Does MercadoLibre’s Latest Digital Payments Expansion Signal a New Value Opportunity in 2025?

- Ever caught yourself wondering whether MercadoLibre's share price really reflects what the business is worth? You're not alone, and the answer might be more nuanced than you think.

- The stock has climbed 17.0% year-to-date, though it dipped by 11.3% over the last month. This highlights how quickly sentiment and growth expectations can shift.

- In recent weeks, MercadoLibre's price has responded to headlines about the company's latest innovations in digital payments and ongoing expansion into new Latin American markets. Several analysts have pointed to the regulatory landscape and strengthening e-commerce trends as important influences on these movements.

- For those interested in numbers, MercadoLibre currently has a 4 out of 6 valuation score according to Simply Wall St’s assessment, suggesting some areas of undervaluation. Here is an explanation of how that score is calculated and why the real story may lie beyond just the numbers on the surface.

Find out why MercadoLibre's 7.0% return over the last year is lagging behind its peers.

Approach 1: MercadoLibre Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors look beyond daily price changes and focus on the business’s long-term earning potential.

For MercadoLibre, the latest reported Free Cash Flow (FCF) stands at $8.77 Billion. Analysts forecast a steady increase, projecting FCF to reach over $10.75 Billion by 2027. Beyond the analyst window, Simply Wall St extrapolates annual FCF figures as high as $15.66 Billion in 2035. These projections are all denominated in USD, the company’s reporting currency. The DCF model applied here follows a two-stage free cash flow to equity methodology, reflecting both current financial strength and expected long-term growth.

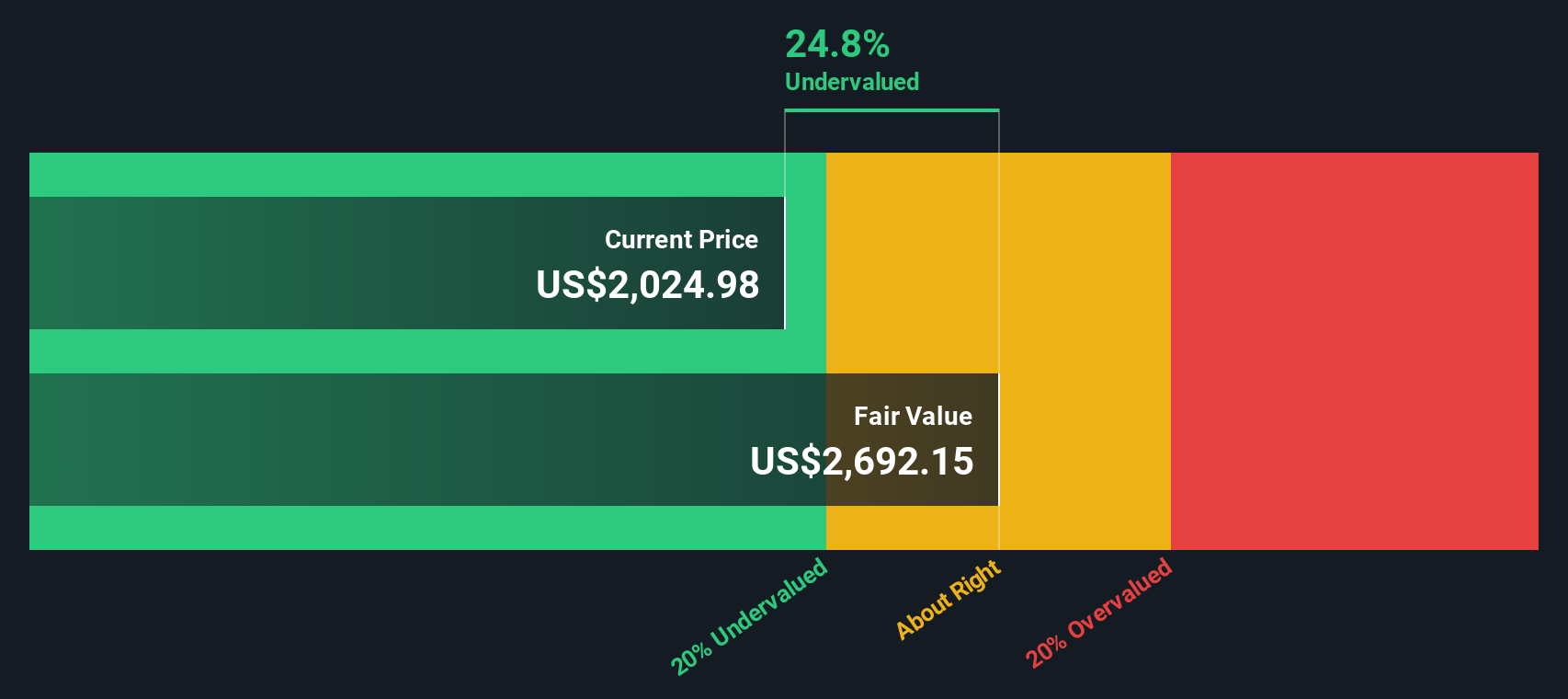

According to the DCF analysis, MercadoLibre’s intrinsic value is estimated at $2,903.59 per share. At its current price, the stock trades at a 28.9% discount to this calculated fair value, indicating a notable undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MercadoLibre is undervalued by 28.9%. Track this in your watchlist or portfolio, or discover 930 more undervalued stocks based on cash flows.

Approach 2: MercadoLibre Price vs Earnings

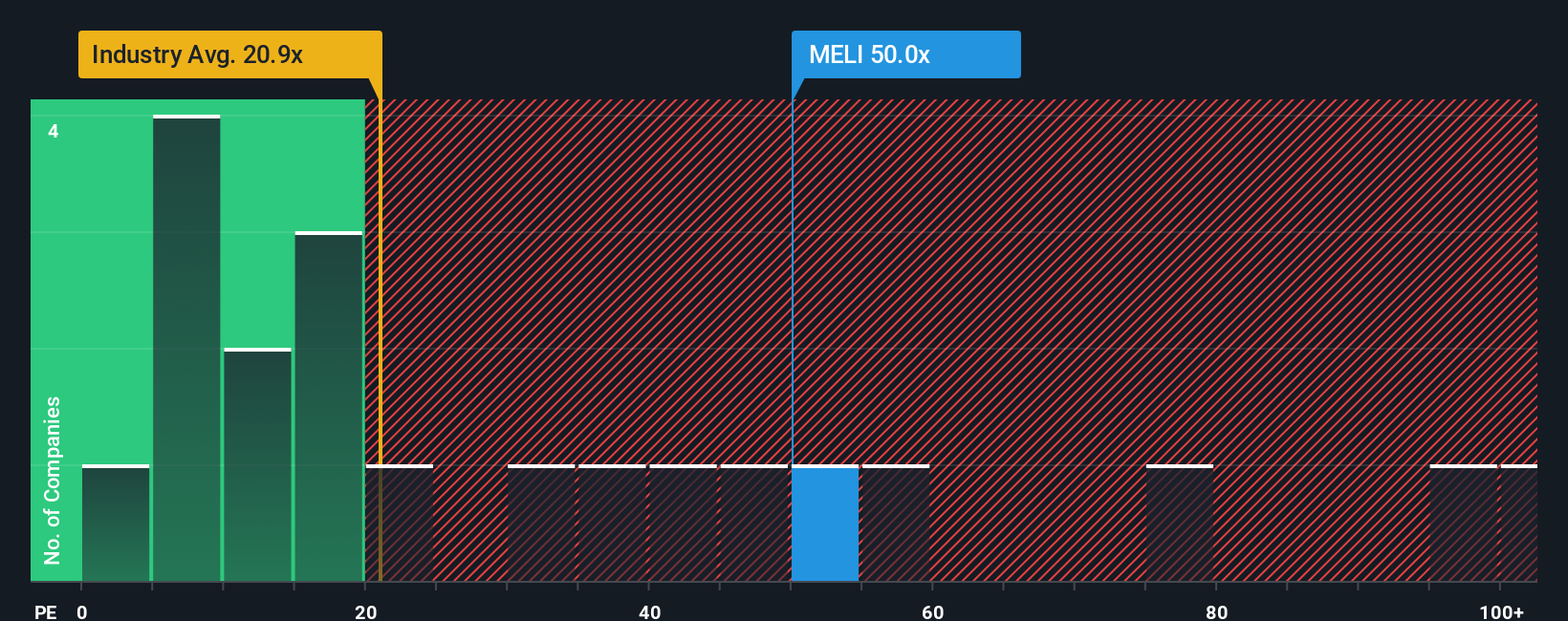

For profitable companies like MercadoLibre, the Price-to-Earnings (PE) ratio is a well-established way to judge valuation because it relates the company's current share price to its earnings. This metric gives investors a quick snapshot of how much they are paying for each dollar of profit today.

It's important to note that what counts as a "normal" PE ratio depends on growth prospects and risk. Higher expected growth or lower risk usually justifies a higher PE, while slower growth or higher risk can pull the ratio down.

Currently, MercadoLibre trades at a PE ratio of 50.4x. Compared to the Multiline Retail industry average of 20.2x, and its peer average of 50.6x, MercadoLibre appears richly valued at face value.

Simply Wall St's "Fair Ratio" aims to go deeper than these comparisons. It is a proprietary valuation metric designed to reflect the exact multiple that’s reasonable, accounting for factors like MercadoLibre’s rapid earnings growth, competitive profit margins, industry characteristics, company size, and business-specific risks. Unlike the simple industry or peer average, the Fair Ratio tells us what’s reasonable for MercadoLibre’s unique profile.

For MercadoLibre, the Fair Ratio is 34.8x, which is notably lower than its current PE. This gap suggests the company’s stock is trading above what would be considered fair using a holistic perspective that balances its strengths and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MercadoLibre Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company, combining your perspective on its future, such as what revenues, earnings, and margins you expect, with your view on what counts as fair value. Rather than just looking at static numbers, a Narrative helps you connect MercadoLibre’s real-world strategy and business changes directly to a financial forecast and a valuation that reflects what you actually believe.

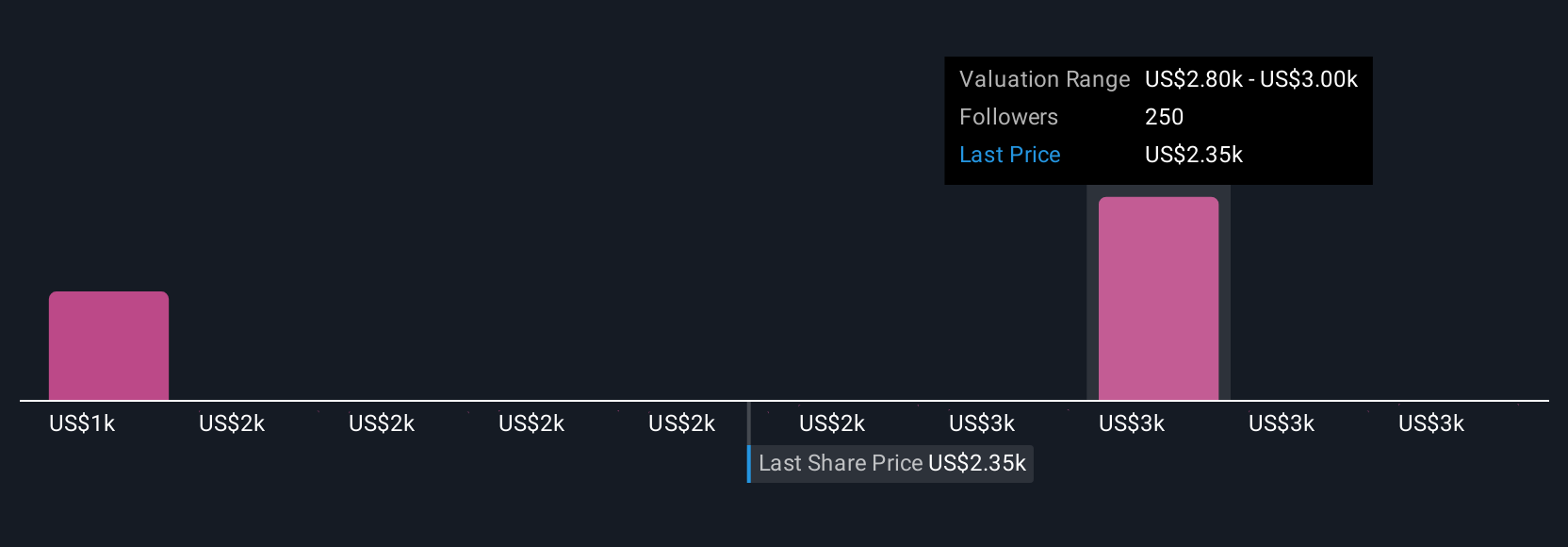

Narratives make investment decisions more accessible by letting you easily edit assumptions and see how your outlook compares to other investors. This feature is available to everyone on Simply Wall St's Community page, which is used by millions globally. Narratives help you act decisively. When your assumptions show that fair value is above the current share price, it could be a signal to buy. If it’s below, you may want to sell or wait. Additionally, Narratives update dynamically as new earnings, news, or analyst targets are released, so your view stays relevant without manual effort.

For example, some investors see MercadoLibre’s potential for margin expansion and set their Narrative price target above $3,500, while others, worried about competition and future profitability, set theirs closer to $2,170. This represents a wide range that reflects real differences in outlook.

Do you think there's more to the story for MercadoLibre? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal