How Trip.com Group’s (TCOM) Dunhuang Partnership Signals a New Approach to China’s Inbound Tourism Potential

- Earlier this year, Dunhuang's Tourism Department announced a partnership with Trip.com Group to boost inbound tourism through digital upgrades and cultural engagement initiatives, including the launch of multilingual service centers and a themed travel page for international visitors.

- This collaboration highlights how digital innovation and tailored content can enhance tourism infrastructure, making destinations like Dunhuang more accessible and engaging for travelers worldwide.

- We'll look at how Trip.com Group’s digital collaboration with Dunhuang expands opportunities in China’s under-penetrated inbound travel market.

Find companies with promising cash flow potential yet trading below their fair value.

Trip.com Group Investment Narrative Recap

To be a shareholder in Trip.com Group, you need to believe in the long-term potential of digital travel platforms to increase cross-border tourism and capture market share as demand for both outbound and inbound travel grows. The digital partnership with Dunhuang is aligned with current efforts to unlock China’s inbound travel market, though the immediate impact on overall revenue growth and on the main short-term catalyst, expansion of inbound travel, is not material at this stage. The most significant risk remains exposure to geopolitical tensions and regulatory dynamics around cross-border travel.

The recent launch of multilingual service centers and a dedicated Dunhuang travel theme page, as part of Trip.com Group’s collaboration with Dunhuang’s Tourism Department, directly supports efforts to enhance the international visitor experience, reinforcing the company’s ongoing focus on digital upgrades and inbound market expansion. This development fits within the catalyst of digital channel adoption and infrastructure investment, which remains vital as Trip.com Group competes to retain and grow its user base amid increased competition and evolving traveler expectations.

However, investors should also be aware that ongoing global uncertainty around international travel could quickly amplify risks from ...

Read the full narrative on Trip.com Group (it's free!)

Trip.com Group's outlook anticipates CN¥83.3 billion in revenue and CN¥23.1 billion in earnings by 2028. Achieving this would require 13.3% annual revenue growth and a CN¥5.1 billion increase in earnings from the current level of CN¥18.0 billion.

Uncover how Trip.com Group's forecasts yield a $85.81 fair value, a 22% upside to its current price.

Exploring Other Perspectives

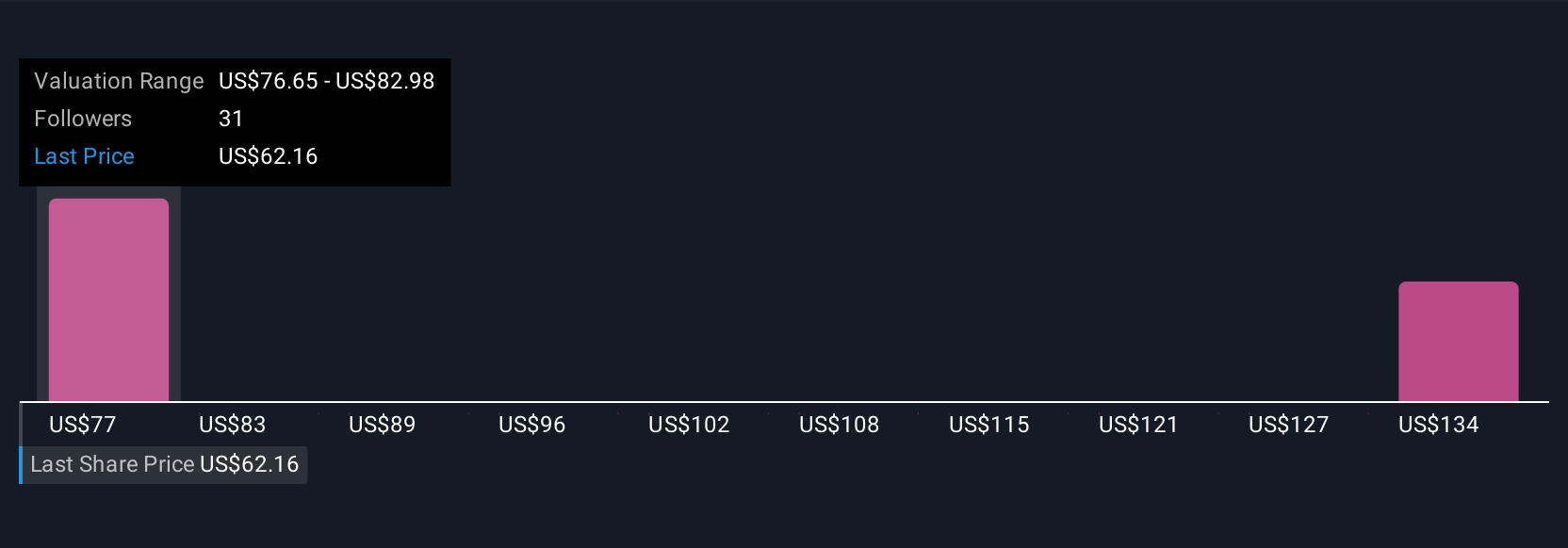

Simply Wall St Community members provided two fair value views for Trip.com Group, stretching from CN¥85.81 to CN¥147.54 per share. With digital upgrades supporting inbound demand, you can explore how these diverse valuations reflect differing expectations for cross-border recovery and future profit growth.

Explore 2 other fair value estimates on Trip.com Group - why the stock might be worth over 2x more than the current price!

Build Your Own Trip.com Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trip.com Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trip.com Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trip.com Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal