MongoDB (MDB) Q3: Losses Narrow Sharply, Testing Bullish Profitability Narratives

MongoDB (MDB) has just posted its Q3 2026 numbers, with revenue of about $628.3 million and basic EPS of roughly -$0.02, alongside net income excluding extra items of approximately -$2.0 million, marking another quarter where growth and profitability are still in tension. The company has seen quarterly revenue move from around $478.1 million in Q2 2025 to $628.3 million in Q3 2026. Basic EPS has swung between about -$0.74 and a brief positive patch of roughly $0.20 before landing at -$0.02 this quarter, a pattern that keeps margins firmly in focus as investors consider how quickly the business model can scale toward sustained profitability.

See our full analysis for MongoDB.With the latest earnings laid out, the next step is to compare these results with the dominant narratives around MongoDB's growth story to see which themes the numbers support and which ones start to look stretched.

See what the community is saying about MongoDB

Losses Narrow to About $2 Million

- Net income excluding extra items improved from about -$47.0 million in Q2 2026 to roughly -$2.0 million in Q3 2026, while total revenue rose from $591.4 million to $628.3 million over the same period.

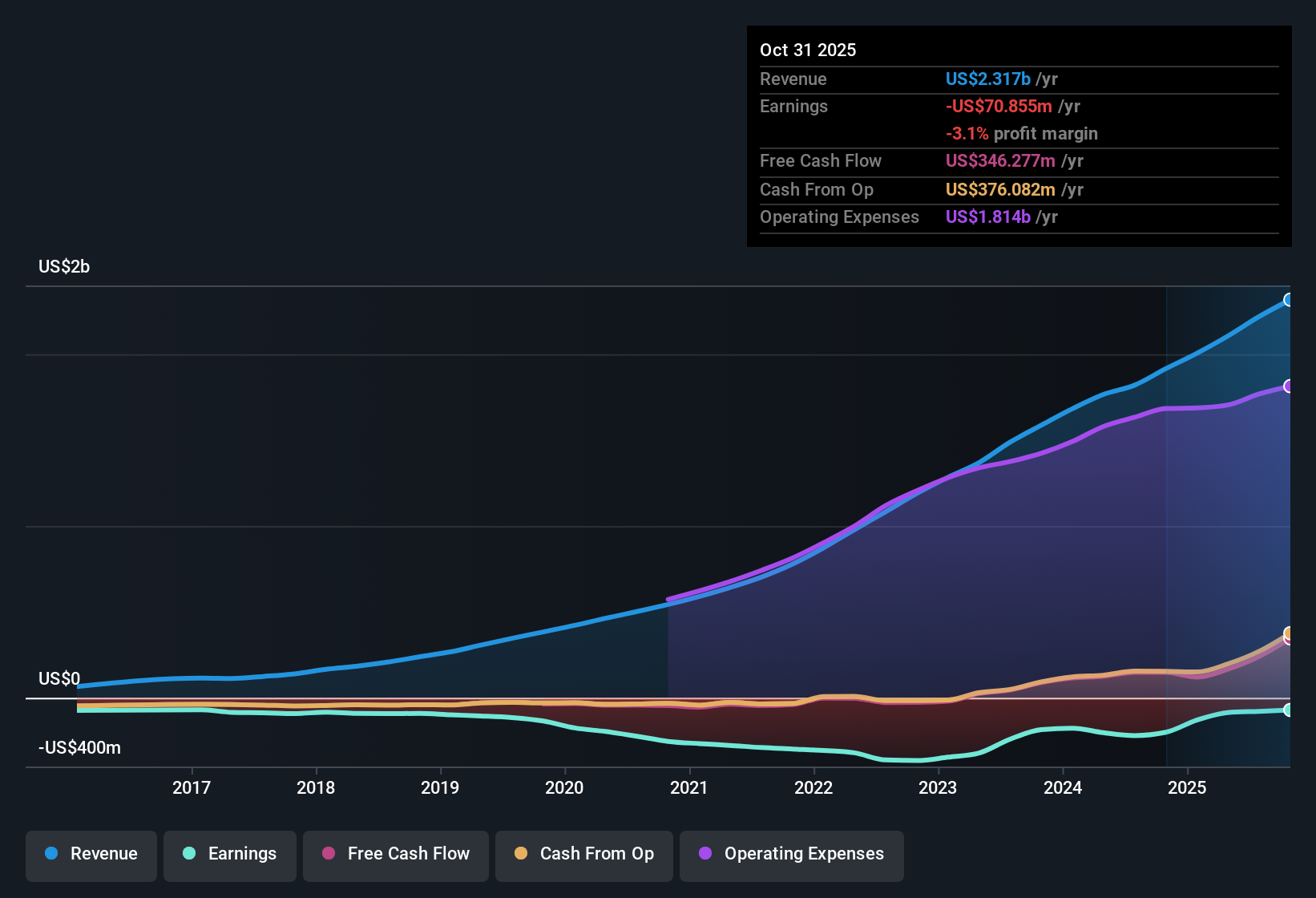

- What stands out for the bullish side is that trailing 12 month losses have moved from about -$219.9 million in Q2 2025 to around -$70.9 million by Q3 2026, which lines up with the view that MongoDB is steadily reducing losses even as it keeps investing for growth.

- That 12 month revenue base has climbed from roughly $1.8 billion to about $2.3 billion over this window, so the company is handling a larger scale while still narrowing the loss line.

- This combination of higher revenue and smaller losses is exactly what bulls point to when they talk about operating leverage starting to show up over time.

Path to Profit Tied to 51% Earnings Growth

- On a trailing 12 month basis, earnings per share are about -$0.88, and analysts are expecting earnings to grow at roughly 51.15 percent per year with revenue around 15.5 percent per year, targeting profitability within about three years.

- Analysts’ consensus narrative, which leans bullish on long term earnings strength, is effectively betting that these high projected earnings growth rates can build on the recent trend where trailing 12 month losses have been cut from about -$219.9 million to roughly -$70.9 million between Q2 2025 and Q3 2026.

- The story is that as more workloads move to the Atlas platform and recurring revenue scales, operating margins should eventually turn that -$70.9 million loss into positive earnings.

- The tension for investors is that the business is still unprofitable today, so the forecasts have to keep matching this kind of improvement for the narrative to hold up.

Premium Valuation Demands Strong Execution

- At a share price of $401.99 and a price to sales multiple of about 14.1 times, MongoDB trades at a notable premium to peers on roughly 6.8 times and the broader US IT industry at about 2.4 times, while also sitting above an indicated DCF fair value of roughly $232.57.

- Bears argue that with the stock well above that DCF fair value and the business still posting a trailing 12 month net loss of about -$70.9 million, investors are paying up heavily for forecasts of 15.5 percent revenue growth and 51.15 percent earnings growth per year.

- The concern is that if revenue growth slows from the recent move to about $2.3 billion over the last 12 months, the valuation premium could be hard to justify.

- Critics also highlight that the path from a -$0.88 trailing 12 month EPS to positive earnings leaves little room for disappointment when the multiple is already this far above peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MongoDB on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a moment to test your own thesis against the data and turn it into a concise narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MongoDB.

Explore Alternatives

MongoDB’s rich valuation, ongoing net losses, and reliance on aggressive growth forecasts leave little margin for error if execution or demand softens.

If paying a premium for uncertainty feels uncomfortable, shift your focus to these 933 undervalued stocks based on cash flows to quickly find companies where current prices more closely reflect sustainable cash flows and earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal