Should Pegasystems' (PEGA) Moody’s-Powered KYC Upgrade Require Action From AI-Focused Investors?

- Pegasystems Inc. recently announced a collaboration with Moody’s Corporation, integrating Moody’s real-time entity verification data into Pega Client Lifecycle Management to improve KYC, onboarding efficiency, and regulatory compliance for financial institutions.

- This link-up gives Pega CLM users single-source access to data on more than 600 million companies across over 200 countries, potentially changing how financial firms manage client risk and lifecycle workflows.

- We’ll now examine how this deeper access to Moody’s global entity data could influence Pegasystems’ existing investment narrative around AI-driven cloud growth.

Find companies with promising cash flow potential yet trading below their fair value.

Pegasystems Investment Narrative Recap

Pegasystems’ appeal rests on its ability to turn AI-driven workflow software into stable, recurring cloud revenue, helped by strong margins and an active buyback program. The Moody’s collaboration strengthens Pega’s CLM and KYC value proposition, but does not materially change the near term focus on converting backlog to Pega Cloud revenue or the key risk around differentiating its AI solutions in a crowded market.

The Moody’s integration dovetails with recent Pega Blueprint and agentic workflow enhancements that emphasise AI-enabled, compliant automation across complex enterprises. Together, these developments support the existing catalyst of expanding cloud adoption and cross sell opportunities, while still leaving investors to weigh earnings volatility from term licenses and macro uncertainty in Europe.

Yet while the Moody’s partnership reinforces Pega’s AI story, investors should also be aware that its ability to clearly differentiate its AI offering...

Read the full narrative on Pegasystems (it's free!)

Pegasystems' narrative projects $1.9 billion revenue and $292.2 million earnings by 2028. This requires 4.2% yearly revenue growth and roughly a $72 million earnings increase from $220.2 million today.

Uncover how Pegasystems' forecasts yield a $73.09 fair value, a 31% upside to its current price.

Exploring Other Perspectives

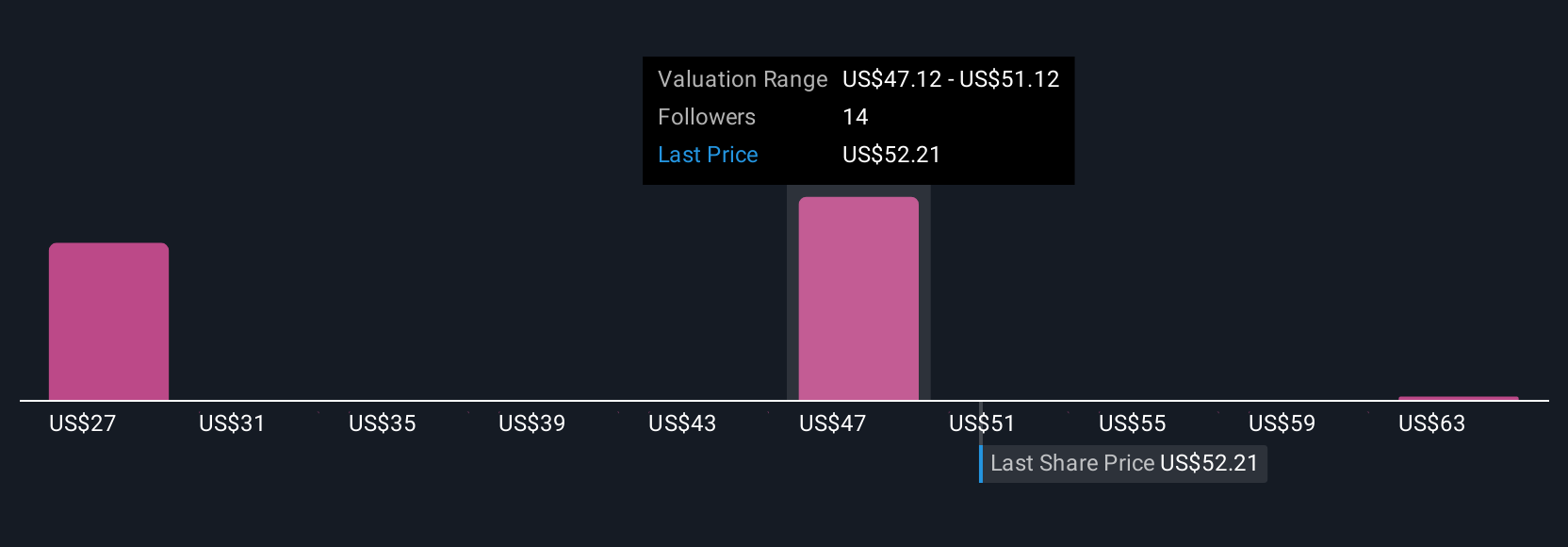

Six fair value estimates from the Simply Wall St Community span roughly US$26 to US$78 per share, underscoring how far apart individual views can be. Set that against Pega’s reliance on forward looking statements, where any divergence between expectations and actual revenue or earnings could have a meaningful impact, and you have several contrasting angles on future performance worth exploring.

Explore 6 other fair value estimates on Pegasystems - why the stock might be worth as much as 40% more than the current price!

Build Your Own Pegasystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pegasystems research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Pegasystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pegasystems' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal