Is Silver X Mining (TSXV:AGX) Trading Near-Term Output For Longer-Term Efficiency Gains?

- In late November 2025, Silver X Mining Corp. reported third-quarter 2025 results showing lower ore mined, processed, and silver-equivalent production versus the prior year, while sales were broadly flat at about US$4.96 million.

- Despite reduced output and slightly softer nine-month sales of about US$15.61 million, the company significantly narrowed its net loss compared with the same periods in 2024, which may signal improving cost control or operational efficiency.

- Next, we’ll examine how reduced production alongside a much smaller net loss shapes Silver X Mining’s investment narrative for investors today.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Silver X Mining's Investment Narrative?

To own Silver X Mining today, you have to believe that its turnaround plan at Nueva Recuperada, including the 40,000‑meter drill campaign and “Plan 100” cost push, can outweigh the realities of a small, loss‑making producer with a volatile share price and recent dilution. The latest Q3 numbers complicate that belief: production volumes fell sharply year‑on‑year, yet the net loss shrank to just US$0.33 million on roughly flat sales, suggesting early traction on costs. That mix of weaker output but better margins could influence short term catalysts by shifting attention from pure production growth to whether the company can consistently operate closer to break‑even while it spends fresh equity capital on drilling and mine development. If those efficiency gains stall, the going concern flag from 2024 and the reliance on external funding remain front and center.

However, one key operational risk could quickly test that improving loss trend if conditions turn. The valuation report we've compiled suggests that Silver X Mining's current price could be inflated.Exploring Other Perspectives

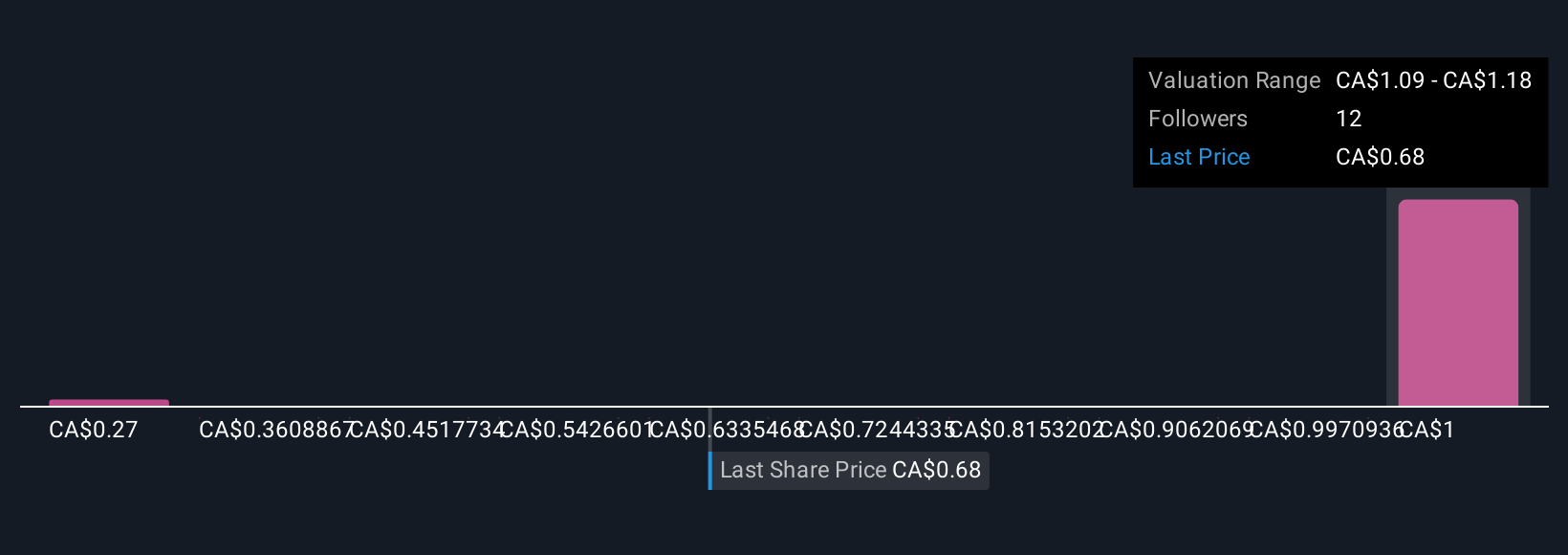

Simply Wall St Community members see fair value anywhere between US$0.27 and about US$1.18 across just two estimates, underlining how far apart expectations sit. Set that against the recent mix of lower production, narrowing losses and heavy share price gains, and you can see why different investors may read the same story very differently. You are getting a spread of views worth comparing before you form your own stance on Silver X’s next few years.

Explore 2 other fair value estimates on Silver X Mining - why the stock might be worth less than half the current price!

Build Your Own Silver X Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silver X Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Silver X Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silver X Mining's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal