How Investors May Respond To Keysight Technologies (KEYS) Share Buyback and Strong 2025 Earnings

- Keysight Technologies recently reported its full year 2025 earnings, highlighting sales of US$5.38 billion and net income of US$846 million, alongside new product launches and board changes.

- An interesting development saw the company announce a US$1.5 billion share repurchase program and introduce scalable test automation systems supporting high-volume electronics manufacturing efficiency.

- Now, we will examine how Keysight's robust earnings and return of capital initiatives could influence its long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Keysight Technologies Investment Narrative Recap

To be a shareholder in Keysight Technologies, you need confidence in the accelerating demand for advanced testing solutions, driven by secular trends like AI adoption and next-generation connectivity. The company's strong recent earnings and revenue growth continue to support that catalyst; however, the biggest near-term risk, the impact of recently announced tariffs, remains material, as new results have not shown enough detail yet on mitigation success or cost control in the face of these pressures.

Among the latest announcements, the introduction of the Keysight A90 Application-Specific Automated Test Suite stands out, directly addressing the need for greater test throughput and efficiency amid technology complexity, a key factor supporting growth in data center and electronics manufacturing end markets that continue to fuel the investment thesis.

However, investors should also be aware that, in contrast, persistent margin pressure from newly imposed tariffs could...

Read the full narrative on Keysight Technologies (it's free!)

Keysight Technologies' outlook anticipates $6.3 billion in revenue and $1.2 billion in earnings by 2028. This projection implies a 6.5% annual revenue growth rate and a $656 million increase in earnings from the current $544.0 million.

Uncover how Keysight Technologies' forecasts yield a $213.38 fair value, a 8% upside to its current price.

Exploring Other Perspectives

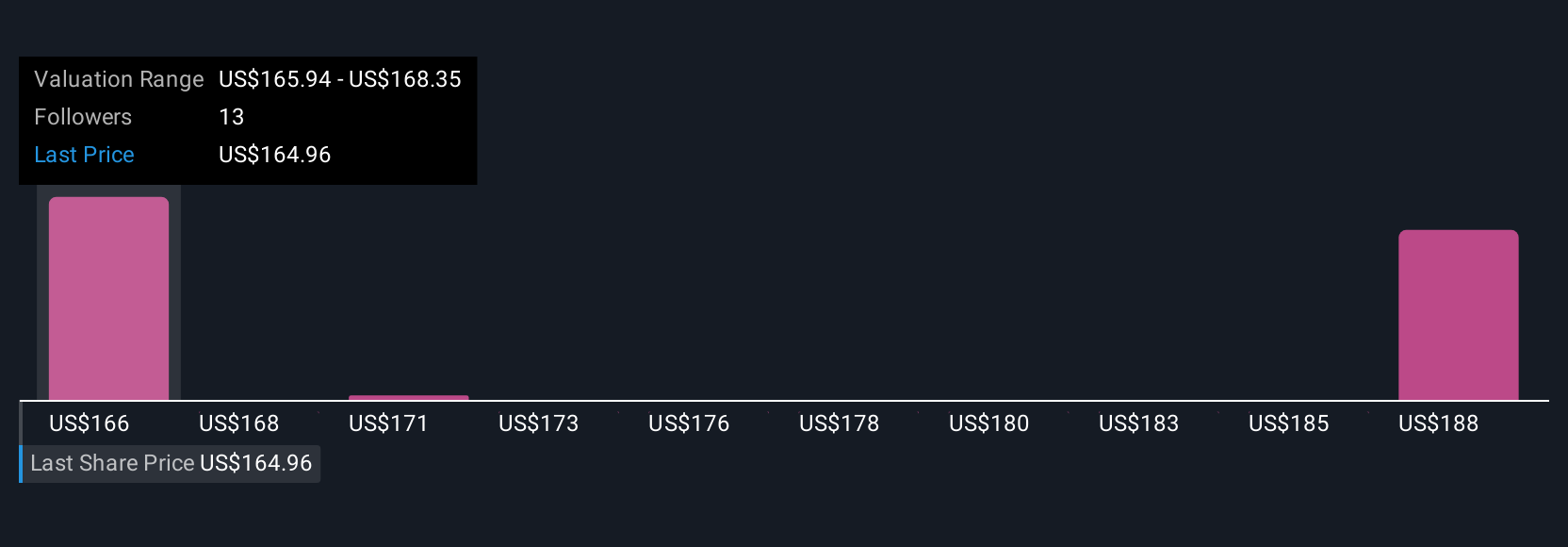

Five fair value estimates from the Simply Wall St Community span US$173 to US$213 per share, underscoring wide differences in outlook. While many expect continued growth from AI and connectivity, the risk of higher operating costs due to new tariffs remains critical for anyone considering Keysight’s potential.

Explore 5 other fair value estimates on Keysight Technologies - why the stock might be worth 12% less than the current price!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal