Tomer Energy Royalties (TASE:TOEN) Margins Compress, Reinforcing Valuation Caution in Q3

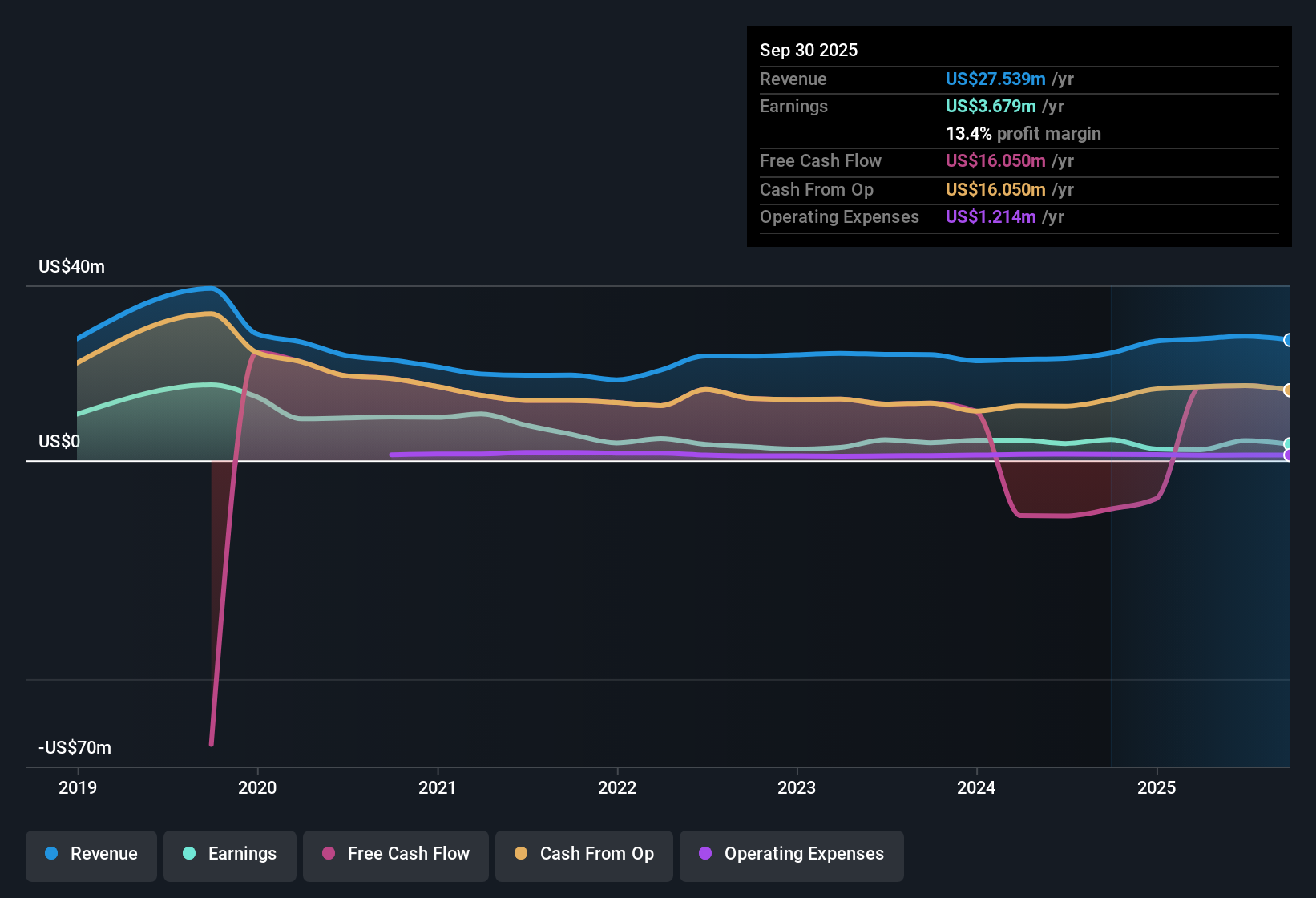

Tomer Energy Royalties (2012) (TASE:TOEN) just posted its Q3 2025 numbers, reporting $6.7 million in revenue and basic EPS of $0.04, with net income at $0.8 million. Looking back, the company has seen revenue fluctuate between $6.3 million and $7.5 million per quarter, while EPS has ranged from -$0.004 to $0.12 over the last year. Margins compressed somewhat this quarter, which may influence how investors weigh these figures against expectations.

See our full analysis for Tomer Energy Royalties (2012).Next, we will see how these results compare with the prevailing narratives and perspectives from the Simply Wall St community and which stories still hold up after this report.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Holds Steady Near 16%

- The net profit margin over the last twelve months was 16%, representing only a slight decrease from the prior period's 16.5% and indicating generally stable profitability on a trailing basis.

- Market analysis notes that while stable margins may offer some reassurance to yield-focused investors, the slight decline to 16% comes as there is increasing scrutiny on the sustainability of dividend coverage and earnings quality.

- The current dividend yield of 4.9% is not fully supported by earnings, which raises questions about the durability of income streams.

- Bears point out that margin stability alone may not address concerns related to weak interest coverage and the potential for long-term earnings declines.

Price-to-Earnings Far Above Peers

- Tomer Energy Royalties trades at a price-to-earnings ratio of 31.5x, which is significantly higher than the Asian Oil & Gas industry average of 13.4x and the peer average of 16x, positioning the stock as expensive on an earnings basis.

- Critics suggest that this valuation should be supported by above-average profit growth or unique cash flow reliability. However, recent sector data shows only a 17.5% earnings growth over the last year, with extended periods where earnings declined by 24.2% per year.

- The elevated P/E may be difficult to justify if profit trends do not outpace the sector or if questions about dividend coverage remain.

- The current share price of $24.50 stands well above a DCF fair value of $10.59, highlighting premium market expectations.

Earnings Rebound Faces Coverage Risks

- Earnings grew 17.5% this year following a multi-year downturn, but interest expense and dividend coverage continue to be noted as risk factors in the last twelve months.

- The prevailing narrative observes that while the recent recovery may lead to optimism about business improvement, risks remain prominent for cautious investors.

- Interest payments are not well covered by profits, and earnings quality faces pressure despite growth.

- Value-focused investors may remain on the sidelines until further consistent profit growth or coverage improvements are evident.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tomer Energy Royalties (2012)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Tomer Energy Royalties’ high valuation, declining profit coverage, and risks around dividend sustainability may concern investors searching for more reliable fundamentals.

If you’re looking for stronger companies where valuation better matches financial health, use our these 932 undervalued stocks based on cash flows to discover compelling investments trading at more attractive prices and with sustainable prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal