TGS (OB:TGS): Evaluating Current Valuation After Recent Share Price Weakness

TGS (OB:TGS), a leading provider of geoscience data services, has seen its stock move in recent sessions. Many investors are now reevaluating the company’s performance, particularly as its recent returns differ from sector trends.

See our latest analysis for TGS.

TGS’s share price has struggled to find momentum recently, with a 27.3% decline year-to-date and a one-year total shareholder return of -17.05% putting performance behind sector expectations. A modest 8.6% gain over the past three months hints at short-term optimism, but overall the company’s long-term trajectory has yet to signal a lasting turnaround.

If you’re interested in discovering what else could be gaining market traction, now is a smart time to check out fast growing stocks with high insider ownership.

With TGS's shares lagging despite recent short-term gains, the big question for investors is whether the current price underestimates the company’s value, or if the market is already factoring in any future recovery and growth.

Most Popular Narrative: 2.7% Undervalued

Market watchers have noted that the latest analyst narrative fair value only slightly exceeds the last close. This suggests a potential disconnect between cautious optimism and current share pricing. This narrative, shaped by major sector headwinds and cost adjustments, sets the foundation for a deeper look at TGS's prospects.

Bullish analysts point to TGS's diversified service offerings, which position the company to benefit from an eventual recovery in sector demand. Steady operational execution and cost management provide a level of earnings stability, even as macroeconomic conditions fluctuate.

What assumptions power this fair value? Hinted inside are bold margin expansion forecasts and dramatic shifts in profit growth, but the forecasted earnings leap and the narrative's confidence hinge on a few surprising drivers. Why do analysts believe current challenges can turn into record future profits? Peek under the hood to find out which figures drive this narrative's price call.

Result: Fair Value of $87.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oil price volatility and concentrated client exposure could quickly undermine optimistic forecasts if sector conditions worsen or customer deals do not succeed.

Find out about the key risks to this TGS narrative.

Another View: Earnings-Based Ratios Raise Caution

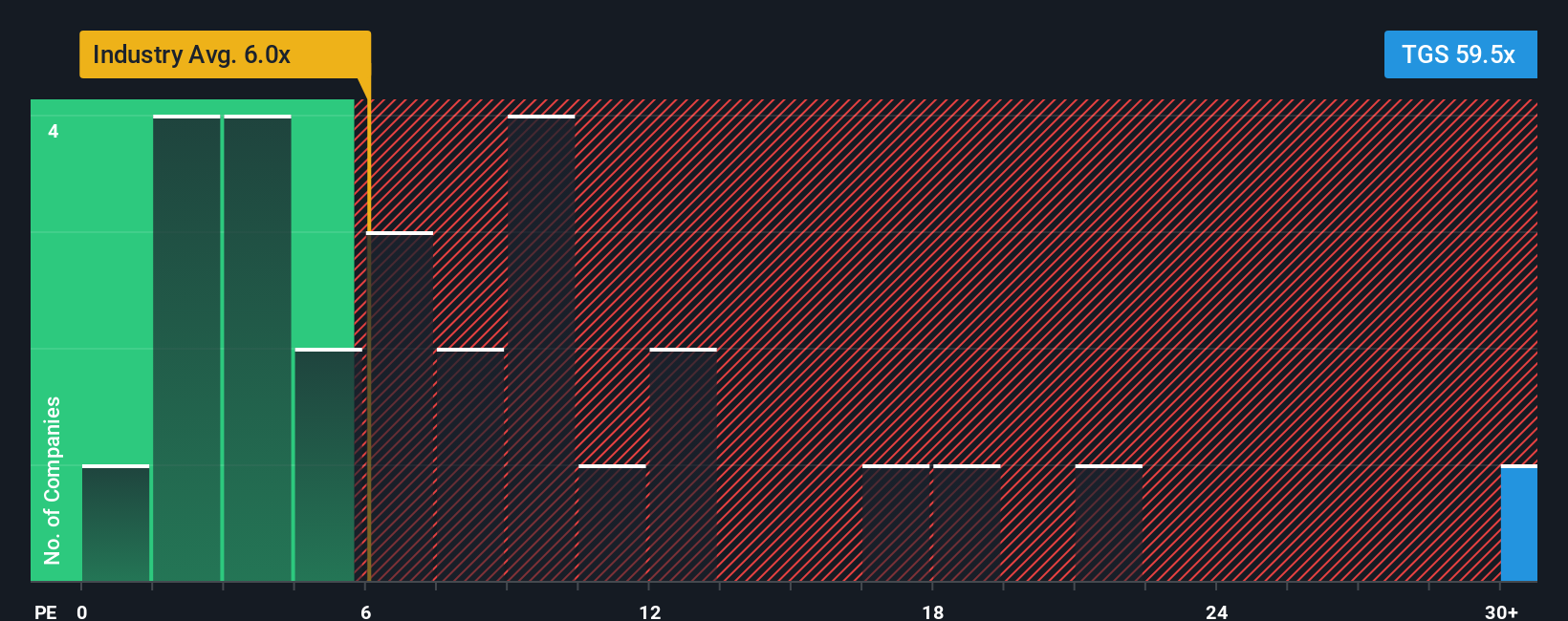

While the current narrative suggests TGS is undervalued, a closer look at its price-to-earnings ratio paints a different picture. TGS trades at 33.5 times earnings, which is much higher than the Norwegian Energy Services sector average of 6.2x, the fair ratio of 10.1x, and peer averages of 8.4x. This premium means investors are paying up for future growth that must be delivered. Does the multiple signal long-term opportunity, or could expectations already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TGS Narrative

If you’re inclined to dig deeper or have your own take, it’s easy to shape your perspective and build a narrative in just a few minutes. Do it your way.

A great starting point for your TGS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Sharper Investment Opportunities?

Don’t let the best ideas pass you by. Get ahead by using powerful screeners that uncover standout stocks before the crowd catches on.

- Unlock future potential by evaluating these 928 undervalued stocks based on cash flows with strong cash flow metrics favored by market pros.

- Secure steady returns by reviewing these 14 dividend stocks with yields > 3% offering robust yields in today’s unpredictable climate.

- Join the innovation wave and target these 25 AI penny stocks poised to shape tomorrow with breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal