Is Andean Precious Metals (TSX:APM) Using New Credit Flexibility to Quietly Redefine Its Growth Ambitions?

- In late November 2025, Andean Precious Metals Corp. replaced its prior borrowings with a new 2-year, US$40 million revolving credit facility from National Bank of Canada, while a separate arbitration with Silver Elephant Mining over US$1,000,000 in contingent consideration moved toward a year-end ruling.

- By consolidating its debt into a single revolving facility and tying project timing to regional approvals, Andean is reshaping both its financial flexibility and the pace at which it can expand its operations.

- We’ll now examine how Andean’s new revolving credit facility and streamlined capital structure affect the company’s broader investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Andean Precious Metals Investment Narrative Recap

To own Andean Precious Metals, you need to be comfortable with a Bolivia centered precious metals producer whose growth depends on securing permits and maintaining smooth operations at key assets. The new US$40 million revolving credit facility materially improves short term liquidity, but does not directly change the central near term catalyst around environmental and social approvals at San Bartolomé, nor the key risk of concentrated exposure to Bolivian regulatory and political shifts.

The refinancing announcement on November 25, 2025 stands out here, because consolidating the CommerceWest and Banco Santander facilities into a single NBC revolver gives Andean more room to manage working capital while it waits on project clearances and processes the pending US$1,000,000 Silver Elephant arbitration outcome. That extra flexibility can be important if permitting or community discussions take longer than expected, or if operating costs move against the company in the meantime.

Yet investors should still be aware that heavy reliance on Bolivian assets leaves Andean exposed if...

Read the full narrative on Andean Precious Metals (it's free!)

Andean Precious Metals' narrative projects $352.0 million revenue and $83.1 million earnings by 2028. This requires 8.3% yearly revenue growth and about a $41.2 million earnings increase from $41.9 million today.

Uncover how Andean Precious Metals' forecasts yield a CA$9.92 fair value, a 8% upside to its current price.

Exploring Other Perspectives

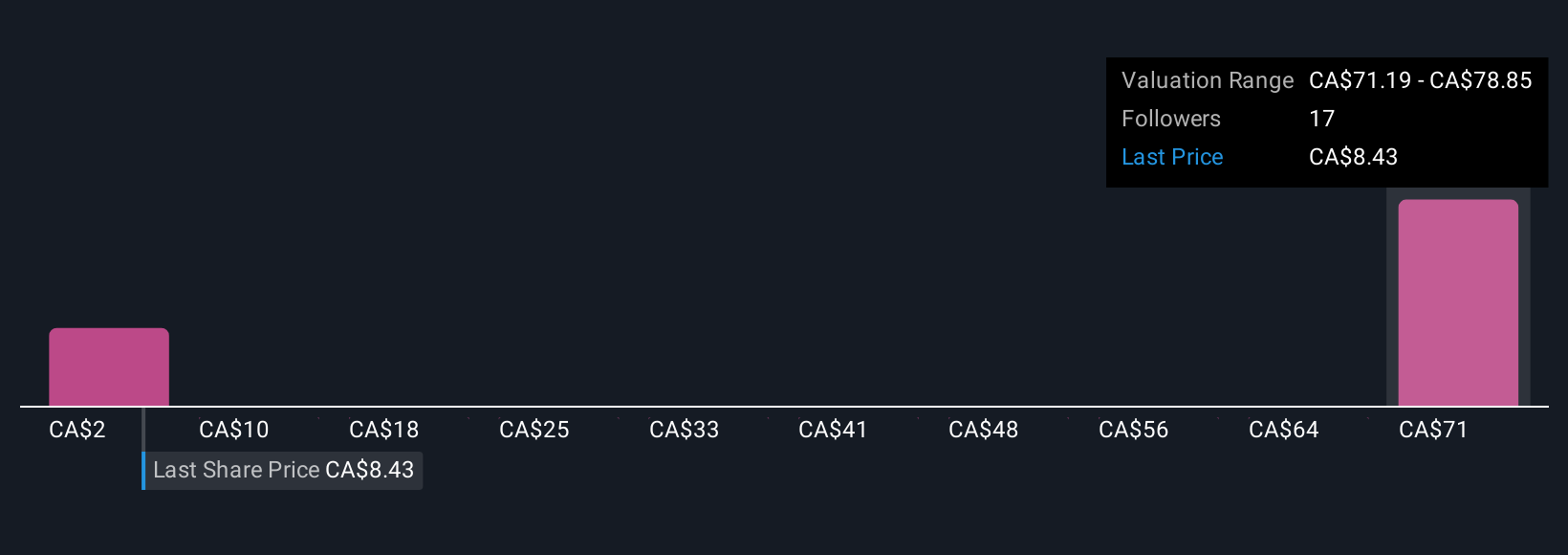

Three Simply Wall St Community valuations span a wide range, from about CA$2.30 to CA$108.77, reflecting sharply different expectations for Andean. Against that backdrop, the company’s dependence on timely environmental permits and social licenses at San Bartolomé could be a key swing factor for how those scenarios play out over time.

Explore 3 other fair value estimates on Andean Precious Metals - why the stock might be a potential multi-bagger!

Build Your Own Andean Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Andean Precious Metals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Andean Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Andean Precious Metals' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal