 undervalued stocks based on cash flows to explore companies trading below intrinsic value that also highlight strong cash flow potential.

- Use these 24 AI penny stocks to explore businesses involved in automation and data that are shaping the next wave of intelligent technology.

- Use these 14 dividend stocks with yields > 3% to explore companies offering yields above 3 percent while maintaining balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal