European Value Stocks Priced Below Estimated Worth

As European markets experience a positive upturn, with the pan-European STOXX Europe 600 Index closing 2.35% higher and major single-country indexes also on the rise, investors are increasingly turning their attention to value stocks that may be priced below their estimated worth. In such an environment, identifying stocks that are undervalued can offer opportunities for investors seeking to capitalize on potential market inefficiencies and favorable economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN129.80 | PLN256.05 | 49.3% |

| Truecaller (OM:TRUE B) | SEK23.30 | SEK46.25 | 49.6% |

| PVA TePla (XTRA:TPE) | €22.18 | €44.14 | 49.8% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.88 | 48.9% |

| Mo-BRUK (WSE:MBR) | PLN304.00 | PLN598.65 | 49.2% |

| Jæren Sparebank (OB:JAREN) | NOK382.95 | NOK752.67 | 49.1% |

| Hemnet Group (OM:HEM) | SEK165.90 | SEK324.49 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.388 | €0.77 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.06 | €6.09 | 49.8% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

Here's a peek at a few of the choices from the screener.

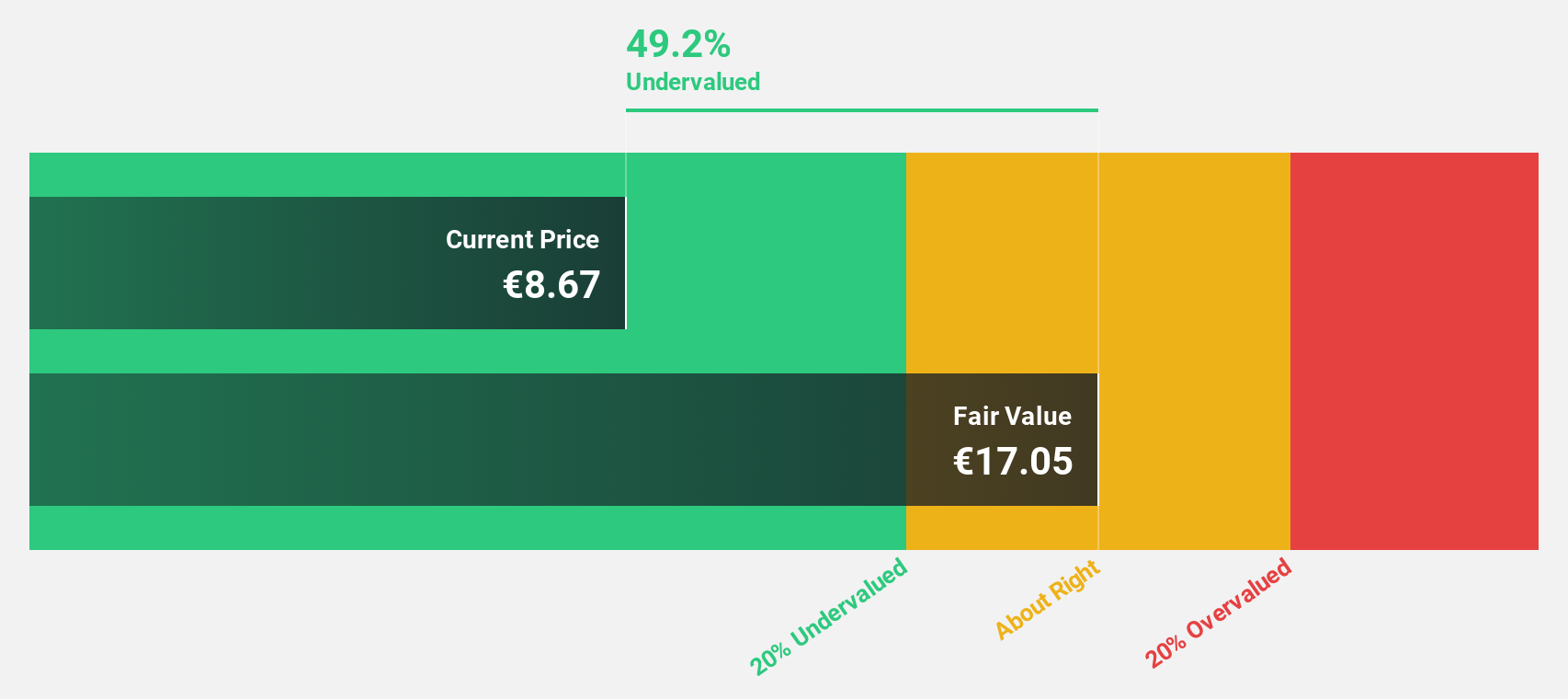

tonies (DB:TNIE)

Overview: tonies SE develops, produces, and distributes a digital, cloud-based interactive audio platform and entertainment system for children in Germany, the United States, the United Kingdom, and internationally with a market cap of €1.11 billion.

Operations: The company's revenue is derived from North America (€230.32 million), the DACH region (Germany, Austria, Switzerland) (€183.21 million), and the Rest of World segment (€103.76 million).

Estimated Discount To Fair Value: 28.4%

tonies SE is trading at €9.63, significantly below its estimated fair value of €13.45, suggesting it may be undervalued based on cash flows. The company has recently become profitable and forecasts earnings growth of 36.49% per year, outpacing the German market's 16.7%. Revenue is expected to grow by more than 25% this year, surpassing €600 million. However, its Return on Equity remains low at a forecasted 10.6%.

- Our expertly prepared growth report on tonies implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on tonies' balance sheet by reading our health report here.

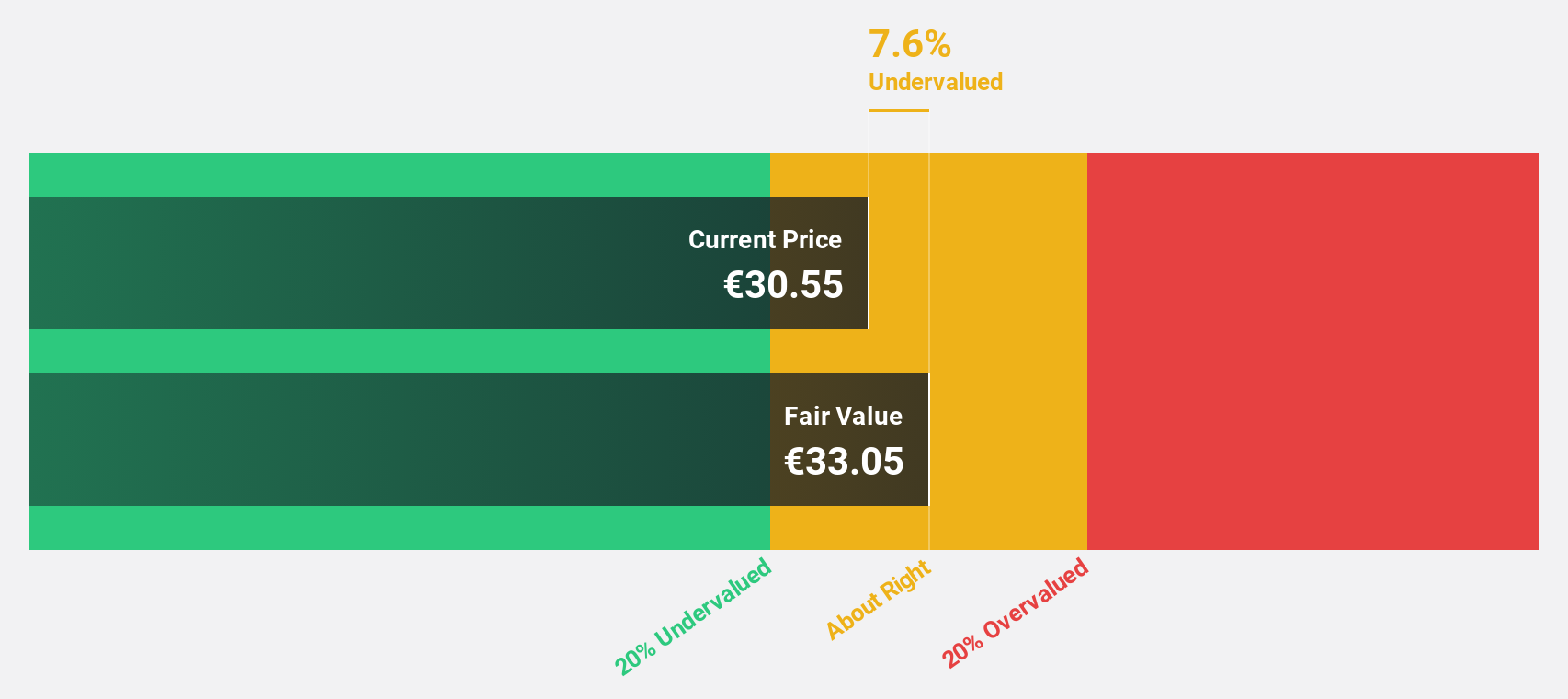

Theon International (ENXTAM:THEON)

Overview: Theon International Plc specializes in the development and manufacturing of customizable night vision, thermal imaging, and electro-optical ISR systems for military and security applications across Europe and globally, with a market cap of €1.90 billion.

Operations: The company generates revenue of €383.71 million from its Optronics segment, focusing on the production of advanced night vision, thermal imaging, and electro-optical systems for defense and security sectors worldwide.

Estimated Discount To Fair Value: 11.9%

Theon International is trading at €27.2, below its estimated fair value of €30.89, indicating it may be undervalued based on cash flows. The company recently raised earnings guidance and secured a significant contract with OCCAR, enhancing revenue visibility. Despite high share price volatility, forecasted annual earnings growth of 24.5% surpasses the Dutch market's average. A recent €300 million credit facility supports strategic initiatives, while ongoing share buybacks reflect confidence in financial health and future prospects.

- The analysis detailed in our Theon International growth report hints at robust future financial performance.

- Navigate through the intricacies of Theon International with our comprehensive financial health report here.

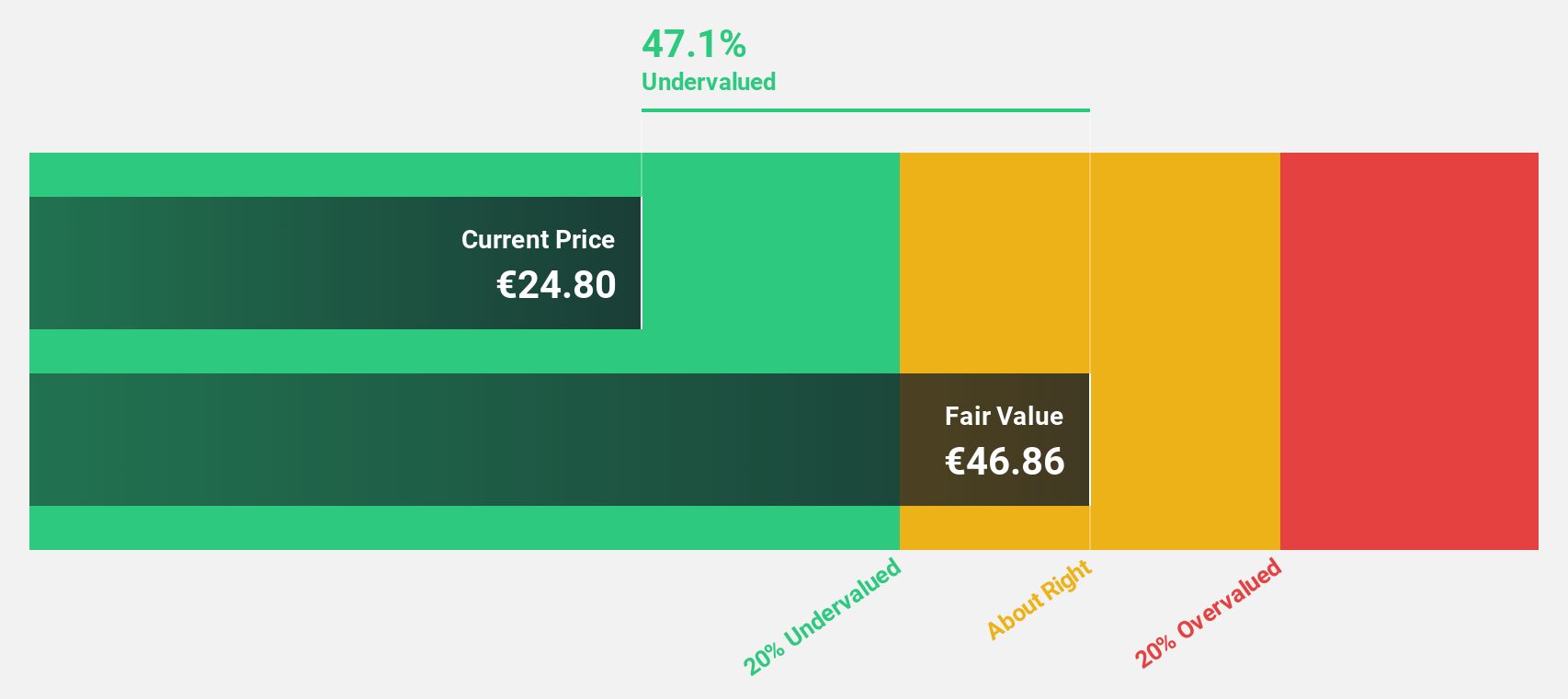

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €940.76 million.

Operations: The company's revenue is derived from three main regions: €168.04 million from the Americas, €126.97 million from Asia-Pacific, and €220.55 million from EMEA (Europe, Middle East, and Africa).

Estimated Discount To Fair Value: 39.4%

Lectra is trading at €24.75, significantly below its estimated fair value of €40.82, highlighting potential undervaluation based on cash flows. Despite a slight decline in recent earnings, forecasted annual profit growth of 22.4% outpaces the French market's average of 12%. Revenue growth is expected to be modest at 5.4% per year but still above the market average. The company's return on equity is projected to remain low at 11.6% over three years.

- Upon reviewing our latest growth report, Lectra's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Lectra with our detailed financial health report.

Summing It All Up

- Discover the full array of 201 Undervalued European Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal