Uncovering 3 US Hidden Gems with Strong Potential

As the U.S. stock market experiences a slight uptick following the end of a five-session winning streak, investors are closely watching tech and crypto-tied shares rebounding amidst fluctuating sentiment. In this dynamic environment, identifying stocks with solid fundamentals and growth potential can be crucial for navigating market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xunlei (XNET)

Simply Wall St Value Rating: ★★★★★★

Overview: Xunlei Limited, along with its subsidiaries, operates an internet platform for digital media content in the People's Republic of China and has a market cap of approximately $448.96 million.

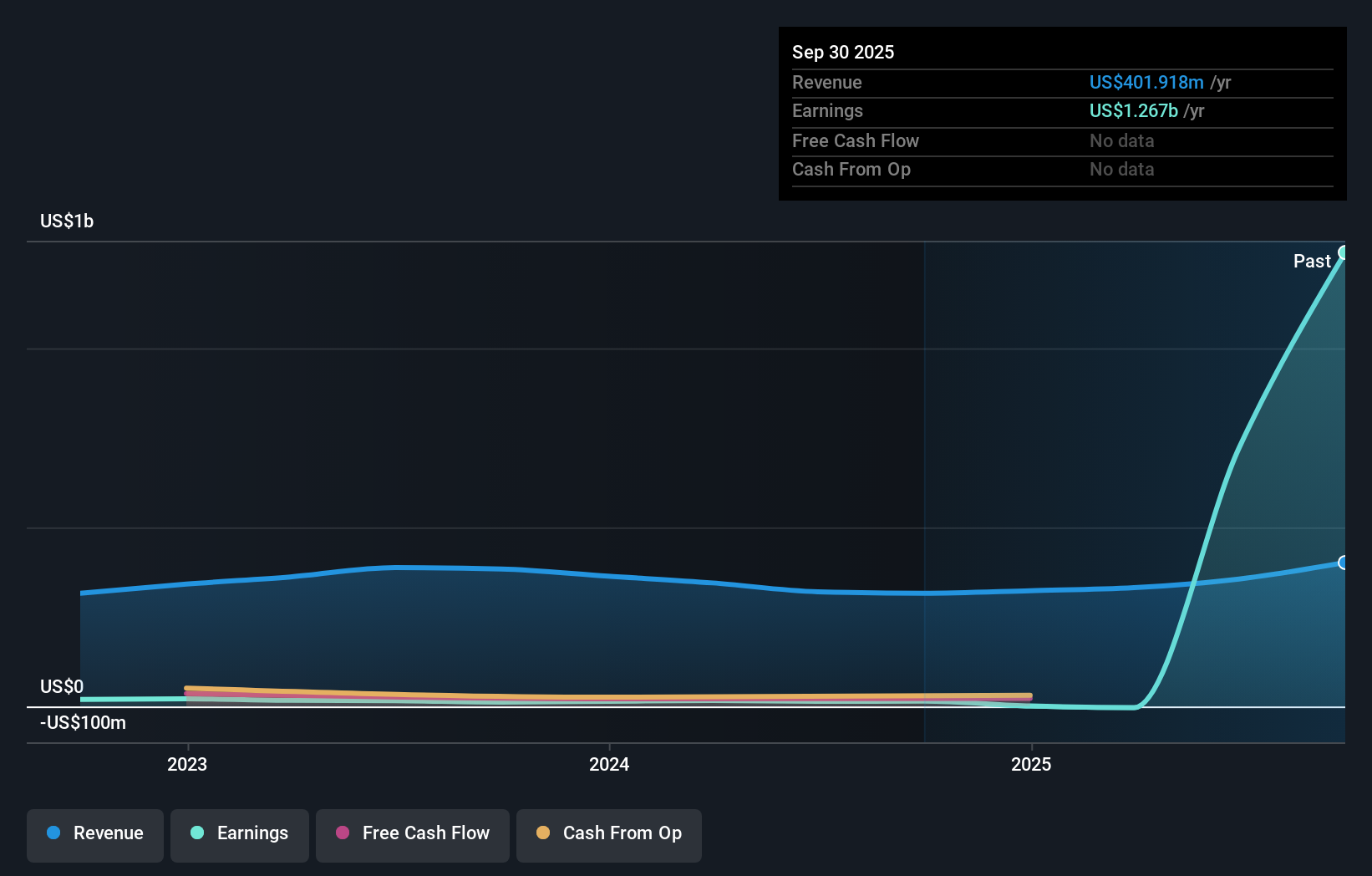

Operations: The company generates revenue primarily through the operation of its online media platform, with this segment contributing approximately $401.92 million.

Xunlei has shown remarkable growth, with earnings skyrocketing by 8524% over the past year, far outpacing the software industry's 19%. The company's debt-to-equity ratio has improved from 6.9 to 4.3 over five years, indicating better financial health. Net income for Q3 reached US$550.25 million compared to US$4.6 million a year ago, reflecting robust performance and high-quality earnings. Trading at approximately 5.8% below its estimated fair value suggests potential investment appeal while maintaining more cash than total debt ensures financial stability without concerns over interest payments coverage.

- Take a closer look at Xunlei's potential here in our health report.

Gain insights into Xunlei's past trends and performance with our Past report.

Crawford (CRD.B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Crawford & Company offers claims management and outsourcing solutions for carriers, brokers, and corporations across various regions including the United States, the United Kingdom, Europe, Canada, Australia, Asia, and Latin America with a market cap of $534.30 million.

Operations: Crawford's revenue streams are primarily derived from four segments: Broadspire ($398.08 million), Platform Solutions ($153.32 million), International Operations ($438.81 million), and North America Loss Adjusting ($314.24 million).

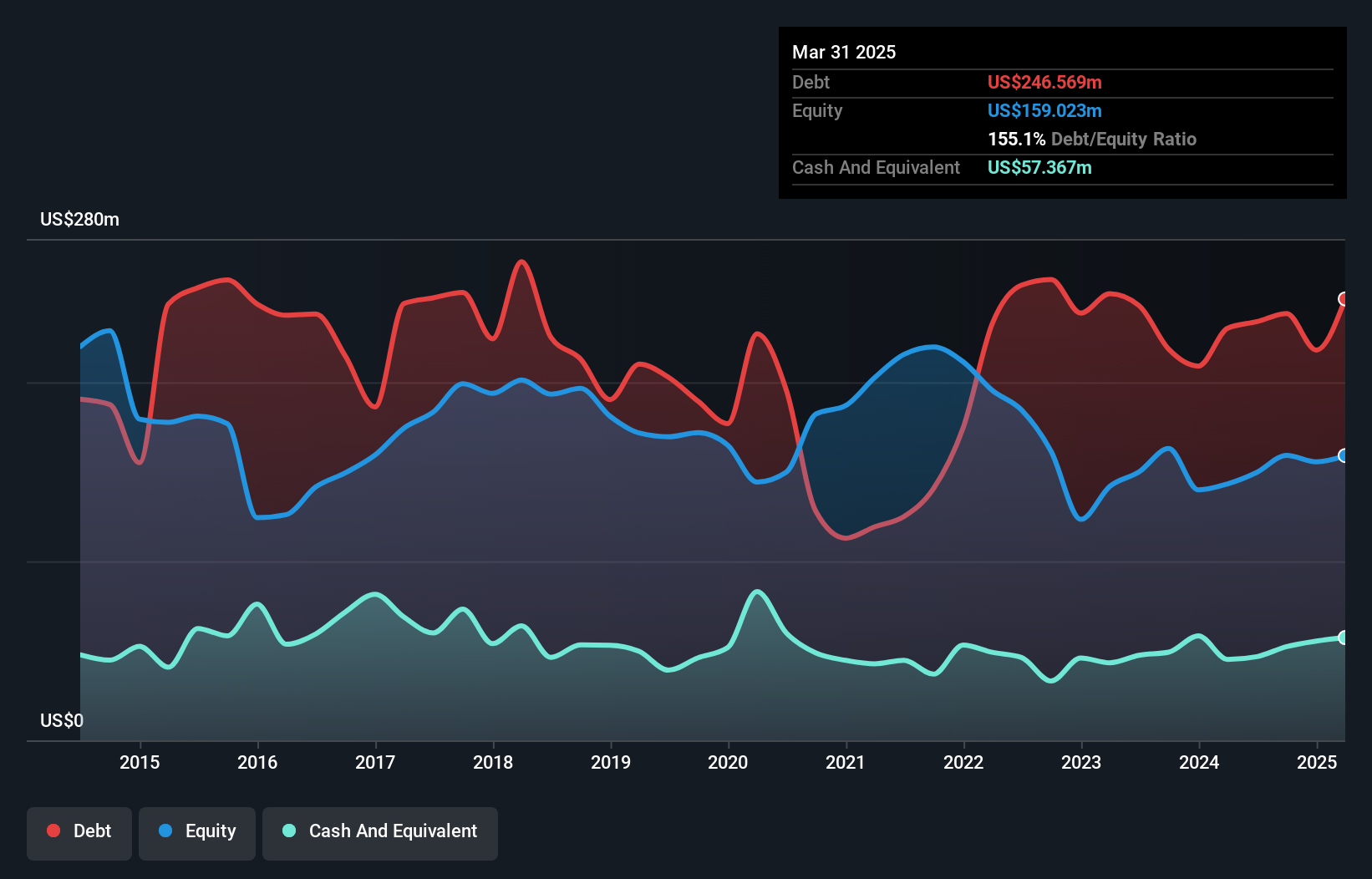

Crawford, a notable player in the insurance sector, has demonstrated impressive performance with earnings growing by 62.5% over the past year, outpacing the industry average of 10.3%. The company is valued attractively with a price-to-earnings ratio of 15.7x compared to the US market's 18.7x, suggesting potential upside for investors seeking value. Despite its high debt levels—evident from a net debt to equity ratio of 80.4%—the company manages interest payments well with an EBIT coverage of 4.1x. Recently, Crawford repurchased shares worth $6.43 million and declared dividends at $0.075 per share for both classes of stock.

- Click here and access our complete health analysis report to understand the dynamics of Crawford.

Assess Crawford's past performance with our detailed historical performance reports.

Ranger Energy Services (RNGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ranger Energy Services, Inc. offers onshore high specification well service rigs, wireline services, and complementary solutions to exploration and production companies in the U.S., with a market cap of approximately $296.54 million.

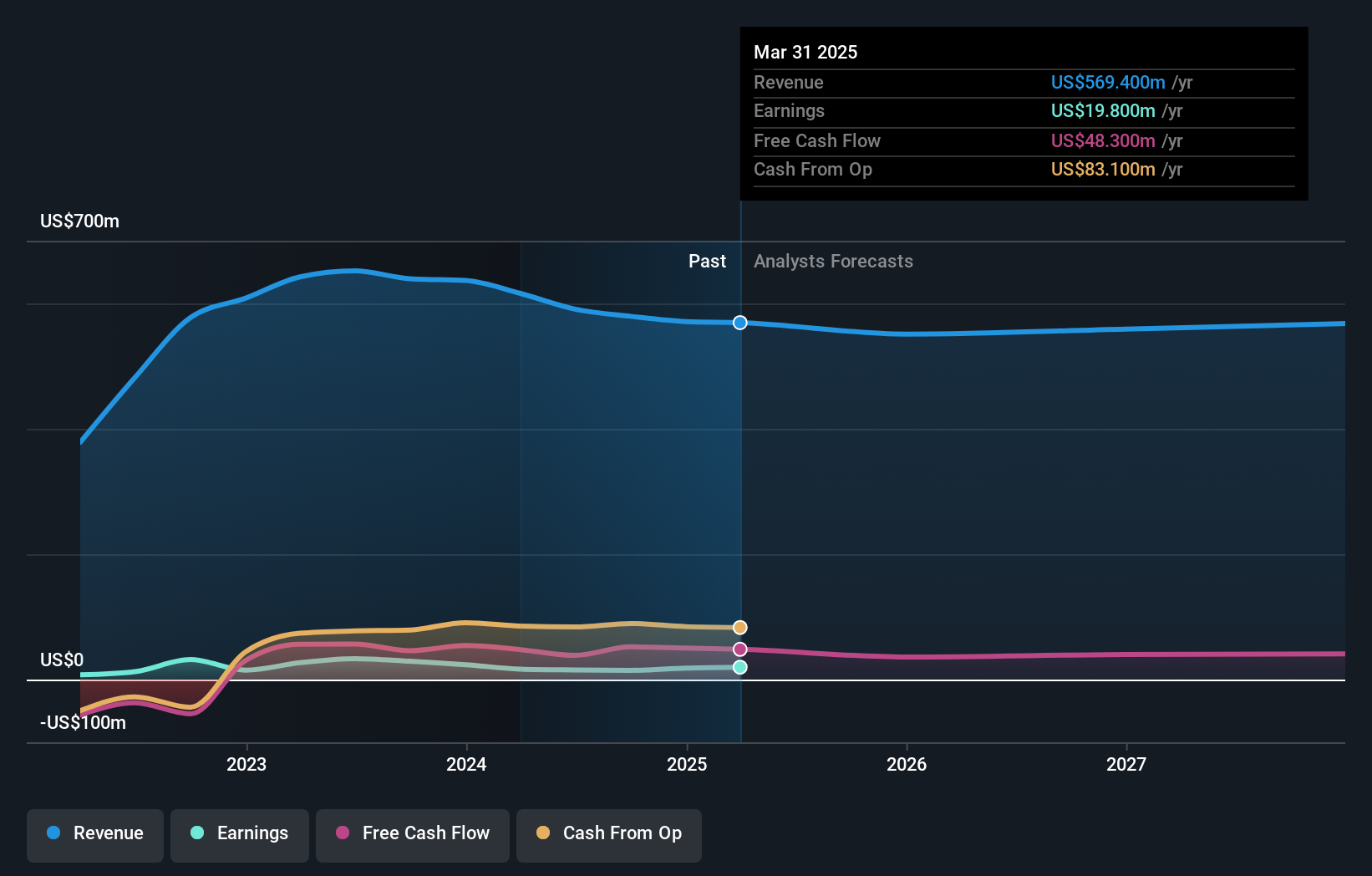

Operations: Ranger Energy Services generates revenue primarily from high specification rigs, wireline services, and processing solutions, with the high specification rigs segment contributing $341.70 million. The company also earns $79.10 million from wireline services and $127 million from processing solutions and ancillary services.

Ranger Energy Services, a nimble player in the energy sector, has shown resilience with its earnings growing 1.4% over the past year, outpacing an industry decline of -19.5%. The company is trading at a significant discount, 67.5% below its estimated fair value, and boasts high-quality earnings with no debt burden compared to a debt-to-equity ratio of 11.8% five years ago. Recent activities include repurchasing 667,500 shares for US$8.2 million and declaring a quarterly dividend of US$0.06 per share, demonstrating commitment to shareholder returns despite revenue and net income reductions this year compared to last year’s figures.

- Unlock comprehensive insights into our analysis of Ranger Energy Services stock in this health report.

Evaluate Ranger Energy Services' historical performance by accessing our past performance report.

Summing It All Up

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 295 more companies for you to explore.Click here to unveil our expertly curated list of 298 US Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal