$6 Billion Buyback and Asset Charges Might Change The Case For Investing In ON Semiconductor (ON)

- In November 2025, ON Semiconductor Corporation announced a share repurchase program authorizing up to US$6 billion in share buybacks, with authorization active through December 31, 2028, and disclosed management's approval of additional non-cash impairment and accelerated depreciation charges related to manufacturing assets.

- This series of management actions may be viewed as moves to boost future operational efficiency and enhance returns to shareholders through meaningful capital allocation.

- Next, we’ll explore how the expanded share repurchase program could shape ON Semiconductor’s wider investment appeal for investors.

Find companies with promising cash flow potential yet trading below their fair value.

ON Semiconductor Investment Narrative Recap

To be a shareholder in ON Semiconductor, you need to believe in the company’s prospects within key structural growth markets such as silicon carbide and intelligent power solutions, especially as electric vehicle (EV) and data center demand evolves. The new US$6 billion share repurchase plan and related cost-cutting moves may help streamline operations, but they do not materially change the importance of improved manufacturing utilization and a cyclical demand recovery as near-term catalysts, or lessen the ongoing risk from soft automotive and EV end markets. Among the latest announcements, ON Semiconductor’s decision to accelerate depreciation and recognize non-cash impairment charges is closely related to the buyback news, as these steps free up cash flow by reducing recurring costs. This could potentially reinforce the company’s ability to fund buybacks, but does not address concerns about underutilized manufacturing capacity or provide immediate relief to revenue pressures from portfolio changes. In contrast, investors should also be aware that persistent underutilization of ON’s manufacturing capacity remains a crucial risk, especially if...

Read the full narrative on ON Semiconductor (it's free!)

ON Semiconductor's narrative projects $7.5 billion in revenue and $1.9 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $1.43 billion increase in earnings from the current $465.8 million.

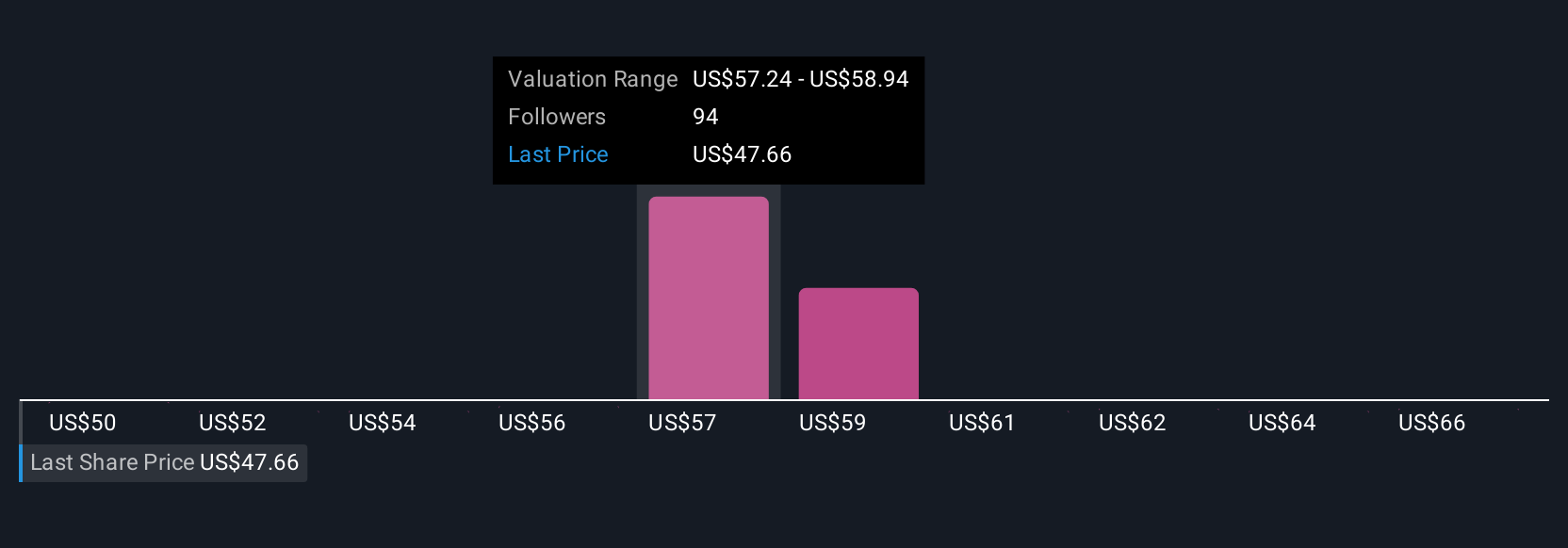

Uncover how ON Semiconductor's forecasts yield a $58.70 fair value, a 16% upside to its current price.

Exploring Other Perspectives

11 individual members of the Simply Wall St Community estimate ON Semiconductor’s fair value ranges widely, from US$49.59 to US$70. While many see operational improvements and product mix benefits, uncertainty around manufacturing utilization and end-market demand continues to influence sentiment.

Explore 11 other fair value estimates on ON Semiconductor - why the stock might be worth as much as 39% more than the current price!

Build Your Own ON Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ON Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ON Semiconductor's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal