Zephyrus (TASE:ZPRS) Q3: Net Margin Drops to 1%, Margin Miss Challenges Growth Narrative

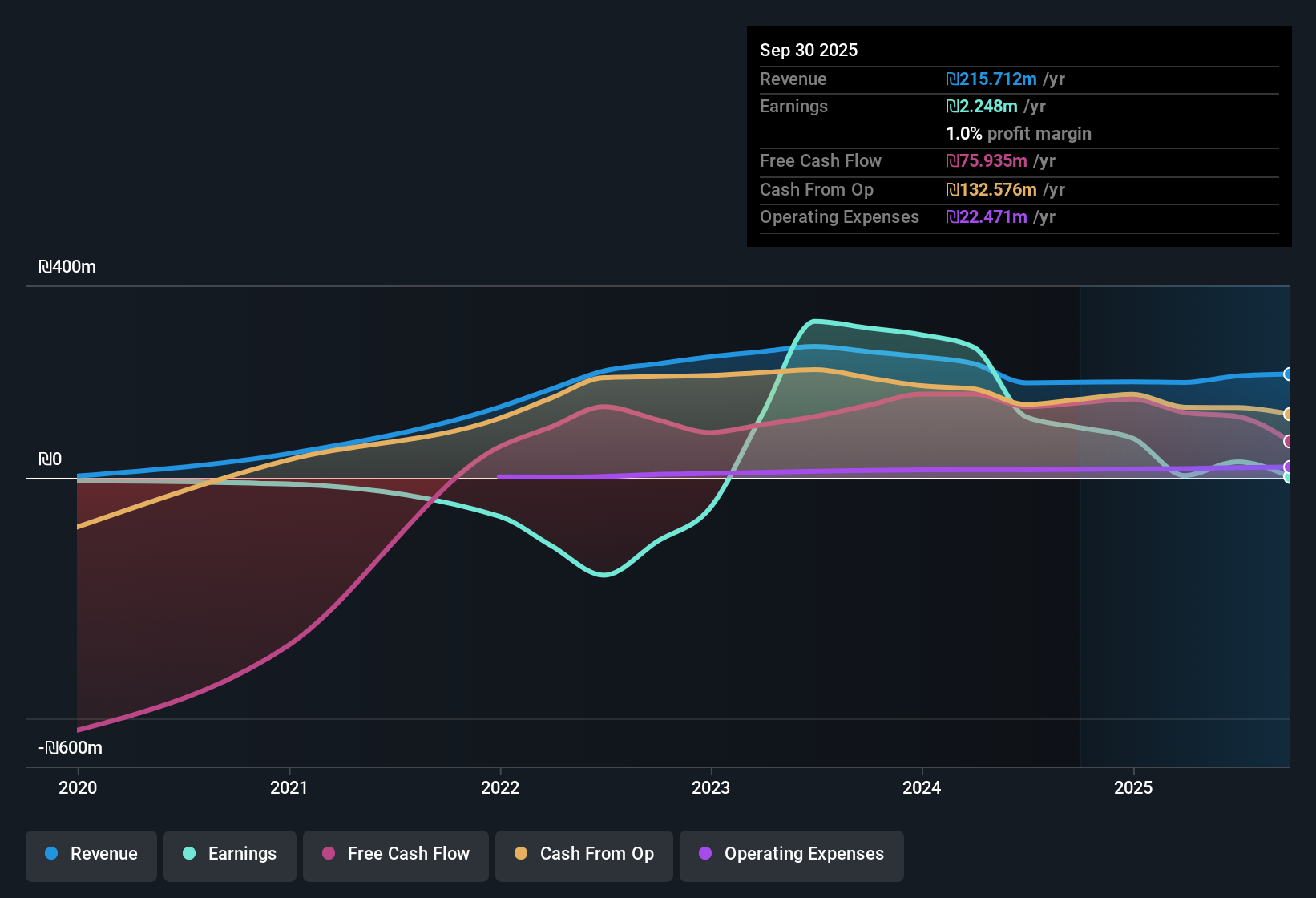

Zephyrus Wing Energies (TASE:ZPRS) has just announced Q3 2025 results, reporting revenue of ₪36.5 million and a basic EPS of -₪0.40. Over the past several quarters, revenue has shifted from ₪59.3 million in Q1 2025 down to ₪36.5 million this quarter. EPS has moved from ₪0.24 in Q1 to -₪0.40 most recently. Margins have compressed further following these results, with the trajectory raising new questions heading into the next quarter.

See our full analysis for Zephyrus Wing Energies.Now we are digging into how these numbers compare with the leading narratives most investors follow, and what that might mean going forward.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides to 1% as One-Off Loss Hits Bottom Line

- Net profit margin for Zephyrus Wing Energies over the past twelve months dropped to just 1%, weighed down by a significant one-time loss of ₪6.0 million, compared to a much stronger 52.6% margin the year before.

- Market observers highlight:

- The sharp fall in profit margins, despite five-year annual earnings growth of 32.8%, draws attention to the downside of relying on historical performance when recent net income is only ₪2.2 million for the year. This follows a string of profitable quarters that abruptly turned negative in the last two periods.

- The presence of a large exceptional expense and rapidly shifting margins tempers hopes that previous multi-quarter profitability alone lays the groundwork for a stable earnings profile going forward.

- With such a dramatic margin reversal, consensus warns this balance between former growth and fresh headwinds could tilt expectations in either direction. Find out how the full narrative weighs both the company's turnaround potential and the scale of recent setbacks. 📊 Read the full Zephyrus Wing Energies Consensus Narrative.

DCF Fair Value Sits 49% Below Share Price

- Zephyrus’s current share price of ₪19.90 materially exceeds the estimated DCF fair value of ₪10.20, meaning the market is pricing in a significant premium compared to fundamentals.

- What is surprising is:

- Despite the lower Price-to-Sales ratio (6x) relative to peers (7x), the valuation remains more than double the broader Asian Renewable Energy industry average (2.2x). Profit margins have softened further, raising questions about the justification for such a large premium.

- Analysts note that while some investors might credit the stronger historical growth and sector positioning, current fundamentals do not support a valuation gap of this size, especially with recent periods swinging into a net loss.

Interest Coverage Signals Risk to Financial Flexibility

- Recent financials point to a key risk: earnings over the past year were not adequate to cover interest payments, limiting Zephyrus’s ability to manage debt or buffer against future shocks.

- Critics highlight:

- The combination of negative net income in Q3 2025 (-₪25.8 million) and only modest cumulative profit for the year (₪2.2 million) calls into question whether liquidity is sufficient for ongoing operations unless profitability improves swiftly.

- This warning is underscored by a steep decline from earlier periods, when net income was solidly positive and interest payments were less concerning on a cash flow basis.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Zephyrus Wing Energies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite previous growth, Zephyrus Wing Energies is now struggling with declining profit margins, negative net income, and insufficient earnings to cover interest expenses. If you want stocks with stronger financial health and less risk from debt or profitability setbacks, start your search with solid balance sheet and fundamentals stocks screener (1941 results) and discover companies better positioned for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal