Amprius Stock Surges 271% in 2025 as Battery Partnerships Fuel Valuation Debate

- Ever wondered if Amprius Technologies stock is a hidden gem or just getting swept up in hype? Let’s dig in and see if its current price stacks up to its longer-term value.

- After surging an incredible 271% year-to-date and boasting a 329.6% gain over the past year, the stock has been on a rollercoaster ride. It has recently cooled off, with a dip of 24.7% over the last month.

- Much of this volatility comes amid news of Amprius ramping up battery technology partnerships. Headlines circulate about collaborations that could accelerate production capacity and broaden market reach. Investors have reacted quickly to updates about new contracts, sparking swift changes in both optimism and risk.

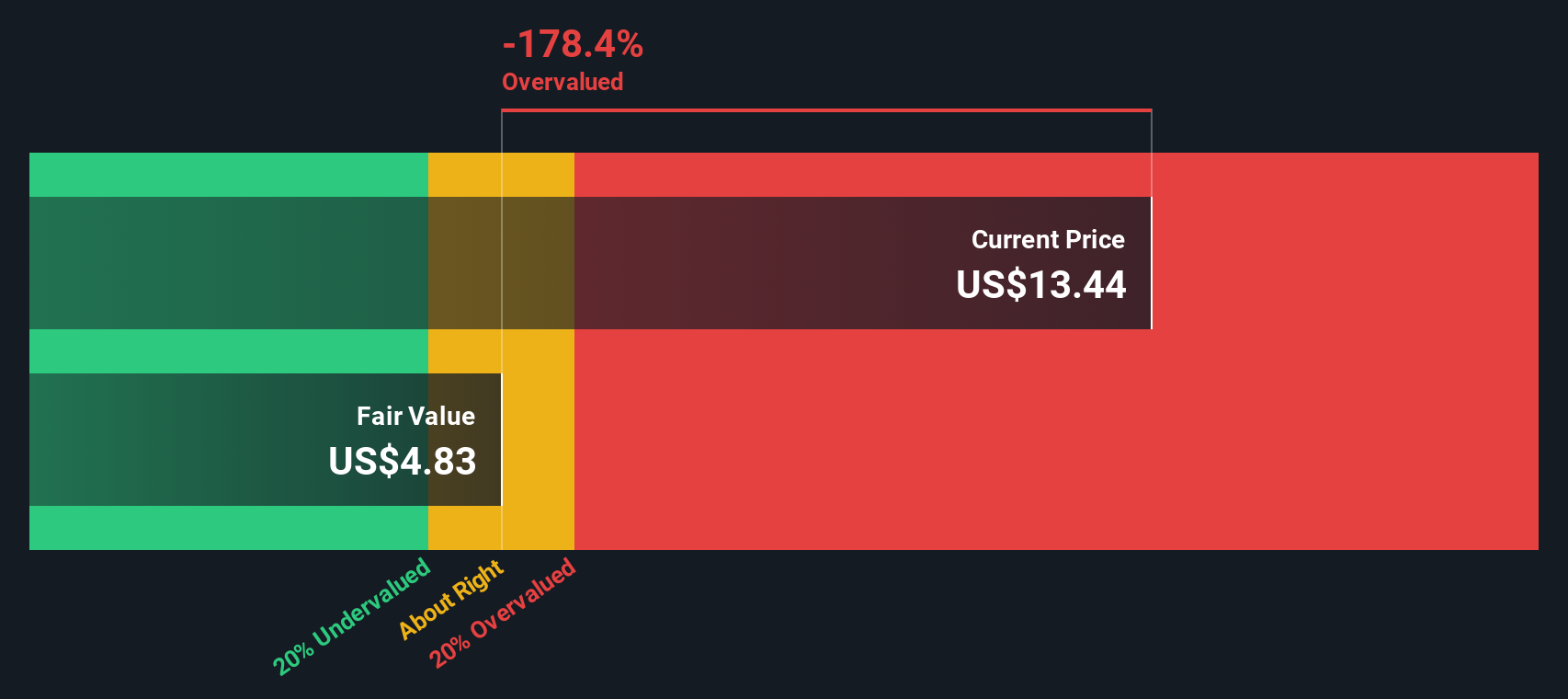

- Looking at the fundamentals, Amprius scores only 1 out of 6 on Simply Wall St’s valuation checks. This suggests many analysts still see the stock as overvalued by traditional metrics. Next, let's break down what goes into these valuation methods and why some investors are looking for an edge beyond just the headline numbers.

Amprius Technologies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amprius Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those projections back to today's dollars. For Amprius Technologies, the model used is the 2 Stage Free Cash Flow to Equity method.

Currently, Amprius has a Free Cash Flow (FCF) of approximately -$50.5 million. While this is negative at present, projections anticipate significant growth in the years ahead. By 2027, analysts expect FCF to reach $17.18 million, with further increases estimated each year for the next decade. Simply Wall St extrapolates FCF to $95.99 million by 2035. The early years reflect analyst forecasts, while later numbers are based on growth trends and estimates.

Based on these projections and by discounting future cash flows, the estimated intrinsic value per share is $7.70. However, with the current share price sitting 37.7% above this value, the DCF model suggests the stock is overvalued at today's levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amprius Technologies may be overvalued by 37.7%. Discover 932 undervalued stocks or create your own screener to find better value opportunities.

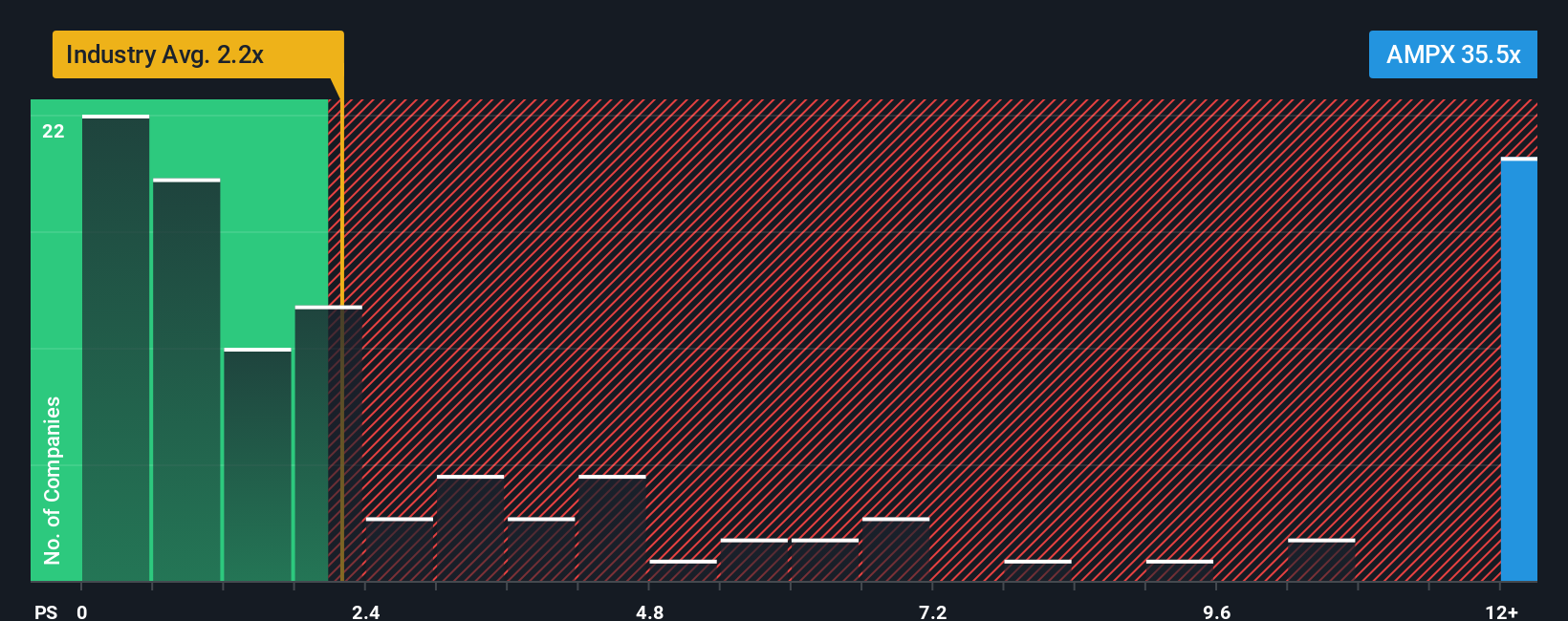

Approach 2: Amprius Technologies Price vs Sales

For many growing companies in the technology and battery manufacturing sector, the Price-to-Sales (P/S) ratio is a go-to metric when earnings are still negative or lumpy. Since Amprius Technologies is not yet profitable, the P/S ratio helps investors relate the current stock price to how much revenue the business generates. This makes it a practical approach for early-stage innovators like Amprius.

Growth expectations and risk play a big role in what counts as a “normal” P/S ratio. Higher anticipated revenue growth and strong expansion prospects can justify a higher ratio, while increased risks or slowing sales typically push it lower. Comparing numbers, Amprius currently trades at a P/S ratio of 23.7x. That stands sharply above the electrical industry average of 2.01x, and its closest peers average out at 18.1x, highlighting a significant premium at today’s price.

Simply Wall St’s proprietary “Fair Ratio” for Amprius comes in at 2.63x. This proprietary metric fine-tunes what’s reasonable for Amprius by factoring in nuances like its forecasted growth, margins, market cap and sector trends, rather than just looking at broad industry or peer averages. This makes it a more comprehensive reference point for assessing fair value in context.

With Amprius trading well above its Fair Ratio, the P/S valuation currently points to the stock being overvalued relative to what the fundamentals and growth outlook suggest.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

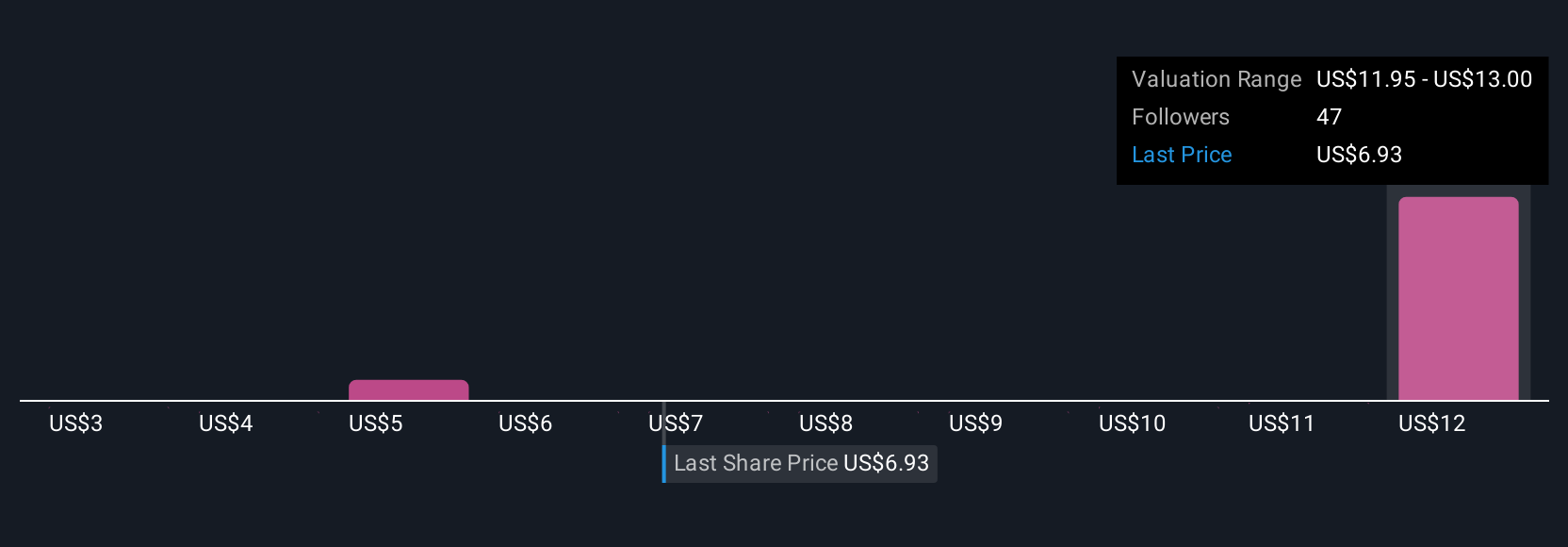

Upgrade Your Decision Making: Choose your Amprius Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story, a clear, evidence-based perspective that ties together what you believe about a company’s future with real numbers, such as your assumptions for revenue growth, margins, and fair value.

Using Narratives, you connect Amprius Technologies’ unique story, such as new government contracts or product milestones, directly to a financial forecast. This allows you to estimate what the company is genuinely worth (fair value) based on your scenario, not just market hype or standard ratios.

This approach is easy to access on Simply Wall St, where millions of investors share and refine Narratives on the Community page. Narratives empower you to confidently decide if it is time to buy, hold, or sell by comparing your fair value with the latest market price. Because these forecasts update as new information or earnings arrive, your investment story is always adapting.

For example, one investor could build a bullish Narrative with an $18.00 price target, optimistic about global expansion and premium-tech contracts. Another might highlight margin and competition risks, setting a more cautious $10.00 target, showing how Narratives deliver truly personalized, actionable insights on Amprius Technologies.

Do you think there's more to the story for Amprius Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal