Will Coty’s (COTY) AI Push Mark a Turning Point in Its Competitive Edge?

- Coty Inc. recently presented at the 2025 Morgan Stanley Global Consumer & Retail Conference, highlighting its deeper integration of artificial intelligence across business operations.

- By automating workflows, deploying AI-driven procurement tools, and launching personalized product technologies, Coty reports early cost savings and anticipates ongoing margin improvement as these efforts mature.

- We'll explore how Coty's enhanced use of AI-driven personalization could influence the company's long-term investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Coty Investment Narrative Recap

For Coty shareholders, the core investment thesis often rests on the company’s ability to regain revenue growth and margin expansion once retailer inventory destocking subsides, particularly as new product launches and digital initiatives gain traction. The recent spotlight on AI integration does not significantly alter the near-term catalyst, balancing sell-in and sell-out or rekindling US demand, but may help address persistent cost pressures if adoption continues to yield savings. The most significant risk remains a prolonged period of weak demand in key markets, which could further delay profitability improvements and pressure margins.

Of Coty’s recent announcements, the ongoing business reorganization aimed at closer integration of Prestige and Mass Fragrance divisions stands out, as this structural change could amplify the margin benefits Coty is targeting with its expanded use of AI and digital tools. As those digital enhancements improve workflow efficiency, their impact is likely to build alongside operational streamlining rather than directly influencing the major catalysts in the short term.

Yet investors should also keep in mind another potential challenge, the threat that ongoing inventory destocking may remain pressure on sales and recovery timelines if...

Read the full narrative on Coty (it's free!)

Coty's outlook anticipates $6.1 billion in revenue and $302.1 million in earnings by 2028. This is based on an expected annual revenue growth rate of 1.3% and a $683.2 million increase in earnings from the current level of -$381.1 million.

Uncover how Coty's forecasts yield a $4.86 fair value, a 46% upside to its current price.

Exploring Other Perspectives

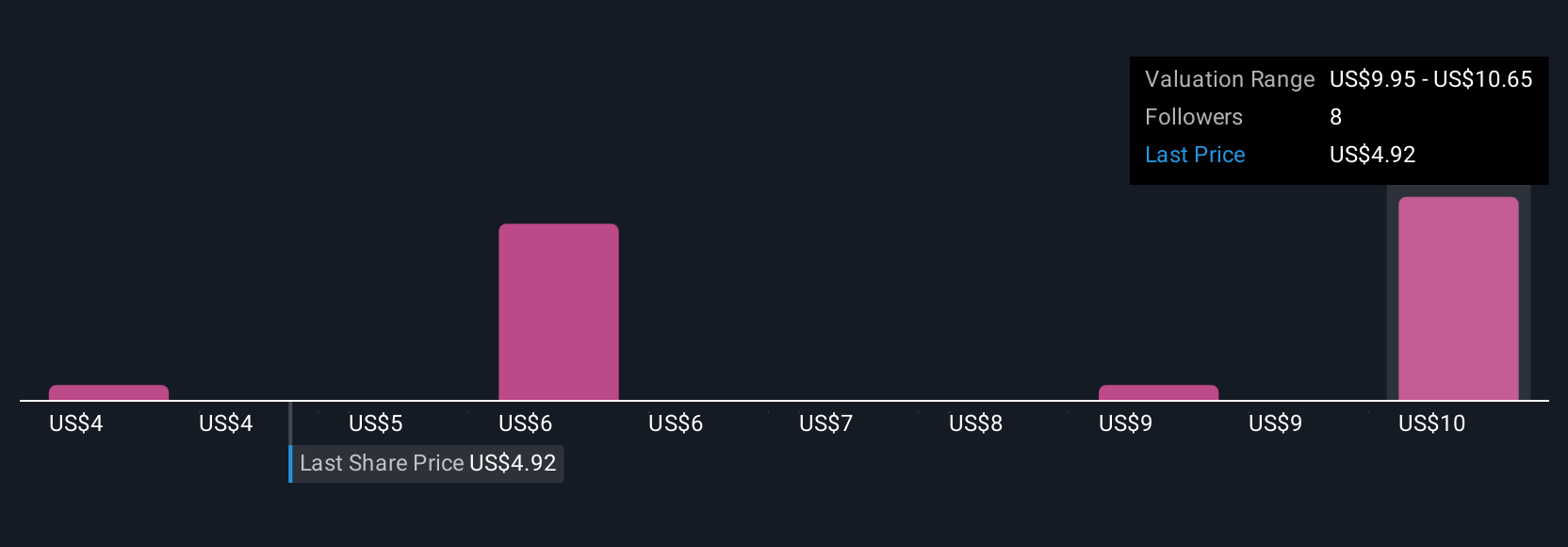

Simply Wall St Community members have set fair value estimates for Coty from US$3.69 to US$9.22, across five analyses. While the consensus sees margin improvement potential as digital adoption grows, competing risk factors suggest you should consider several perspectives on where Coty could be heading.

Explore 5 other fair value estimates on Coty - why the stock might be worth just $3.69!

Build Your Own Coty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Coty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coty's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal