Wayfair (W): Assessing Valuation After Strong Q3 Earnings and Holiday Demand Boost

Wayfair (W) shares are in focus after the company surpassed third-quarter earnings expectations and delivered positive guidance for the next quarter. Momentum is also building as Black Friday and Cyber Monday promotions attract unprecedented online demand.

See our latest analysis for Wayfair.

Wayfair’s momentum has been hard to ignore, with a 138.9% year-to-date share price return that signals surging optimism around execution and ecommerce trends. Favorable third-quarter earnings and a wave of holiday promotions have helped fuel a powerful swing in sentiment, even as long-term total returns remain mixed.

If you’re watching retail rebound stories, it is also an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With Wayfair’s shares surging and positive earnings guidance fueling investor enthusiasm, the central question remains: is the stock still trading below its true value, or has the market already priced in all the anticipated growth?

Most Popular Narrative: 3.5% Undervalued

Wayfair's current fair value estimate sits at $114 per share, just above the last close of $110.04. With such a small gap, the narrative suggests expectations for future performance are grounded in specific catalysts and bold profit assumptions.

The launch of Wayfair Verified and new merchandising initiatives like personalized promotions are aimed at enhancing customer trust and user experience. These efforts may potentially drive higher sales and revenue per unit through increased customer engagement and conversion rates.

Want to know what’s locking in this valuation? The narrative’s secret sauce is a future profit turnaround, rising margins, and ambitious sales targets that could outpace many competitors. The key question is which growth levers and upward earnings trajectory are making all the difference.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as ongoing weakness in the housing market and international uncertainty. Either of these factors could challenge the optimistic outlook for Wayfair.

Find out about the key risks to this Wayfair narrative.

Another View: What Does the Price-To-Sales Ratio Reveal?

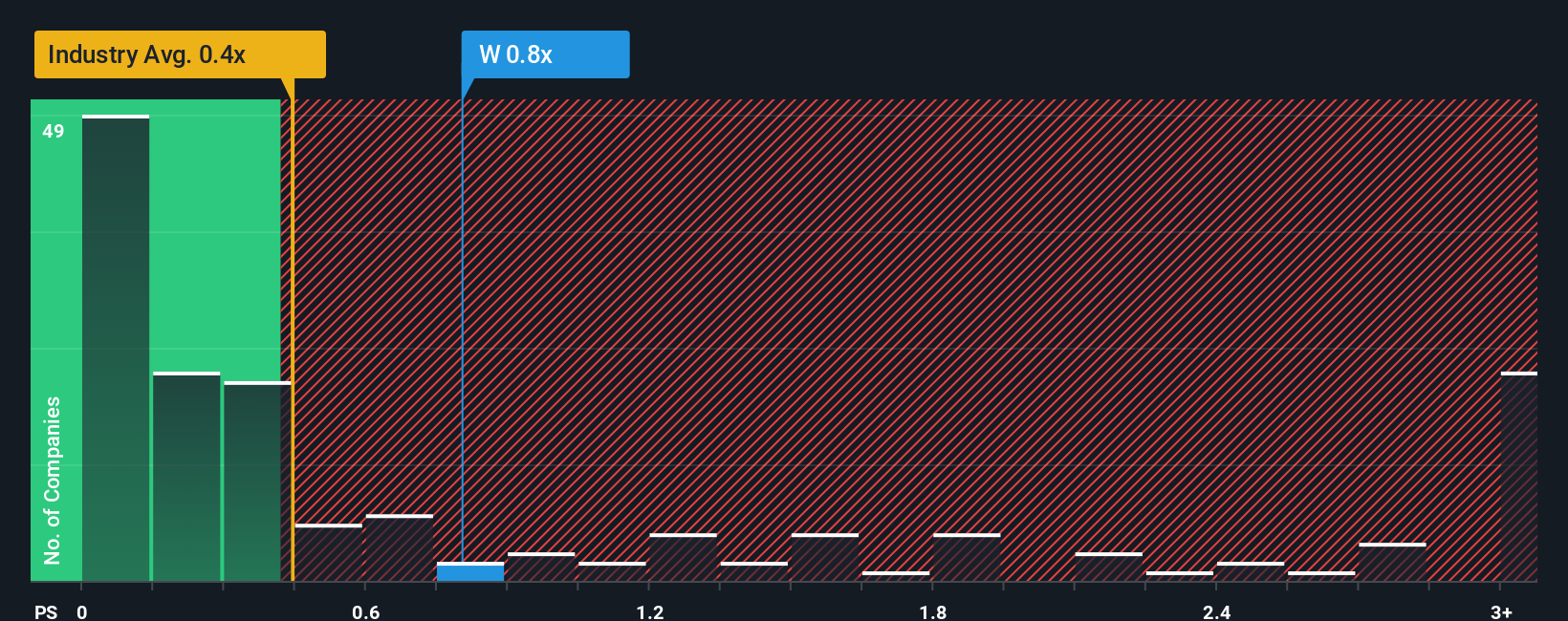

Taking a different approach, Wayfair trades at a price-to-sales ratio of 1.2x. This is above both the US Specialty Retail industry average of 0.5x and its own fair ratio of 0.8x. This premium raises concerns about valuation risk and suggests limited room for upside if expectations aren’t met. Could optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wayfair Narrative

If you have your own ideas or insights, now is the perfect time to dive in and build a custom perspective. Your complete narrative is only a few clicks away. Do it your way

A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your advantage and uncover stocks with unique potential using tailored screeners on Simply Wall Street. The next big opportunity could be closer than you think.

- Maximize income from stable payers and check out these 14 dividend stocks with yields > 3% with yields over 3% that could strengthen your portfolio’s returns.

- Tap into healthcare’s AI breakthroughs by surveying these 30 healthcare AI stocks positioned at the intersection of medicine and cutting-edge technology.

- Ride the digital frontier and access these 81 cryptocurrency and blockchain stocks driving innovation in blockchain and crypto-fueled business growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal