Does the Rally in Dell Still Have Room to Run After AI Hardware Headlines?

- Wondering if Dell Technologies is a value opportunity right now? You are not alone, as plenty of investors are eyeing whether the rally has room to run or if the share price has already gotten ahead of itself.

- The stock climbed 3.8% in the last week but remains down 18.5% over the past month. Despite this, Dell still shows a gain of 13.4% year-to-date and an increase of 226.5% over three years.

- Recent headlines have highlighted Dell’s strategic moves in the AI and server hardware spaces, stoking investor interest and possibly fueling recent swings in sentiment. In particular, partnerships and product launches have grabbed market attention and reinvigorated the discussion around Dell’s long-term potential.

- On our six-point valuation check, Dell scores 6 out of 6 for being undervalued, which is noteworthy. We will dive into what that means using classic valuation methods, and later in the article, we will explore an alternative way to judge fair value.

Find out why Dell Technologies's 6.9% return over the last year is lagging behind its peers.

Approach 1: Dell Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This approach is particularly useful for assessing long-term value because it relies on how much cash the business is expected to generate over time.

Dell Technologies currently reports a Free Cash Flow (FCF) of approximately $4.19 Billion. According to analyst consensus and further extrapolations, Dell’s annual FCF is forecasted to grow significantly and reach around $9.84 Billion by 2030. The first five years are based on explicit analyst estimates, while longer-term projections are modeled to reflect potential growth trends.

Based on this DCF analysis, the estimated intrinsic value per share for Dell is $221.78. With the current share price trading about 40.4% below that intrinsic value, the stock appears to be notably undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dell Technologies is undervalued by 40.4%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

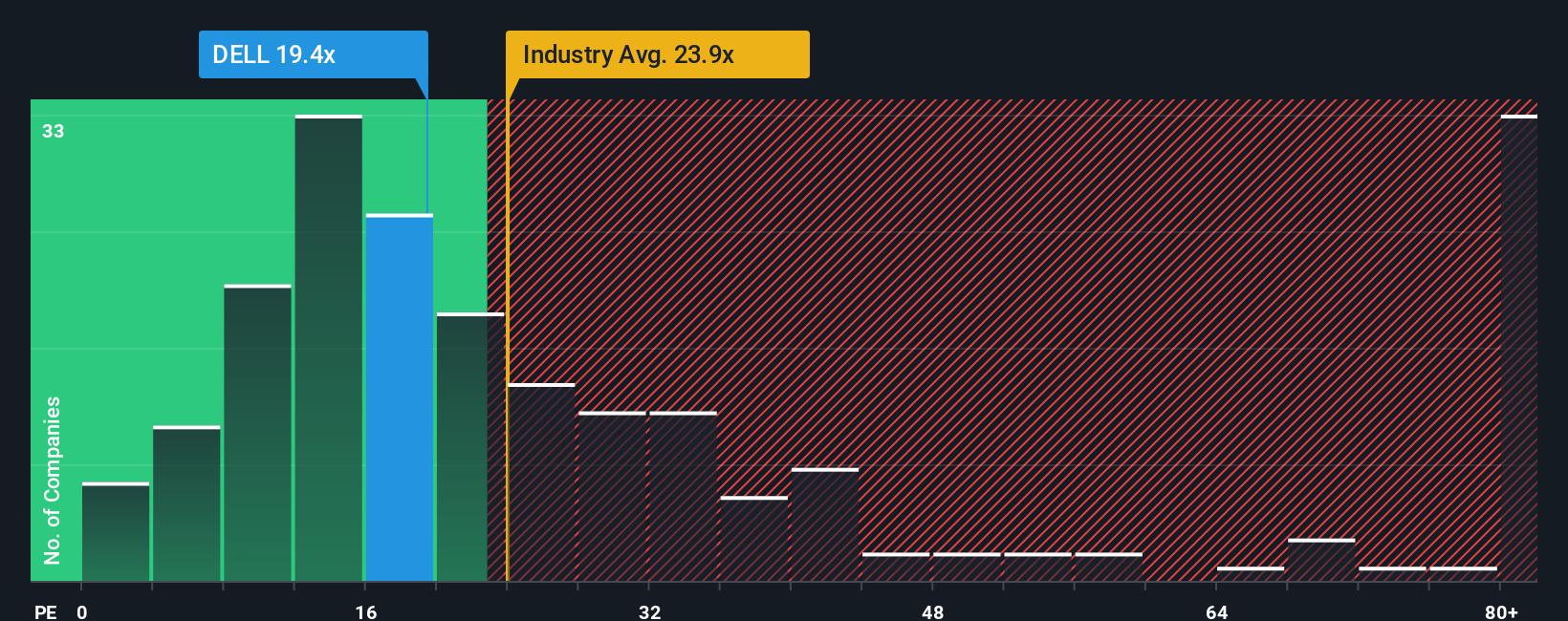

Approach 2: Dell Technologies Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it offers a straightforward way to gauge how much investors are willing to pay for each dollar of a company's earnings. For established, consistently earning businesses like Dell Technologies, the PE ratio can be especially insightful in assessing whether the stock is attractively priced relative to its profitability.

When assessing what a "normal" or "fair" PE ratio should look like, it is important to account for both growth prospects and risk. Companies with higher earnings growth and lower risk profiles often justify higher PE ratios, while lower growth or greater uncertainty tends to mean a lower PE is warranted.

Currently, Dell trades at a PE ratio of 17x. This is below both the Tech industry average of 22.5x and the peer group average of 25x, suggesting a modest valuation discount based on these traditional yardsticks. However, Simply Wall St's Fair Ratio model sets Dell’s fair PE at 33.3x. This Fair Ratio takes into account specific details such as Dell’s earnings growth, its profit margins, market capitalization, and industry-specific risks. This makes it a more comprehensive benchmark than a simple peer or industry comparison.

With the Fair Ratio well above the current PE, this analysis implies Dell is undervalued relative to its earnings outlook and risk-return profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dell Technologies Narrative

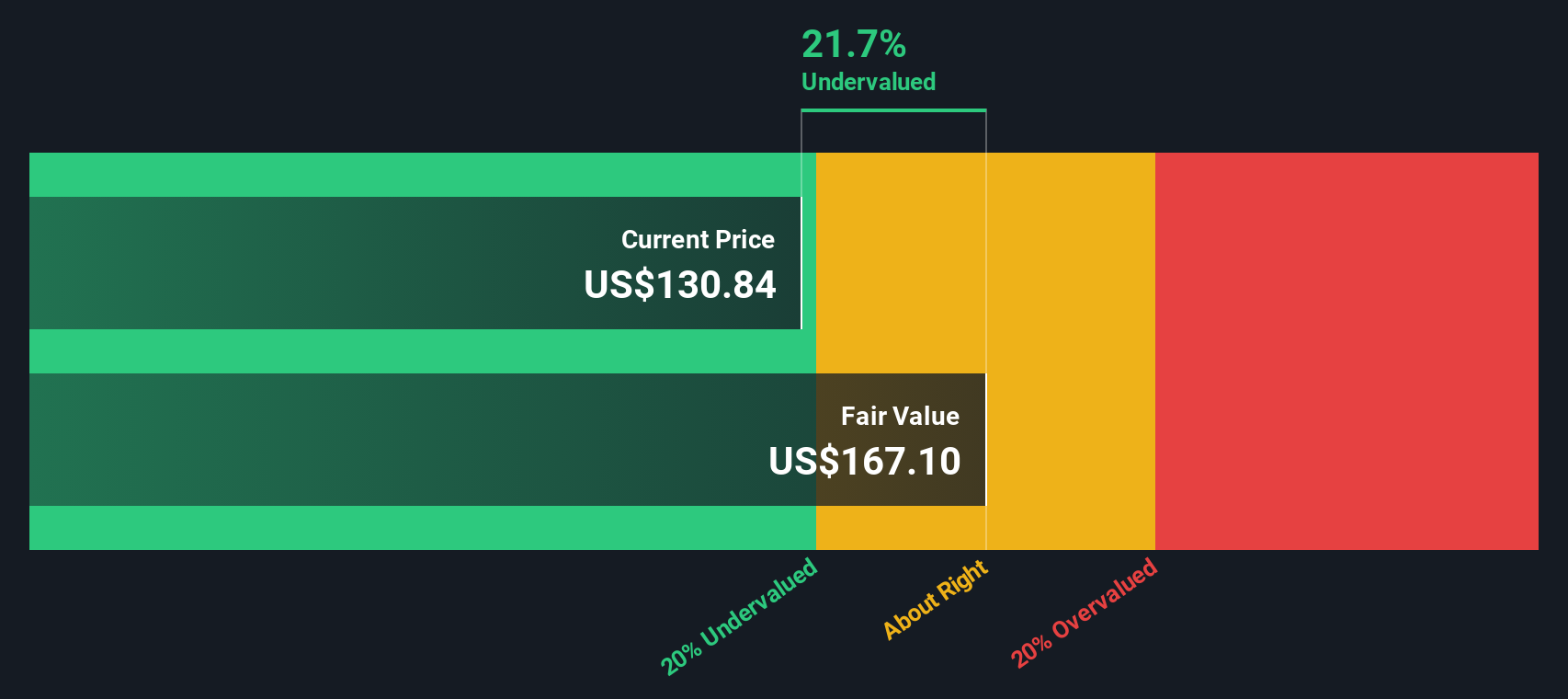

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story investors create to explain their personal view on a company, combining their fair value estimate and expectations for future revenue, earnings, and margins. Instead of just relying on valuation multiples or forecasts, Narratives connect Dell Technologies’ unique business journey, such as growth in AI infrastructure or shifts in PC demand, to financial forecasts and ultimately to a personalized fair value.

Narratives are an easy and accessible tool available on Simply Wall St's platform within the Community page, where millions of investors share, compare, and update their perspectives. By showing the story behind the numbers, Narratives help you decide when to buy or sell Dell Technologies by directly comparing your calculated Fair Value to the current Price, which is automatically kept up to date when new news or earnings reports are released.

For example, one investor might set a bullish Narrative for Dell with a Fair Value of $180, highlighting optimism about AI-driven growth and margin expansion. Another investor, more cautious about supply chain risks and hardware commoditization, may set a Fair Value closer to $104. Narratives let you see these different viewpoints at a glance, empowering smarter, more dynamic investment decisions.

Do you think there's more to the story for Dell Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal