Omdia: In the third quarter of 2025, Lenovo (00992) tablet shipments surged by more than 70%, and PC market share expanded

The Zhitong Finance App learned that Omdia's latest data shows that in the third quarter of 2025, the overall growth pace of the Chinese PC market was affected by the weakening of consumer subsidies, and the overall growth rate slowed down, with only a slight increase of 2% over the previous year. Among the leading manufacturers, Huawei and Softcom Power all experienced negative growth. However, Lenovo (00992) has shown strong cyclical resistance in this market environment, continuing to lead the industry with impressive growth in both shipment volume and market share. At the same time, the tablet business growth rate exceeded 70%, further consolidating its core competitive advantage in the smart terminal field and becoming a “stabilizer” in market fluctuations.

PC market trend differentiation

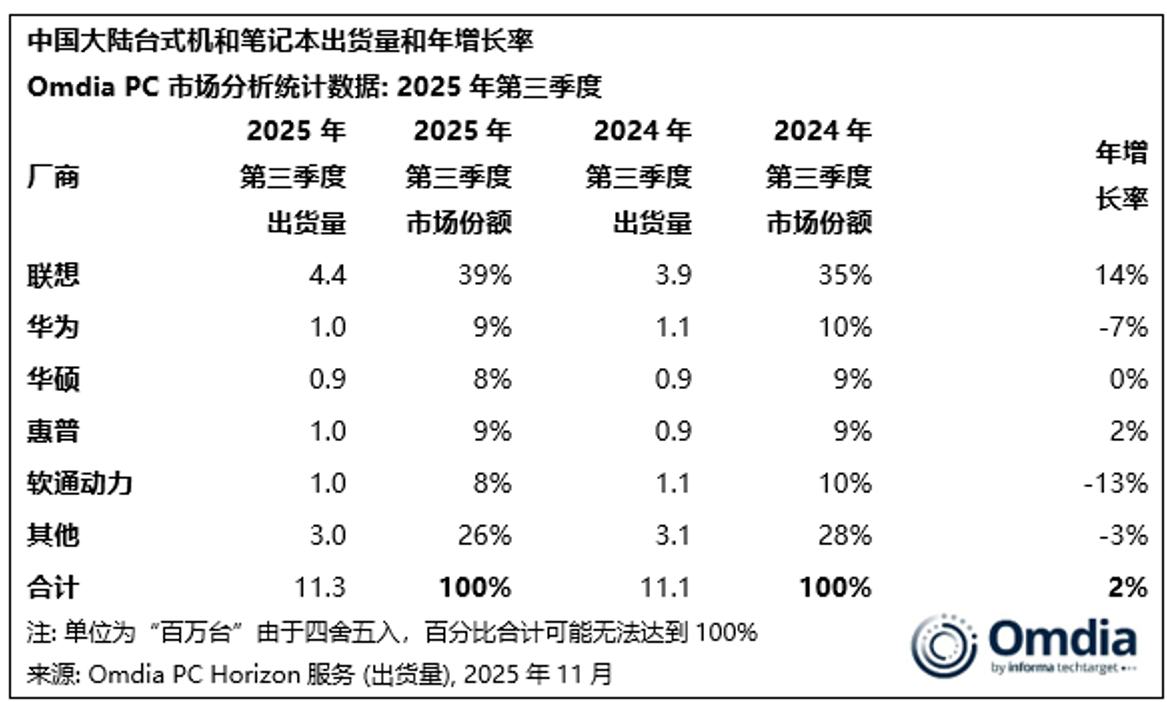

According to Omdia's latest monitoring data, the total shipment volume of the Chinese PC market (including desktops, notebooks and workstations) in the third quarter of 2025 reached 11.3 million units, an increase of 2% over the previous year. In this context, Lenovo ranked first in the industry with a shipment volume of 4.4 million units and a market share of 39%. The year-on-year growth rate reached 14%, far exceeding the overall growth level of the market, and has become a key force driving the growth of the industry.

In contrast to Lenovo's strong performance, the market performance of other major manufacturers was generally weak. Among them, the Huawei Q3 PC shipment volume was 1 million units, down 7% year on year, and the market share fell to 9%; Softcom Power also shipped 1 million units, down 13% year on year, and maintained a market share of 8%; Asus shipped 900,000 units, which remained flat year on year, with a market share of 8%; even though HP, which performed relatively well, achieved a 2% year-on-year increase, the shipment volume remained around 1 million units, which failed to impact Lenovo's leading position.

Notably, Lenovo's growth did not depend on a single category. Driven by strong demand in the commercial market, Lenovo's desktop (including workstations) business grew at the same time, while the notebook business remained stable against the backdrop of declining consumer subsidies. This “two-wheel drive” product layout makes it more resilient in the face of market fluctuations.

Tablets have become a new growth pole

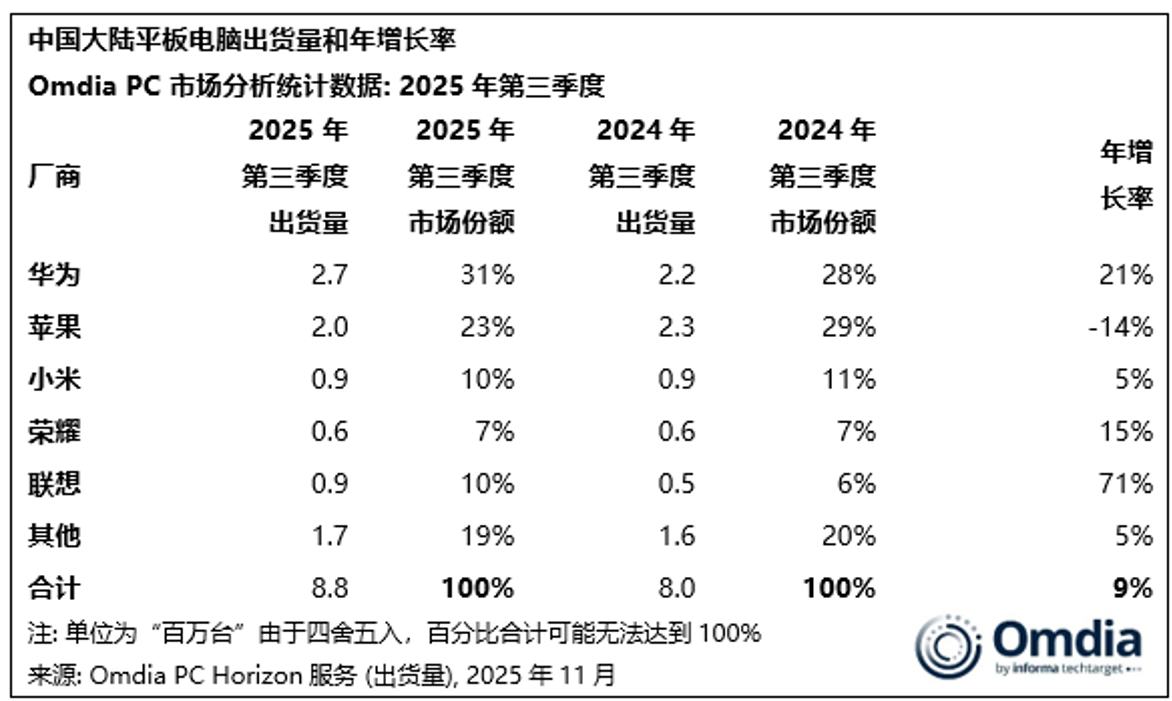

Unlike the PC market, tablets continued to grow strongly in 2025, with shipments in the Chinese market increasing 9% year over year to 8.8 million units.

And Lenovo's performance in the tablet sector was also impressive, becoming another major growth engine for it. According to Omdia data, in the third quarter of 2025, Lenovo shipped 900,000 tablets in the Chinese market, surging 71% year on year. The market share increased to 10%, and the growth rate was among the leading manufacturers.

Since this year, Lenovo has continued to expand its tablet product portfolio, covering the needs of multiple scenarios, from basic daily use to gaming and productivity, and successfully attracted a large number of users in line with the cost-effective advantages brought by direct vendor support. Comparatively, Apple tablet shipments fell 14% year on year during the same period, and its market share shrank to 23%. Lenovo's rapid growth further highlighted its competitive potential in the tablet market.

Emma Xu (Emma Xu), senior analyst at Omdia, said: The popularity of AI is accelerating in mainland China's consumer and commercial markets. CPU performance, storage capacity, and NPU modules are still the key hardware metrics that buyers are most concerned about when planning AI-related use scenarios (including Xinchuang requirements). Lenovo's forward-looking layout in the field of AI technology also adds points to the competitiveness of its products.

Currently, Lenovo has incorporated functions such as end-side AI assistants, cross-device interconnection, and AI applications into PC and tablet products to provide users in productivity scenarios with a more attractive value experience through unified AI back-office capabilities. Omdia predicts that 32% of PCs in Greater China will have AI capabilities in 2025, and this percentage will increase to 46% in 2026.

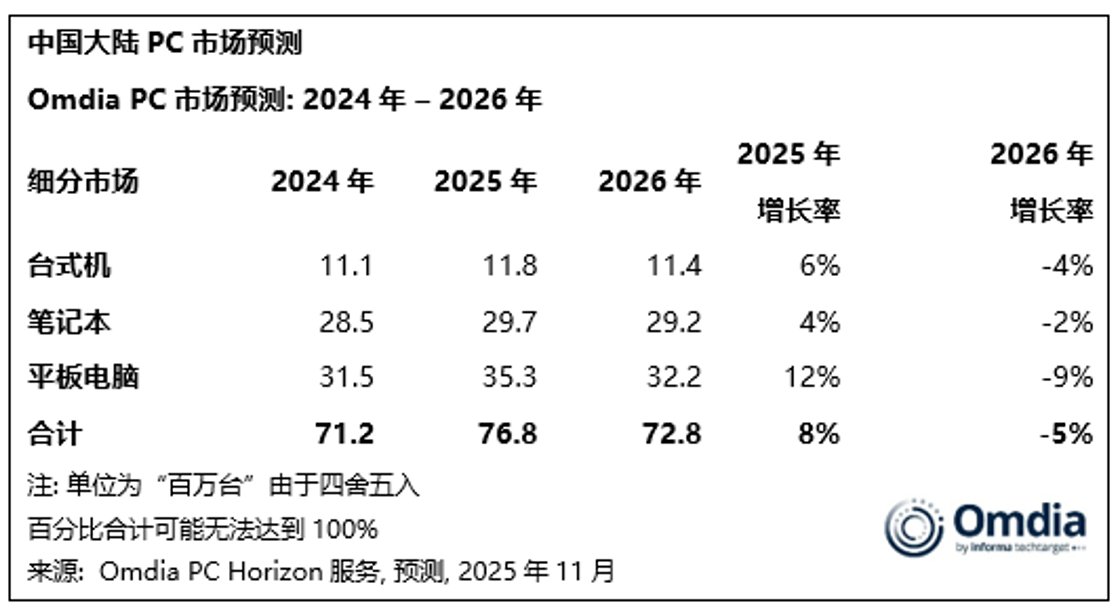

Although Omdia expects the Chinese PC market to decline slightly by 2% in 2026 due to further weakening consumer demand, and the tablet market will also face a 9% correction, Lenovo is expected to continue to withstand market fluctuations and continue to lead the way with its deep accumulation in the commercial market, the continued empowerment of AI technology, and the high growth momentum of the tablet business.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal